- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Work in NY, live in NJ. Why are cap gains (stocks) showing as taxable in NY? I tried allocati...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work in NY, live in NJ. Why are cap gains (stocks) showing as taxable in NY? I tried allocating $0 to NY but "Additional income taxed by NY" line still shows the amount

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work in NY, live in NJ. Why are cap gains (stocks) showing as taxable in NY? I tried allocating $0 to NY but "Additional income taxed by NY" line still shows the amount

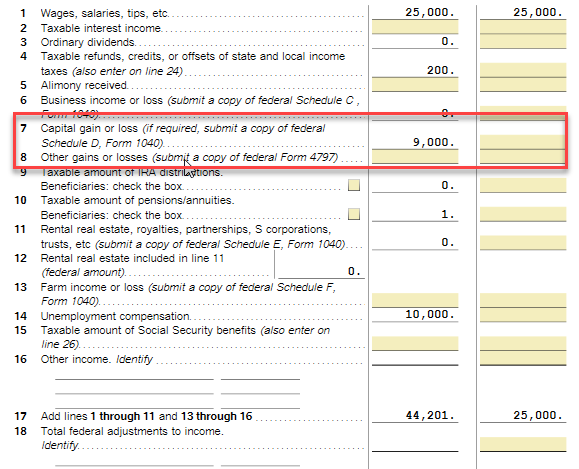

Capital gains and dividends will show up in New York adjusted gross income because of the way NY calculates tax for part-year and non-residents.

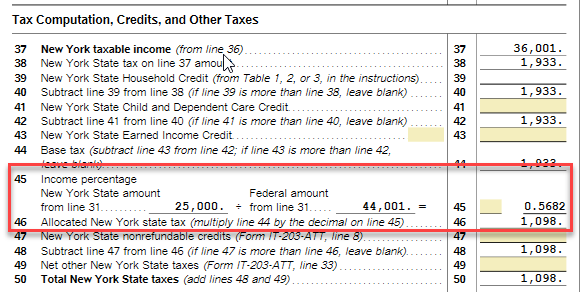

NY includes income earned everywhere to come up with a base tax amount. Nonresidents then pay tax on the NY percentage of the base tax (NY income ÷ all income). For example if you made $90,000 in salary and had $10,000 in capital gains, your base tax would be the tax on $100,000. Suppose that tax is $10,000. Your actual NY liability is 90% ($90,000/$100,000) of your base tax.

Check your IT-201. It will have a NY column. Capital gains should be blank or $0. The allocation will be on page 2 line 45.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17539892623

Returning Member

Sweet300

Level 1

Vermillionnnnn

Returning Member

in Education

xu_tax

New Member

fpho16

New Member