- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

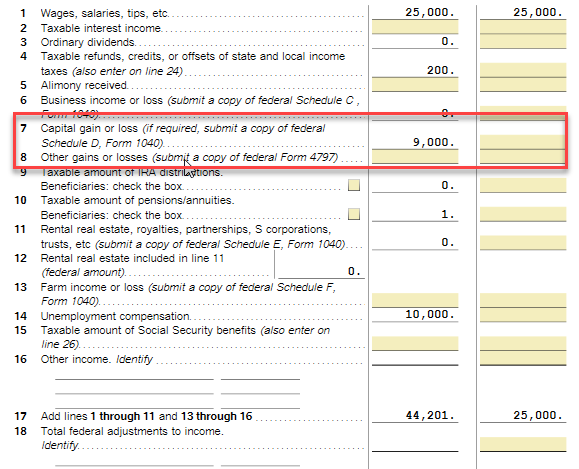

Capital gains and dividends will show up in New York adjusted gross income because of the way NY calculates tax for part-year and non-residents.

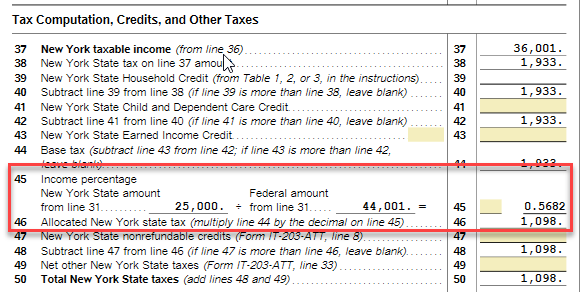

NY includes income earned everywhere to come up with a base tax amount. Nonresidents then pay tax on the NY percentage of the base tax (NY income ÷ all income). For example if you made $90,000 in salary and had $10,000 in capital gains, your base tax would be the tax on $100,000. Suppose that tax is $10,000. Your actual NY liability is 90% ($90,000/$100,000) of your base tax.

Check your IT-201. It will have a NY column. Capital gains should be blank or $0. The allocation will be on page 2 line 45.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 24, 2021

8:16 PM