- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Will TurboTax ask me about our multi-member LLC?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will TurboTax ask me about our multi-member LLC?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will TurboTax ask me about our multi-member LLC?

@beanorama wrote:

On setup, TurboTax's questions presumed my wife and I are in separate businesses. We're not. We share a multi-member LLC. There was no way to tell it htat. How will TurboTax know how to correctly file our form 1065 if it won't even ask?

Are you trying to enter K-1s that were issued to you and your wife or trying to file a Form 1065?

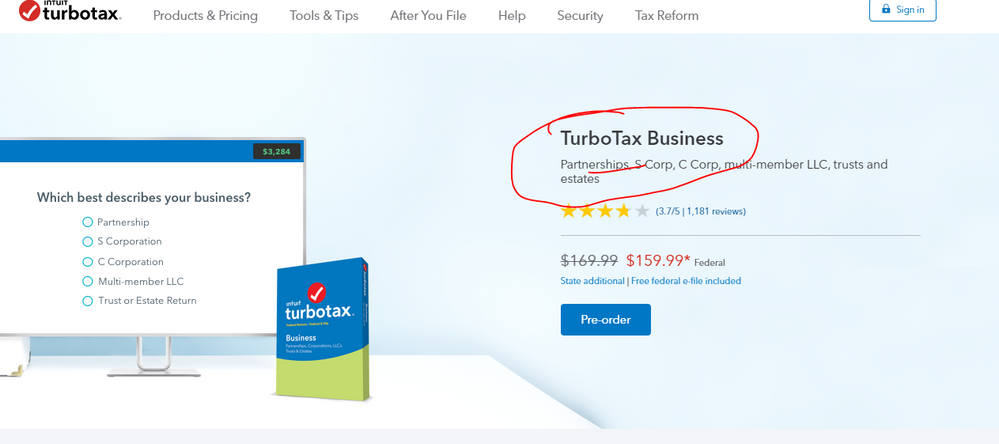

Only TurboTax Business is capable of preparing a Form 1065 and TurboTax Business is only available as an installed (desktop) product under Windows. There is no Mac nor online version.

Please post additional details with respect to exactly where in the program you are stuck.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will TurboTax ask me about our multi-member LLC?

you need the business version of TT to prepare and file a 1065, the version listed in your thread is only for 1040s. since you are a LLC, you can't use the qualified joint venture option to avoid filing the 1065. it was due 3/15/2019 and the extended due date was 9/15/2019. so it is at least one month late and if you didn't extend it it is now 7 months late . since there are two members the penalty for late filing is $390 per month. expect a bill from the iRS. if you get one, you can try to get it abated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will TurboTax ask me about our multi-member LLC?

Thank you. Now I also see in answer to another post that this won't do what I need. TurboTax Self-Employed apparently won't work for a married couple that's self-employed in the same multi-member LLC treated as a disregarded entity and taxed as a partnership. Wish they would have said that before I spent hours on it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will TurboTax ask me about our multi-member LLC?

Thank you for the information. In investigating TurboTax Self-Employed, I thought it would work for us since we're both self-employed. Apparently not.

And I'm not needing to file 2018 as we already did. I'm investigating TurboTax for filing in 2019 (and finding that there's not much I can learn about TurboTax until they decide to release something for 2019). Thank you for your concern.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will TurboTax ask me about our multi-member LLC?

"multi-member LLC treated as a disregarded entity and taxed as a partnership"

This contradicts itself, if youre taxed as a partnership, youre not a disregarded entity. When you applied for and obtained your federal EIN, the letter that was provided that showed the EIN would have also shown what tax form would be required and when it was due....do you have that letter?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will TurboTax ask me about our multi-member LLC?

Further, if you reside in a community property state and the only members of the LLC are you and your wife, see the following Rev. Proc.:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will TurboTax ask me about our multi-member LLC?

Lisa, I wasn't being clear. As another poster notes, the IRS accepts our characterization of the LLC (which technically isn't "disregarding" it, though it sure seems that way). We chose to have our LLC "treated" as a partnership (which is to say, it doesn't pay tax, but we as its partners do).

Yes, the LLC has an EIN and it is used for the LLCs informational return filed on Form 1065.

Again, to be clear, I'm not doing my 2018 taxes here now. I'm trying to figure out how TurboTax works to decide if it will help me in preparing my 2019 taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will TurboTax ask me about our multi-member LLC?

I appreciate everyone's concern. Maybe I can be more clear about what I'm now asking.

I've already learned a few things. TTSE won't do Form 1065. I would need to use TT Business for the Form 1065. But TT Business won't do personal taxes, so I'd also need TT SE. But TTSE won't help me plan for 2019 personal taxes yet because it still presumes I'm doing my 2018 taxes.

I'm now trying to discern if there's anything I can do now to investigate how either of the TT products/services would work for me for 2019. If anyone has any suggestions, I'm all ears.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will TurboTax ask me about our multi-member LLC?

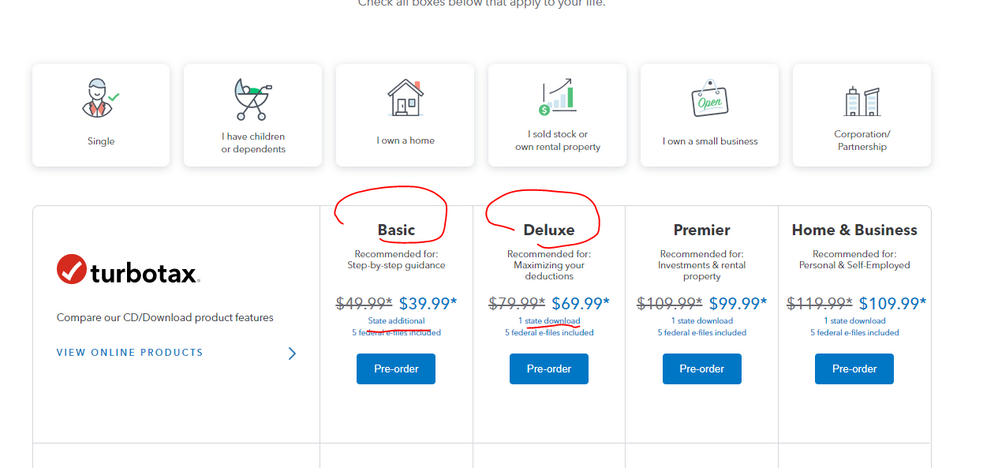

Ok ... the downloaded 2019 programs will not be available until late November but you can pre order them here :

For the Partnership : https://turbotax.intuit.com/small-business-taxes/

You can use ANY of the personal versions... Use Basic if you have no state return to do and Deluxe if you do ... and only upgrade (in program) if you feel you need more help.

For a Personal return : https://turbotax.intuit.com/personal-taxes/cd-download/

If you want to use the Online personal version ... that comes online sometime in December ... and since you need to enter the K-1 forms from the 1065 return you must use the Premier version ... you do NOT need the SE version UNLESS you also have a sole proprietorship to report.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will TurboTax ask me about our multi-member LLC?

Now if you need to tax plan for 2019 then you do use the 2018 program ... if you have the downloaded version you can use a couple of options ... see below. If you used the Online version then access has closed.

This is my mini version of the downloaded tutorial that should be in the downloaded program:

What is Forms Mode?

Forms Mode lets you view and make changes to your tax forms "behind the scenes."

If you're adventurous, you can even prepare your return in Forms Mode, but we don't recommend it. You may miss obscure credits and deductions you qualify for, and you may forget to report things that will come back and haunt you later.

Forms Mode is exclusively available in the TurboTax CD/Download software. It is not available in TurboTax Online.

Related Information:

- Why would I use Forms Mode?

- How do I switch to Forms Mode in the TurboTax for Windows software?

- How do I switch to Forms Mode in the TurboTax for Mac software?

If you want to play around with different figures and tax scenarios without affecting your original return you can ….

- >>>In the TurboTax CD/Download software by creating a test copy:

- Open your return in TurboTax.

- From the File menu, choose Save As.

- Give the copy a new name to distinguish it from the original (for example, by adding "Test" or "Example" to the file name).

- Click Save. You are now safely working in the test copy and anything you do here will not affect the original.

- https://ttlc.intuit.com/questions/1900642-how-to-make-a-test-copy-of-your-return

- >> use the WHAT IF tool:

- - Click Forms Icon (upper right of screen) or Ctrl 2 (forms view)

- - Click on the Open Form Icon

- - In the “Type a form name.” area type What-If (with the dash), click on the name of the worksheet - click on Open Form

- - You will see the worksheet on the right side of the screen; enter the information right into the form

- - To get back to interview mode - click on the Step-by-Step Icon (upper right of screen) or Ctrl 1

It's always a good idea to make a backup copy of your tax data file, in case your original gets lost or corrupted. Here's how:

- From the File menu in the upper-left corner of TurboTax, choose Save As (Windows) or Save (Mac).

- Browse to where you want to save your backup.

- Tip:If you're saving to a portable device, save it to your computer first to prevent data corruption. Then, after completing Step 4, copy or move the backup file to your device.

- In the File name field, enter a name that will distinguish it from the original tax file (for example, add "Backup" or "Copy" to the file name)

- Click Save and then close TurboTax.

- Restart TurboTax and open the backup copy to make sure it's not corrupted. If you get an error, delete the backup and repeat these steps.

If you make changes to your original tax return file, repeat these steps to ensure your original and backup copies are in-synch.

Related Information:

- Retrieve a Tax File from a Portable Device

- What's the difference between the tax data file and the PDF file?

- How do I save my return as a PDF in the TurboTax software for Windows?

- How do I save my return as a PDF in the TurboTax software for Mac?

- How can I protect the tax files on my computer?

GEN85508

Answered by TurboTax FAQ to this question

AND save it as a PDF so you have access to a copy even if you don’t have the program still installed and operational :

- How do I save my return as a PDF in the TurboTax software for Windows?

- How do I save my return as a PDF in the TurboTax software for Mac?

AND protect the files :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will TurboTax ask me about our multi-member LLC?

@Critter, thank you for all the information you provide in your responses. Yet I'm still really at sea trying to figure out how to even evaluate TurboTax. Maybe it's just not possible. Maybe I just have to bite the bullet and buy.

But if so, which one? Do I buy a CD/download? Or online? Which ones work for the "partnership" and which for us personally? How do I choose? When can I buy it?

The "Tell us about you" page says the online TT SE is the one, but I've learned here that it won't work for multi-member LLCs. The "which product is right for you" page says that TT Business is the one, but I've also learned here that's wrong: TT Business won't do my personal returns.

As best as I can tell, I'm supposed to buy a CD/Download of TT Business and then also buy either a CD/download or subscription to TT SE.

I've been doing my own taxes, with several businesses, for years now. This year I was hoping TT would help me run different scenarios, mainly on how we allocate revenues and contributions among various tax-advantaged options. I was also hoping for a 21st Century solution that would automate things better than fumbling around with a bunch of filled-in PDFs. Everything else we do is cloud-based, so I was hoping to streamline my tax preparation process, too. But I can't wait until sometime in December. Some of those decisions need to be made sooner than that.

Frankly, using the IRS's forms and publications is infinitely easier than shopping and evaluating TurboTax has been so far. At this point it's just really hard for me to imagine that my experience with TurboTax's tax preparation will be any less confusing and convoluted.

I really appreciate the information and help you folks here on the community forum have provided. It is concerning that, with TurboTax's own information about its products and services being incorrect, it has apparently outsourced its sales process to you all as the only source of reliable information. That's just not instilling confidence.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will TurboTax ask me about our multi-member LLC?

@beanorama wrote:But if so, which one? Do I buy a CD/download? Or online? Which ones work for the "partnership" and which for us personally? How do I choose? When can I buy it?

Buy TurboTax Business (for your LLC - Form 1065) and TurboTax Premier (unless you need to do Schedule C in which case you would buy TurboTax Home & Business).

Buy the download versions of both products; do not buy the online versions (there is no online version of TurboTax Business, anyway).

TurboTax Business can be used to prepare the income tax return for your LLC (Form 1065) and associated K-1s. TurboTax Premier (or Home & Business) can be used to prepare your personal income tax return (Form 1040) and will accommodate entry of the K-1s from your LLC.

You can buy both download versions probably late next month (November).

If you are still in doubt, Intuit offers a 60-day money back guarantee.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will TurboTax ask me about our multi-member LLC?

I agree ... buy the superior downloaded version for both personal and partnership returns since you know what you are doing ... again you can cheap out on the personal return since you do NOT need the premier version as all the downloaded versions have all the same forms unlike the online version. See my notes and links above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will TurboTax ask me about our multi-member LLC?

@Critter @Anonymous_ , thanks so much.

I may or may not get the TT Business. Frankly, the return is drop-dead simple. I may get it if only because I have to pay Intuit to file a handful of 1099s anyway, so might as well have it to do the typing to generate the Form 1065 and K-1s.

For the personal return, I'm fine going with downloaded version if you say it's "superior." That's the only useful information I've heard about the difference between download/online.

One more clarification please, if you will?

We do have other businesses that are single-member LLCs (separate and apart from the multi-member "partnership" that''s causing all the grief here). So we need Schedule Cs for those. And of course we need Schedule Es for reporting the K-1 income, and Schedule SEs. Are you saying if I get the download version, I actually don't have to get the TT SE, because the TT Basic and Deluxe versions both have all the forms, including those forms?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dkbrad

New Member

Idealsol

New Member

roybnikkih

New Member

gerald_hwang

New Member

ahkhan99

New Member