- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: TurboTax online not allowing me to itemize MN state deductions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax online not allowing me to itemize MN state deductions

I noticed a significant difference between my MN state taxes from last year to this year. This led me to discover that TurboTax was reducing my standard deduction in accordance with the standard deduction phase out. However, I should have itemized deductions instead. I itemized my federal return. However, I have re-done my state return several times, and it's not showing up as itemized. It's not submitting a form M1SA. I think I've discovered a bug here.

Edit:

Here are some threads with similar issues but they seem to have resolved by the tax deadline:

https://ttlc.intuit.com/community/taxes/discussion/mn-itemized-deduction/00/8845

https://ttlc.intuit.com/community/state-taxes/discussion/minnesota-form-m1sa-missing-from-2019-progr... - another person with an issue of TurboTax filling in the standard deduction for the state return and not giving the poster the option for the itemized, later fixed.

https://ttlc.intuit.com/community/taxes/discussion/re-why-did-turbotax-change-my-mn-state-return-ded... - another issue with miscalculated MN state return. I experienced this issue as well. My refund magically disappeared and turned into a balance due without any changes.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax online not allowing me to itemize MN state deductions

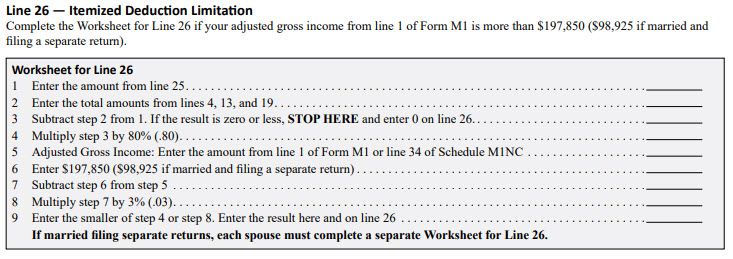

Minnesota itemized deductions begin to phase out at the same income levels as the standard deduction phase-out ($197,850 for all filers expects those married filing separately, where the threshold is $98,925).

See: Phase-Out of Itemized Deductions Addition

It's possible the standard deduction still produces the better result on the Minnesota return, which is why you are not seeing itemized deductions. The phaseout will appear on M1SA line 26 worksheet.

TurboTax will create this worksheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax online not allowing me to itemize MN state deductions

Thanks so much for the reply. I filed MN last year, and I had the itemized deduction. My income went up a bit from last year. I had the phase out calculated in last year too. However line 4 on my form M1 is a full 3 times lower than last year. Unfortunately TurboTax is not even generating the M1SA worksheet for me.

I really think there is a bug here in this version that is preventing me from even generating the worksheet for M1SA. I have tried going back to federal and re-selecting manually the itemized deduction, even though it was higher and TurboTax selected it for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax online not allowing me to itemize MN state deductions

Without looking at your return, it's hard to tell what's going on.

All the error messages about Minnesota standard/itemized deductions seem to relate to the 2019 return. I think if there was a problem for 2020 there would be messages about that as well.

I suggest contacting a TurboTax. Ask for a CPA, Enrolled Agent or Tax Attorney. Tell them to pull a sanitized "diagnostic" copy of your tax return. This is a copy where personal identifying information is removed. The expert can look at how the numbers are flowing onto your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax online not allowing me to itemize MN state deductions

Thank you. I actually did call today. I was able to share my screen with the agent and show him the discrepancy. He escalated it quickly to his manager who also viewed my return. (I hope this was the sanitized version you mentioned.) He said he was 99% sure this was a system issue. It is being escalated to their resolutions team. They are going to get back in touch with me.

I will ask next time to speak to a CPA, enrolled agent, or tax attorney. That is a good recommendation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax online not allowing me to itemize MN state deductions

Great to hear that @bugmenot. Hopefully TurboTax will figure out what's going on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax online not allowing me to itemize MN state deductions

They've been able to confirm for me that there is indeed an error in the online version. They pulled my return into a desktop version and it submitted M1SA. I used the online version because the current TurboTax desktop version doesn't work with the new Macs. Very frustrating overall. Unclear if this will be fixed before the extension deadline.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax online not allowing me to itemize MN state deductions

Why doesn't Turbo Tax Desktop work with new Macs? It should. If you don't have a CD drive you can download the program instead.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax online not allowing me to itemize MN state deductions

It's because of the new chipset that Apple created. If you Google for the M1 or Silicon Macs you will find a lot out about it. There's a big thread about it on the forums here. What's even more frustrating is that I still have my old MacBook but this year TurboTax stopped supporting that OS version. So I had to buy a new one. And now they don't support that. Apple released it to developers ahead of its November 2020 release, and Intuit just didn't write the software to support it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax online not allowing me to itemize MN state deductions

@macuser_22 Do you know anything about this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax online not allowing me to itemize MN state deductions

I don't want to get too far off track with the silicon Mac issue. There is another large thread about it here. There is a work around with Rosetta but it's suboptimal. As you can see, people had to delete cache files, etc etc. I saw enough to not even want to try it and use the online version. In retrospect, that was a mistake. However I have uncovered a bug in the online version that will hopefully help out other people.

Just to continue to describe my experience. I got a very nice rep who downloaded my return with the token ID. I really thought she was going to be able to help me. She transferred my info into the desktop version and confirmed that it was different. It allowed me to itemize. However, she then told me that this was a "feature" of the desktop version. 😑 Intuit doesn't allow the exploding head emoji, but you can use your imagination. She said that it was ok for the online version to allow me to file an inaccurate return because the ability to select itemized deductions--when it's lower--was a "feature." Couldn't believe it. I then tried to explain to her, in great detail with great patience, that there is a phase out of the itemized and standard deduction in Minnesota. I believe the bug that I've found is that it compares your phased out itemized deduction to the non-phased out standard deduction. Then it shows that your itemized deduction is lower so it gives you the standard deduction. THEN it phases out the standard deduction. So it's forcing me to use the lower standard deduction. Incredibly frustrating. The rep even confirmed that it uses the itemized deduction on the desktop version. There shouldn't be a difference between the desktop and online version.

To add insult to injury, after a long time trying to explain this to her, I asked kindly to have her conference in a CPA for a three way call because I figured this would be instantly obvious to a CPA who could then explain it to the rep. Rather than do that she just transferred me back into the regular queue for representatives. Then that new rep couldn't transfer me back to the old rep. I was cutoff from her forever it seems. Even though she was the one most familiar with my case. So I started over and explained the whole situation again. And then for about the 50th time, I let her see my screen, and I went all through the state return, yet again. Then she put a request for someone to call me back at a higher level. We hung up.

Several hours later, I was able to hear from a CPA finally. I explained the entire situation yet again. The first rep had closed out my case, even though it was not fixed. At this point, I could have just forgotten about, bought the desktop, and fixed it, but I really want this issue fixed for other people. This is clearly an error on the online version. It's miscalculating which deduction is lower. So finally this CPA is quite helpful. However, again this is several hours later, I was busy and couldn't supply a token ID again. Although this issue is rapidly becoming my full time job, I did have other things to do. So I setup a callback for today. She kindly called me back. I supplied the token ID, and then of course there were more technical issues, so she couldn't access the return info. (I left out the part earlier where the first rep couldn't access my info and had to contact her own technical support.) So I waited all day today, and she contacted me to let me know that she had another appointment she had to leave for. I appreciated the call because god forbid you ever want to RETURN a call to Intuit. Forget that. It's incredibly difficult to get ahold of a live human at Intuit. We set up another call for tomorrow.

So at this point, many hours wasted for a simple issue. Many phone calls. Issue still not resolved. I just want this fixed so I can file online and move on.

I'm detailing this experience so that maybe someone else can benefit from this encounter. Also maybe someone from Intuit can see this and make some changes. It shouldn't be this hard.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax online not allowing me to itemize MN state deductions

After multiple more phone calls and a very kind CPA who confirmed what I had reported manually, the workaround was to simply do my return on the desktop version. Of course I received this in an email from an email address I could not reply to! Very frustrating to get back into touch with TurboTax. So I imported my information from online, ran through everything, and it still gave me the wrong tax due amount.

The next workaround was to go into the info worksheet and check the box for "Itemize even if Minnesota itemized deductions are less than standard deductions." This gives me the correct MN state tax due (even though itemized is higher than standard).

Very odd. And very interesting this still hasn't been fixed. I only found this issue because I checked my return PDF manually. Good to know that the "100% accurate calculations guarantee" isn't really accurate I guess.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax online not allowing me to itemize MN state deductions

Just wanted to post another update. I decided to start over on the desktop. I found a MacBook I could use for it. I first downloaded the online version data to upload it. It still contained the error. So I COMPLETELY redid my return from a completely fresh return file on the desktop version. Same result as the online. The only difference is that you can manually select to itemize "if the itemized is lower." However, when I force itemized, my tax due drops and refund goes up, so it's not "lower." The bug is that TurboTax inaccurately compares the standard vs itemized deduction to determine which is better for you.

So the bug affects both online and desktop. No fix was rolled out. I know this affected at least one other person who had an even higher itemized deduction balance than me. Very interesting approach TurboTax has had to this issue. Doesn't give me a lot of confidence going forward.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

itsagirltang69

New Member

tcondon21

Returning Member

CTinHI

Level 1

Raph

Community Manager

in Events

user17520191032

New Member