- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- deduct from federal agency bonds interest from state taxable income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

deduct from federal agency bonds interest from state taxable income

I own several U.S. government backed federal agency bonds that are state tax-exempt (Federal Home Loan Bank, Fed. Farm Credit Bank). Interest from these is included in my brokerage 1099-INT (Box 1).

I cannot find a way in TT to designate that this interest is state tax-exempt in Pennsylvania. In PA Interest Income Worksheet, there is a column "US Govt Interest". If I put the interest earned from the agency bond, the amount is *not* deducted from the total amount from Box 1 of my 1099-INT. What form should I use to be able to properly make the correct adjustment?

Please help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

deduct from federal agency bonds interest from state taxable income

If you have interest income from federal agency bonds that are exempt from Pennsylvania income tax, make your adjustment on the screen “Interest Income Summary.”

- On “Interest Income Summary” tap Edit

- On “Adjust Federal Interest Income,” tap Yes

- On “Adjust Federal Interest Income, enter the Adjustment Amount as a positive number and select Other Adjustment

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

deduct from federal agency bonds interest from state taxable income

If you have interest income from federal agency bonds that are exempt from Pennsylvania income tax, make your adjustment on the screen “Interest Income Summary.”

- On “Interest Income Summary” tap Edit

- On “Adjust Federal Interest Income,” tap Yes

- On “Adjust Federal Interest Income, enter the Adjustment Amount as a positive number and select Other Adjustment

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

deduct from federal agency bonds interest from state taxable income

Great post! You found a solution for PA.

Any chance you can find a similar one in the interview for NC, as allowed by NC too?

Interest Income from U.S. Obligations | NCDOR

For NC, the only way I've found is to make an entry in Forms Mode with Desktop software:

_________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

deduct from federal agency bonds interest from state taxable income

Ernie,

Thanks for your reply.

However, I noticed the following problem. I have a Accrued Interest Adjustment, $280 which I entered at the federal step earlier. When I arrived at the PA Adjust Federal Interest Income screen, the amount of $280 is "locked". I can select "Other adjustment", but I cannot change the value of $280 to $2000 (my agency bond interest).

I further noticed that on the Form mode, the "Adj Type" column of the PA Interest Income Worksheet can only accept one entry (either "A" - Accrued Interest, or "H" - Other Adjustment).

It seems that the PA only accepts *one* adjustment, unfortunately, when I have two (accrued interest and agency bond), i am screwed.

Am I right? Do you think you have a way to resolve this situation?

Thanks again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

deduct from federal agency bonds interest from state taxable income

You need to combine the two and enter "Other Adjustment". Then you're all set.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

deduct from federal agency bonds interest from state taxable income

How would Federal Home Loan Bank (FHLB) & Federal Farm Credit Bank (FFCB) bond interest be accomplished for Michigan return? This interest is MI Tax Free yet, all the methods shown above do not work with MI. Everything seems to be hardcoded directly from Federal Schedule B with no method of changing with explanation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

deduct from federal agency bonds interest from state taxable income

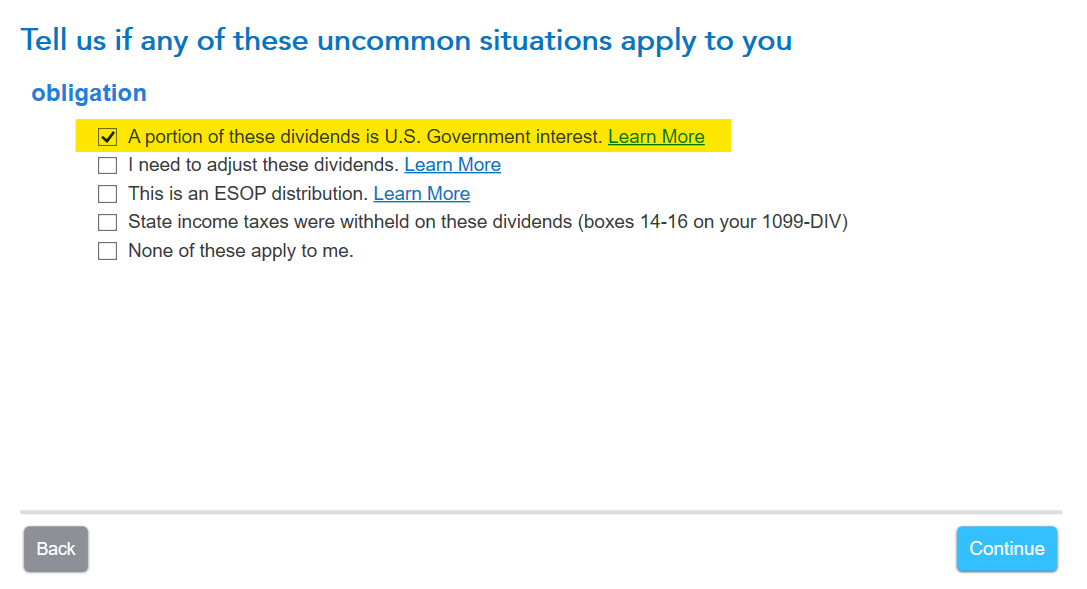

Yes, you will want to return to the federal entry. If the interest is on 1099-INT it should be in box 3 and carrying to the state. Otherwise, it is coming from a 1099-DIV and you have to select a box saying "A portion of these dividends is US Government interest" from the follow up screen. Continue on to enter the nontaxable portion.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

deduct from federal agency bonds interest from state taxable income

Correct, the Federal Home Loan Bank (FHLB) & Federal Farm Credit Bank (FFCB) bond interest is included in 1099-INT and part of Box 1. Do I manually remove this interest value from Box 1 and now include it in Box 3 to allow it to flow properly to Michigan income tax return filing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

deduct from federal agency bonds interest from state taxable income

Yes, to have the data picked up, it should be in box 3. The interest is taxable to the federal but not the state.

The MI subtractions line 10 data source:

From federal Schedule B, Interest and Dividend Income, Interest Income Smart Worksheet, Box 3, US Savings Bond/Treasury Obligations PLUS federal 1099-DIV Worksheet, Box 1a, U.S. Government Interest less related adjustments.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

deduct from federal agency bonds interest from state taxable income

I'm sure these two screen shots would be helpful if had any idea how to get to those screens. I am starting from an income screen that says "Let's finish pulling in your investment income" (I just finsihed "pulling in" 1099 info from my broker. How do I start the manual entry process from where I am?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

deduct from federal agency bonds interest from state taxable income

You will have to review the 1099-DIV entries. @2dwight

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sakilee0209

Level 2

Misspag

Level 2

in [Event] Ask the Experts: Investments: Stocks, Crypto, & More

tianwaifeixian

Level 4

LizzyPinNJ

New Member

user17521061672

New Member