- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

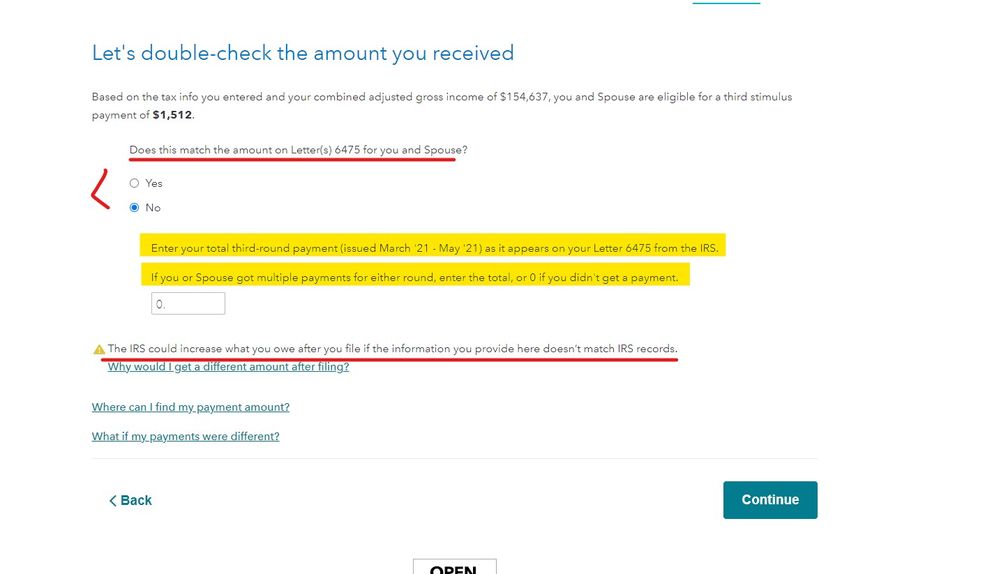

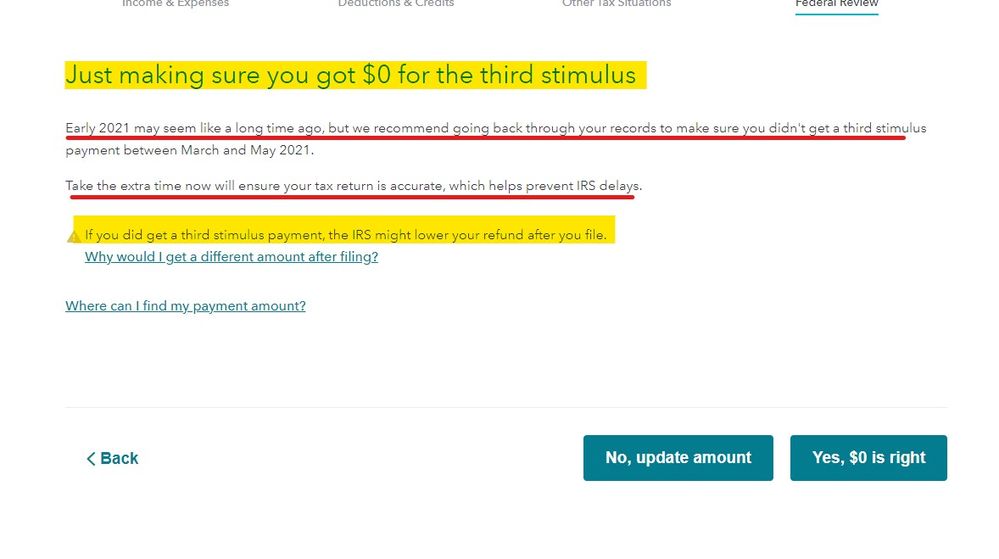

In the beginning of the interview the $2800 credit was added to your anticipated refund amount shown on the home screen. Later as you entered your income the credit could have been reduced or removed based on the income you entered. Then finally the program asked you how much you already got in advance because you could not also get the credit. If you entered exactly what you did get in advance then the credit would have been reduced to zero and there would be nothing on line 30 of the form 1040 instead of the incorrect $2800 amount you see on the return now that the IRS removed for cause. If you got a letter from the IRS indicating the credit was removed then you made an error in the program on these screens ...

May 10, 2022

12:13 PM