- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Child tax credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child tax credit

I have a child that was born in January and most likely one that will be born here in December and the way I understand is that we get the $1400 stimulus check that they would’ve got as well. Does that come in the tax return or is that a separate thing?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child tax credit

The third stimulus payment that was not received for the children will be a Recovery Rebate Credit on your 2021 tax return. It will increase the amount of federal tax refund or decrease the amount of federal taxes owed on the return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child tax credit

Yes you will get it for both of them. If you didn't get a separate check (which you probably didn't didn't since they are born in 2021) you just add them as dependents when you file your 2021 return and the credit will be added on to your return if you qualify if your income isn't too high.

And when you enter them on your tax return be sure to select the WHOLE YEAR for the question How long did the baby live with you if they were born anytime during the year, even in December. You get credit for the whole year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child tax credit

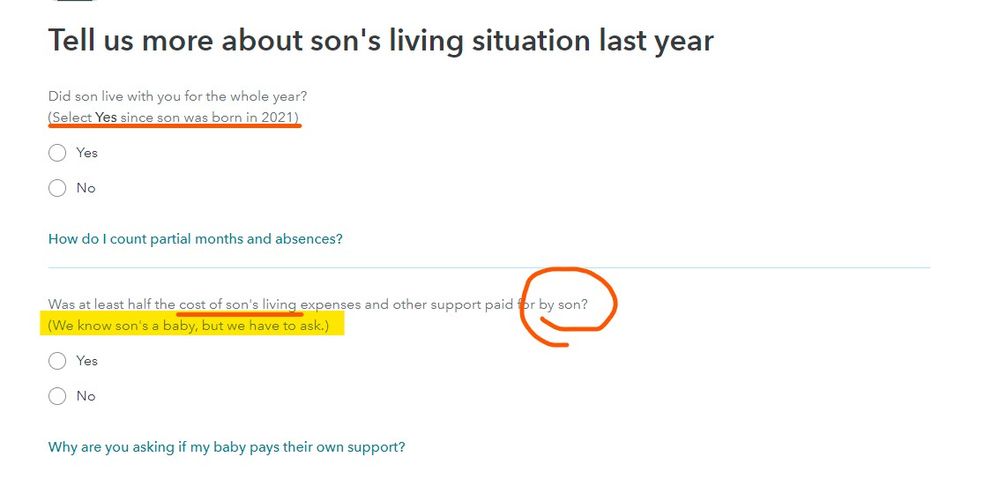

Yes ... pay attention to this screen carefully ... you must say YES and then NO...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child tax credit

As stated, it will be a "recovery rebate" and will be added to your tax return to increase your refund or decrease your tax owed.

Make sure you say the child lived with you the entire year (this is the correct answer for a newborn).

The child(ren) must have social security numbers for any tax benefits. Don't file until you get the SSN, even if you have to wait. If it will take longer than April 15 to get the SSN, be sure to file for an extension. Don't plan to file without the child and then file an amended return when you get the SSN. You need to file an original, on-time tax return that has the child's SSN.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jigga27

New Member

joeylawell1234

New Member

in Education

donnapb75

New Member

linda11mom

New Member

KimberlyFondren86

New Member