- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Child listed as nondependent - possible bug 2021

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child listed as nondependent - possible bug 2021

My first child was born in 2021, and I am trying to add her as a dependent. My spouse and I (filing jointly) have never claimed dependents in the past. Going through the step-by-step process I enter the following (underlined is my entry).

- Who do you support? - My Child

- Tell us about your child: Birthday 02/xx/2021. US Citizen. This child is my daughter

- How many months did xxxxx live with you in 2021? - The whole year. Months in the US - The whole year.

- Did any of these apply to xxxxx - None of these apply

- Who are xxxxx legal parents - Me and my spouse

- Did xxxxx pay for more than half of her living expenses - No, xxxxx did't pay...

- Did a relative help support xxxxx - No, a relative didnt live in my....

- Entered her work-valid social security ##

The program returns her status as Nondependent. I have deleted and gone through the process multiple times with the same result. Based on my entries, she should be listed as a dependent.

Am I missing something or is this a bug with the program?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child listed as nondependent - possible bug 2021

Thanks for your response.

I re-installed the application and opened from my saved return file. Without making any changes to the return, the program now displays my child as a dependent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child listed as nondependent - possible bug 2021

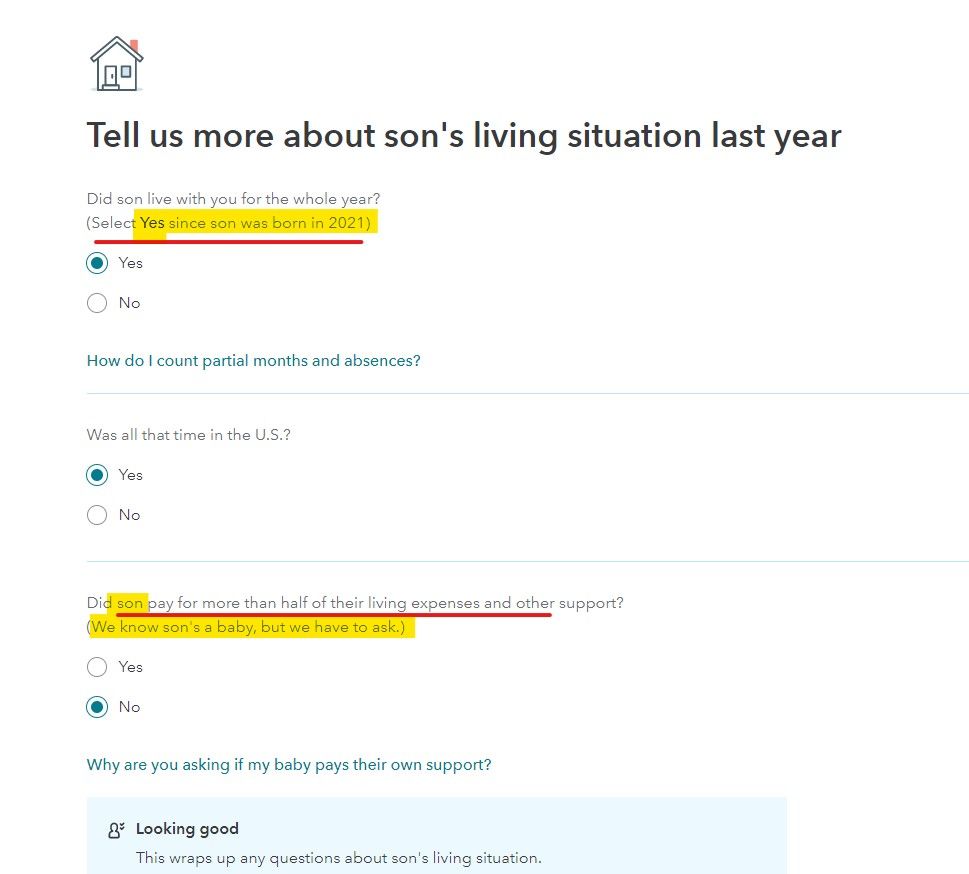

Make sure you have entered your child as a dependent in My Info, and that you have entered the child's Social Security number. If your child was born in 2021make sure you said he lived with you the whole year. There is an oddly worded question that asks if the child paid over half their own support. Say NO to that question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child listed as nondependent - possible bug 2021

Review this screen ... most mistakes are made here ... read the screen carefully...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child listed as nondependent - possible bug 2021

Thanks for your response.

I re-installed the application and opened from my saved return file. Without making any changes to the return, the program now displays my child as a dependent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Child listed as nondependent - possible bug 2021

I just went through the procedure using the same answers to the questions you entered and TurboTax qualified the child as a dependent. Try deleting the child entirely and starting over again.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

oliviasb

New Member

blackcAT721

New Member

jaked2332

New Member

sammycat

New Member

dwane-marsh

New Member