- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Why does Turbo Tax incorrectly think the W-2 shows state wage information (Boxes 15-17) for more than one state? It does not. My husband lives and works in NJ.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbo Tax incorrectly think the W-2 shows state wage information (Boxes 15-17) for more than one state? It does not. My husband lives and works in NJ.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbo Tax incorrectly think the W-2 shows state wage information (Boxes 15-17) for more than one state? It does not. My husband lives and works in NJ.

Your husband lives and works in NJ but if his residency is in another state with you, the resident state gets to tax the income and calculate a credit from the NJ tax liability.

Review the w2 entries and be sure only NJ is showing. You may have something stuck in the program.

Online version:

A full or corrupted cache can cause problems in TurboTax, so sometimes you need to clear your cache (that is, remove these temporary files).

For stuck information follow these steps:

- Delete the w2 if possible, see How to Delete

- Log out of your return and try one or more of the following:

- Log back into your return.

- Enter the information again.

Desktop version:

- Delete the form

- Save your return while closing the program.

- Update the program

- Open

- Enter the information again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbo Tax incorrectly think the W-2 shows state wage information (Boxes 15-17) for more than one state? It does not. My husband lives and works in NJ.

His residency is also in NJ with me. I live and work in NJ, for a NJ based employer. We file jointly. None of this makes any sense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbo Tax incorrectly think the W-2 shows state wage information (Boxes 15-17) for more than one state? It does not. My husband lives and works in NJ.

Please clarify your question.

- What is telling you there is another state?

- Is an additional state listed on his W-2?

- What state is listed as the home state in My Info?

Please contact us again and provide some additional details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbo Tax incorrectly think the W-2 shows state wage information (Boxes 15-17) for more than one state? It does not. My husband lives and works in NJ.

When I tried to do our NJ Return Turbo Tax takes me to a page where it says that there are multiple states referenced in Boxes 15-17 of my husband's W-2. But there are not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbo Tax incorrectly think the W-2 shows state wage information (Boxes 15-17) for more than one state? It does not. My husband lives and works in NJ.

NJ is listed as our home state in Info.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbo Tax incorrectly think the W-2 shows state wage information (Boxes 15-17) for more than one state? It does not. My husband lives and works in NJ.

In that case I suggest you delete that record. and simply re-enter it.

If a problem continues, there is something else going on.

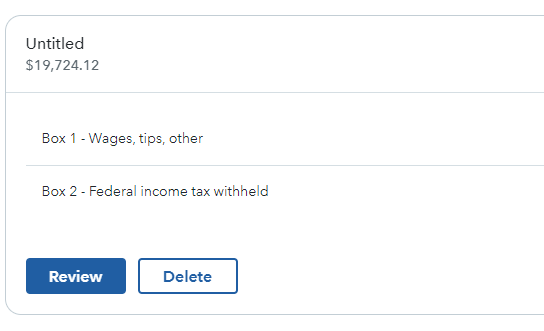

To delete the file, click the Delete in that tax record.

You do have the TurboTax Live feature.

When you need help from a tax expert, just select the “Live Help” button, and we'll connect you.

You can discuss your questions over the phone, via live chat, or via one-way video on your screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbo Tax incorrectly think the W-2 shows state wage information (Boxes 15-17) for more than one state? It does not. My husband lives and works in NJ.

Thanks. I have deleted and reentered the W-2 numerous times I have also worked with Live Help to no avail. They simply can't explain it. I think this may be my last year with Turbo Tax because there are simply too many unexplained issues when I try to do my NJ State return and the Live Help does nothing but say to delete and reenter.

This is just one of many issues I am having. It's counting my husband's 1099-R twice and attributing the 2nd to me, reporting that I have done a rollover that I have not. It insists on asking me all kinds of questions about dividend income even though I have none. It also is providing a business loss carryover of $40k without any explanation. I haven't been part of a business since 2009.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbo Tax incorrectly think the W-2 shows state wage information (Boxes 15-17) for more than one state? It does not. My husband lives and works in NJ.

Did you try all of @AmyC's suggestions?

Did you import your W-2? If so, try deleting it and then re-entering the information manually.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbo Tax incorrectly think the W-2 shows state wage information (Boxes 15-17) for more than one state? It does not. My husband lives and works in NJ.

I did thank you. I entered it manually. Multiple times at this point! It's maddening.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbo Tax incorrectly think the W-2 shows state wage information (Boxes 15-17) for more than one state? It does not. My husband lives and works in NJ.

It's difficult to analyze the problem when you can't see the tax return .

It looks like you have TurboTax Live.

With this feature you can contact a live TurboTax Tax Expert to view your return and answer any questions.

- Select the floating Live help button.

- Select Connect with live help at the top of the chat window.

- Enter your question or topic area and select Continue.

- Please see: How do I connect with a tax expert in TurboTax Live?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbo Tax incorrectly think the W-2 shows state wage information (Boxes 15-17) for more than one state? It does not. My husband lives and works in NJ.

Thank you, but I have done that (twice), and theu couldn't help. Allegedly my issue was being elevated to a manager who was supposed to call me at 9 am this morning. I am still waiting for that call at 11:48 am!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbo Tax incorrectly think the W-2 shows state wage information (Boxes 15-17) for more than one state? It does not. My husband lives and works in NJ.

Instead of deleting and re-entering just the W-2, have you tried deleting or starting over the entire NJ return?

How do I delete my state return in TurboTax Online? (intuit.com)

(Obvious but maybe worth checking) Are you sure that in My Info you answered NO to the question about having income from other states?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbo Tax incorrectly think the W-2 shows state wage information (Boxes 15-17) for more than one state? It does not. My husband lives and works in NJ.

Yes I have run through all the questions numerous times to confirm that the answers are correct. I have redone the State return numerous times as well. No change. And no return call from Turbo Tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbo Tax incorrectly think the W-2 shows state wage information (Boxes 15-17) for more than one state? It does not. My husband lives and works in NJ.

By any chance did your 2022 return include NYS?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Nka0002

New Member

alibandeali

New Member

loislang12

Level 1

CA_HI_NY_Man

Returning Member

Dmitry1

Level 3