- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Is there an error in the "Recovery rebate credit worksheet"?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error in the "Recovery rebate credit worksheet"?

I had the exact same issue. Filed taxes then get letter from IRS saying I owed back the $2,800.

In my opinion this was an error on the part of Turbo Tax since it never had you look at this form or flagged it as an error.

My question is why would the IRS send rebate to us when haven't shown any dependents in years.

Now when I go into TurboTax it has corrected this and now shows us owing the rebate back.

Not happy

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error in the "Recovery rebate credit worksheet"?

@OldSalt13 Sounds like you were confused about the recovery rebate credit and did not understand what you were supposed to enter. If you received the $1400 per person stimulus checks last year you were supposed to answer the questions about that in Federal Review. If you neglected to enter that you received that money, you could end up with $2800 on line 30 of your Form 1040 that you were not entitled to receive a second time. The IRS knows if you received that $2800 and removes it from your refund since you cannot get it twice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error in the "Recovery rebate credit worksheet"?

I just created a new shadow return. Question must be well hidden in Federal Review since I never saw it. Probably why the IRS has 9 million correction letters this year,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error in the "Recovery rebate credit worksheet"?

@OldSalt13 wrote:

I just created a new shadow return. Question must be well hidden in Federal Review since I never saw it. Probably why the IRS has 9 million correction letters this year,

There are only two reasons why the question for receiving the 3rd stimulus payment would not be presented -

1. You are being claimed as a dependent (or)

2. Your 2021 Adjusted Gross Income is over the maximum for receiving the Recovery Rebate Credit

• Single or married filing separately—$80,000

• Married filing jointly or qualifying widow(er)—$160,000

• Head of household—$120,000

You keep the 3rd stimulus payment you received, it does not have to be paid back.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error in the "Recovery rebate credit worksheet"?

I had the same problem. Received an IRS letter yesterday stating there was an error on my 2021 Form 1040 and I owed additional tax. Upon reviewing the 1040, and working through the lines one at a time, I found the Recovery Rebate Credit was the issue. I should not have recorded anything as I did receive the full amount.

However, what bothers me is the way it came about using TurboTax. Did I misunderstand the question? Or, was the question worded in such a way as to lead me to the wrong conclusion? Unfortunately there is no way to walk through the calculations again to see how it was asked.

Of course, TurboTax, Intuit would no doubt deny all culpability as this would be very embarrassing for them and potentially costly. And, even if the software was in error, no doubt Intuit will claim this is ultimately the taxpayer’s fault as I should have reviewed the form before submitting. But, that’s why I use TurboTax, so I don’t have to know every single nuance of tax law. I’ve used Turbotax for many years. Next year it will give me pause whether I use it again.

I’d like to know how many other people had this problem with TurboTax or any other tax filing software?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error in the "Recovery rebate credit worksheet"?

@HeadNorth - it's not only TT customers that got this wrong, there are reports of MILLIONS of adjustments that the IRS is making related to the Recovery Rebate CRedit.

TT asked how much you received as documented on Letter 6475 that would have been received from the IRS. I think many issues were created because there were TWO letters if you filed joint. Half the money was on one letter that you rceived and the other half was on the letter the spouse received. if you didn't add the two letters together THAT overstated Line 30. the IRS has been catching these errors.

Understand that TT guarnetees their software is correct, but it doesn't guarentee that you enter the accurate answer to the questions :(

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error in the "Recovery rebate credit worksheet"?

@HeadNorth If you promise to not change a thing in the program (as this will mess up the archived return) then you can get back into the program to review all the input screens again ...

When you sign onto your online account and land on the Tax Home web page, scroll down and click on Add a state. This will let you back into the filed return and you can wander about at will ... just do NOT make any changes.

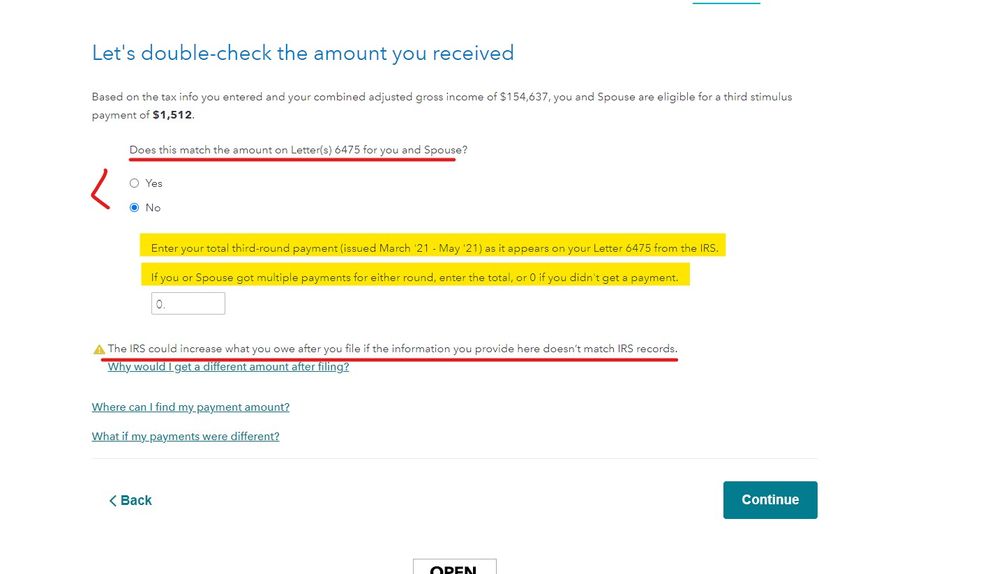

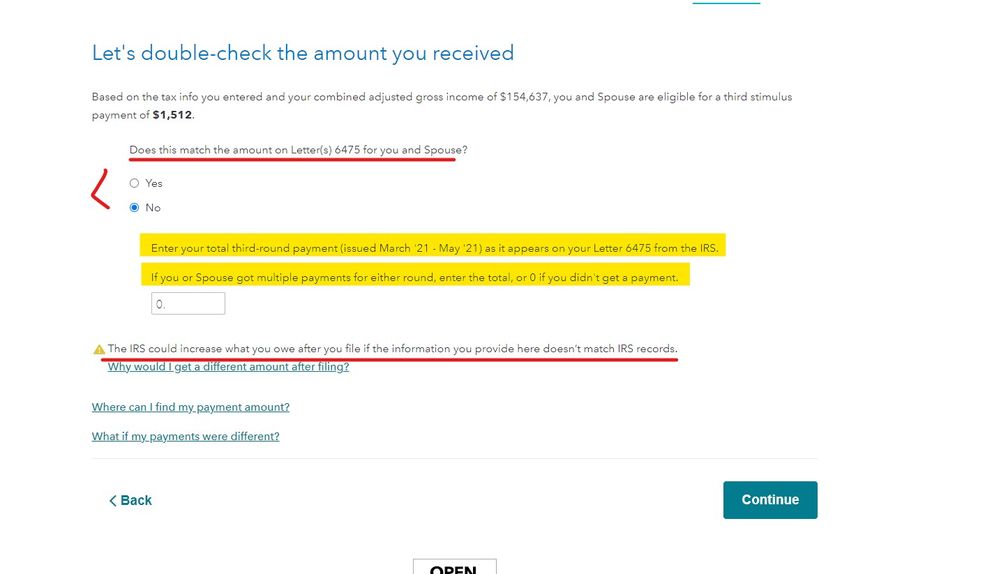

This is the screen you should find ... even if you did not get the 6475 notice(s) you needed to enter in all the payment you did get ... failure to do so will get the return adjusted ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error in the "Recovery rebate credit worksheet"?

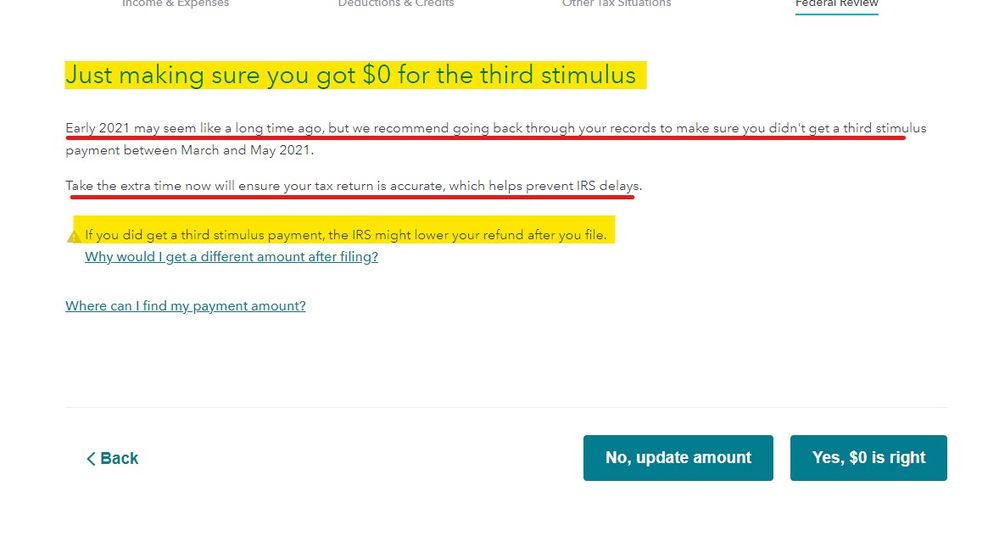

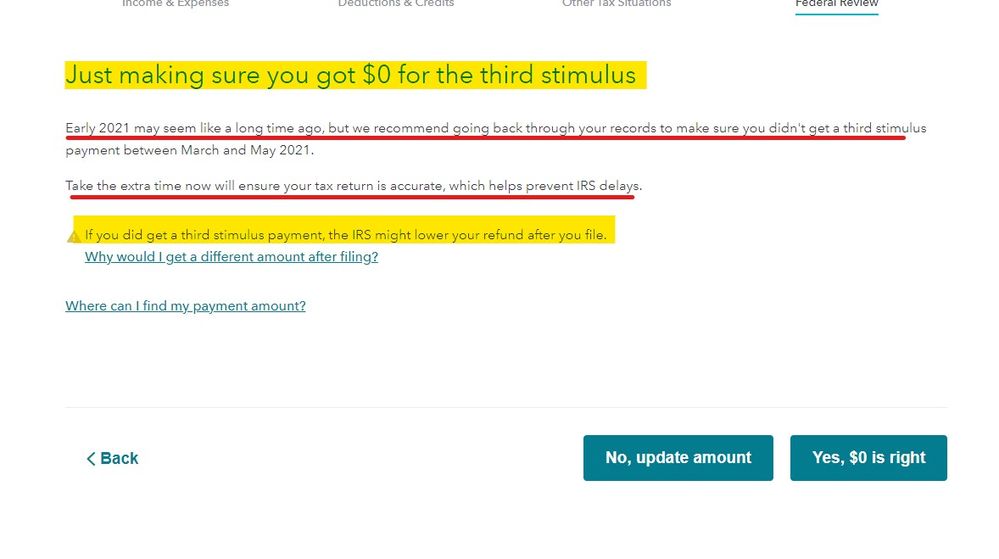

If you said you did not get anything in advance the next screen tells you again to make every sure ... failure to enter the correct advance payment amount could get the return delayed and corrected ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error in the "Recovery rebate credit worksheet"?

Did file married jointly. And, did add the two amounts together. I entered that amount. But, my wife and I received the amounts. Yet, because I answered the question the total was reflected on the return and caused my tax liability to go down. Should not I have entered zero. Anyway, as a result, thought I was getting a refund, when in fact I now owe because of the error. If the amount would have been left at zero I would have owed, and that was okay, I would have accepted that. It was just a total surprise. My only question is really twofold. 1) Is there a software error or perhaps poorly worded question for the Rebate Credit and 2) how many TurboTax users have the same issue. Or, did the IRS screw up in the way the presented it? Maybe it would not have matter if it was a software app or not. I might have made the same error if I manually completed the Form.

Yesterday, as I started to research, I did see that many tax payers (something like 2.5 million) have the same issue. Whether they are TurboTax customers or not would be interesting to known.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error in the "Recovery rebate credit worksheet"?

p.s. Here's a thought. Perhaps I should contact my Congressman (or woman!) and argue this is an IRS problem and no one owes anything because of this boondoggle. Consider it further economic stimulus. Because as it stands now, I'm essentially giving half of it back. As I say, give $1 to one million tax payers will do far more to stimulate the economy than giving $1,000,000 to one millionaire, who might only spend a small percentage of it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error in the "Recovery rebate credit worksheet"?

In the beginning of the interview the $2800 credit was added to your anticipated refund amount shown on the home screen. Later as you entered your income the credit could have been reduced or removed based on the income you entered. Then finally the program asked you how much you already got in advance because you could not also get the credit. If you entered exactly what you did get in advance then the credit would have been reduced to zero and there would be nothing on line 30 of the form 1040 instead of the incorrect $2800 amount you see on the return now that the IRS removed for cause. If you got a letter from the IRS indicating the credit was removed then you made an error in the program on these screens ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error in the "Recovery rebate credit worksheet"?

@HeadNorth - I am just curious, since you went through the experience, what should TT have done differently to the screens that @Critter-3 posted above to ensure that this mistake didn't occur?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error in the "Recovery rebate credit worksheet"?

@HeadNorth I sent you a message.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error in the "Recovery rebate credit worksheet"?

@Donna477 - scroll up a few messages back @Critter-3 pasted the screen shots of the questions....

the question asks, "does this match the amount on Letter(s) 6475 sent to you and your spouse?"

I see so many posts where there was a joint return where the spouse filling out the return did not realize there were TWO letters and you were to ADD the two letters together; they were not duplicate amounts on the letter - they were each half of what the family received.

further down on the screen shots. TT recommended going back through your financial records to determine that the amount entered was accurate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error in the "Recovery rebate credit worksheet"?

Same thing happened to me. I entered everything correctly and TT showed I would get a refund. IRS now says I owe. I checked the worksheet, and TT entered "No" on number 9 of the Rebate Recovery Worksheet, even though I marked "Yes" that the numbers matched. Now the software has corrected and says I owe. With so many people reporting a problem here, there must have been a glitch.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

karin.okada

New Member

andrii16

New Member

Propeller2127

New Member

botin_bo

New Member

bkeenze1

New Member