- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I'm filling only w2g's this year,will I get child tax credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm filling only w2g's this year,will I get child tax credit

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm filling only w2g's this year,will I get child tax credit

just enter the W-2s and Turbo Tax will calculate- it is based on your income so can't answer your question specifically,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm filling only w2g's this year,will I get child tax credit

Make sure you enter W-2G's in the right spot. You do not enter them as "regular" W-2's.

To enter the W-2G or other documents For your Gambling winnings--Go to Federal>Wages & Income>Less Common Income>Gambling Winnings

You can enter your winnings, and then keep clicking through the interview to enter gambling losses.

https://www.irs.gov/help/ita/how-do-i-claim-my-gambling-winnings-and-or-losses

You will not receive earned income credit ---and not likely the child tax credit either--- for gambling income. But if you have a child under the age of 17 as a qualifying dependent you should get stimulus money.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm filling only w2g's this year,will I get child tax credit

Look at your 2020 Form 1040 to see the child-related credits you received

PREVIEW 1040

https://ttlc.intuit.com/questions/1901539-how-do-i-preview-my-turbotax-online-return-before-filing

Child Tax Credit line 19

Credit for Other Dependents line 19

Earned Income Credit line 27

Additional Child Tax Credit line 28

Child and Dependent Care Credit line 31 (from line 13 of Schedule 3)

https://ttlc.intuit.com/questions/1900923-what-is-the-child-tax-credit

https://ttlc.intuit.com/questions/1900643-what-is-the-child-and-dependent-care-credit

https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/use-the-eitc-assistant

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm filling only w2g's this year,will I get child tax credit

@xmasbaby0 - thx - I missed the 'g' when responding!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm filling only w2g's this year,will I get child tax credit

The child tax credit (CTC) is limited to your tax liability. The CTC is a non-refundable credit and can only reduce your income tax to 0, It can not help you beyond eliminating your tax liability.

So if you have enough W-2G income to have a tax liability, you will get enough of the CTC to wipe it out, but not the rest of the $2000 (unless your tax liability is $2000 or more)

For people who have more than $2500 of earned income, some o the unused CTC is usually given back to them thru the "Additional Child tax credit"*. You won't get any ACTC since you have no earned income.

*That is, part of the CTC may be on line 18b of form 1040 (2019 version) instead of line 13a (lines 17 and 12 in 2018). The ACTC is calculated on form 8812 and is basically 15% of your earned income over $2500. The ACTC is a maximum of $1400 per child (not $2000).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm filling only w2g's this year,will I get child tax credit

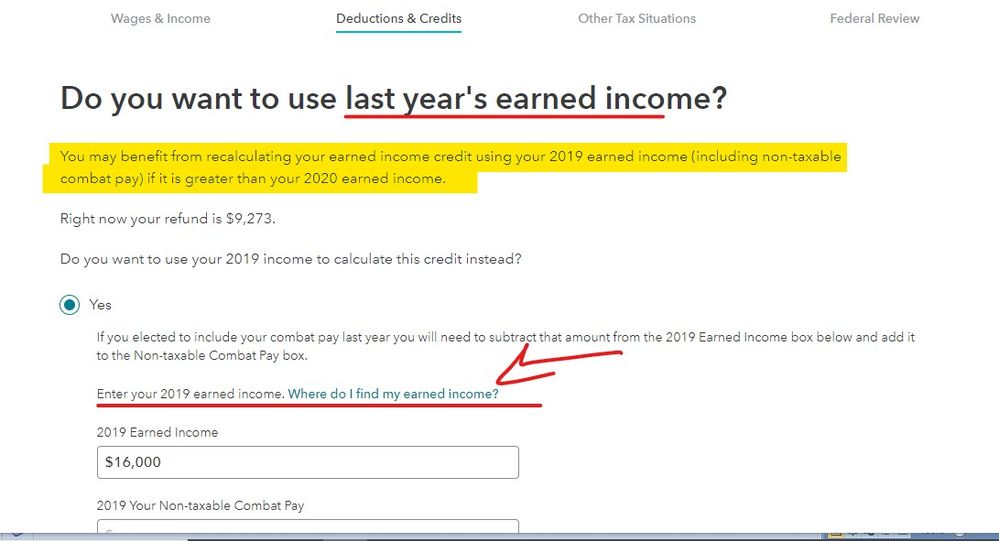

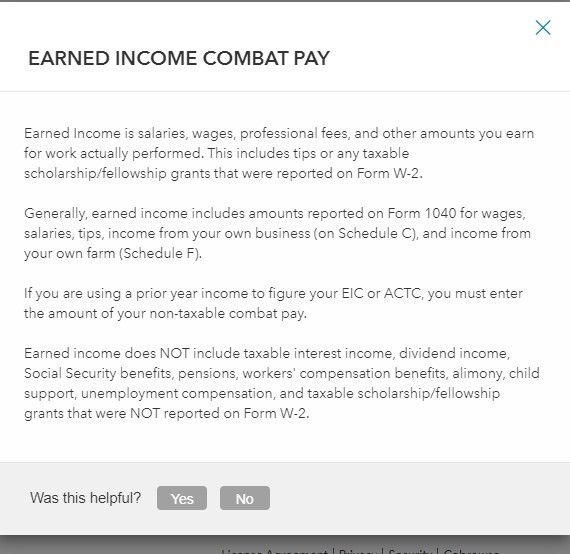

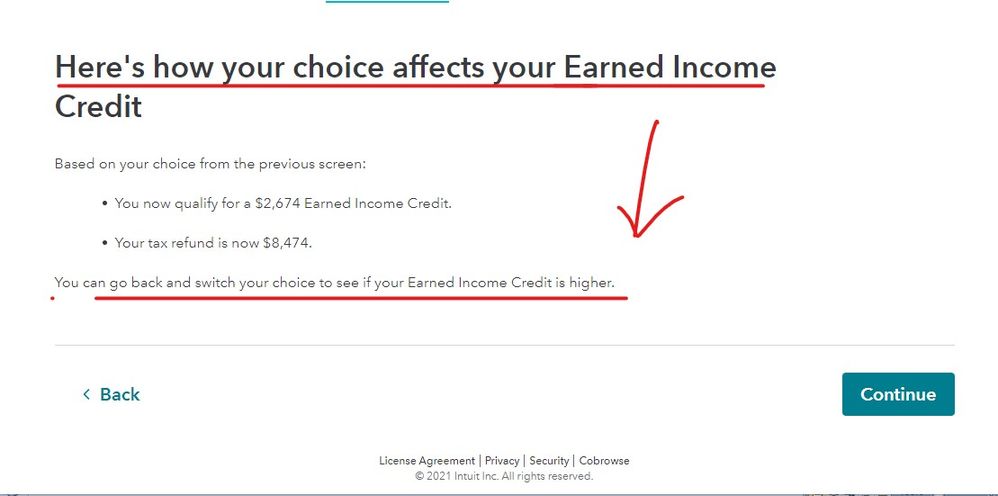

Now ... funny as this may be ... if you had earned income in 2019 you may be able to use that to get an Earned Income Credit on the 2020 return without having any earned income ... please complete the EIC section to see if you possibly qualify ... see these screens when you get there :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm filling only w2g's this year,will I get child tax credit

@Critter-3 - oh WOW, that is right because of the COVID stimulus bill signed two weeks ago, you are allowed to use 2019 income for EIC purposes if it gets you a larger refund!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm filling only w2g's this year,will I get child tax credit

It's not just EIC, it's also the Additional Child Tax Credit, which this poster is asking about. So, if he had more than $2500 of Earned income in 2019, he can still get some ACTC.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

akjacket

New Member

Frankdatank210

New Member

Ginola_89

New Member

kwhite7777

New Member

QRFMTOA

Level 5

in Education