- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Charitable donations

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

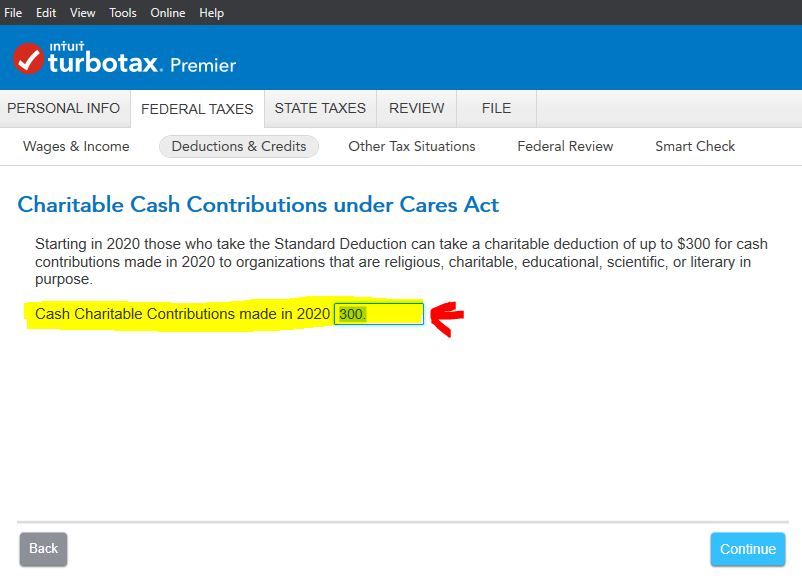

TurboTax Deluxe 2020: For calendar year 2020 those who file using 'standard deduction' are able to claim up to $300 of charitable donation deductions. When I enter that amount of charitable donation there is no change to the Federal Tax showing at the top of the display screen. Is TurboTax properly handling the allowed $300 donation amount for people filing using standard deductions?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

You must complete the Deductions & Credits section. Then go through the following screens where you are shown receiving the Standard Deduction. The next screen will have the cash contribution you entered. Continue. The amount contributed will be entered on the Form 1040 Line 10b and the meter will change.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

You must complete the Deductions & Credits section. Then go through the following screens where you are shown receiving the Standard Deduction. The next screen will have the cash contribution you entered. Continue. The amount contributed will be entered on the Form 1040 Line 10b and the meter will change.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

It is possible that the extra deduction from taxable income will make no difference to the bottom line of the return. LOOK at line 10b of the form 1040 ... do you see the $300 ?

How do I preview my TurboTax Online return before filing?

You can view your entire return or just your 1040 form before you e-file:

- Open or continue your return.

- Select Tax Tools in the left menu (if you don't see this, select the menu icon in the upper-left corner).

- With the Tax Tools menu open, you can then:

- Select Print Center and then Print, Save, or Preview This Year's Return to preview your entire return, including all forms and worksheets (you may be asked to register or pay first).

- View only your 1040 form by selecting Tools. Next, select View Tax Summary in the pop-up, then Preview my 1040 in the left menu.

Related Information:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

Thank you. Guess the salient calculations are buried a bit deeper in the program than I expected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

Can a married couple, using Std Deductions, take two $300 charitable deductions or $600 total?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

Is that $300 per person, or $300 per family (husband & Wife)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable donations

@dickpodolec wrote:

Can a married couple, using Std Deductions, take two $300 charitable deductions or $600 total?

The maximum is $300 for married filing jointly.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

steinerre2020

New Member

CFinAZ

Level 1

daniel-j-demarco

Level 1

JKTax2019

Level 1

bruce-carr49

New Member