- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: NY. IT360.1 Line 15 Other Inc shows HSA Emp'er Cont'n $750. Error is "Amt in line 15 of Other...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY. IT360.1 Line 15 Other Inc shows HSA Emp'er Cont'n $750. Error is "Amt in line 15 of Other Inc w/s don't agree with Inc Alloc w/s to Line 15 Column A" How to fix?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY. IT360.1 Line 15 Other Inc shows HSA Emp'er Cont'n $750. Error is "Amt in line 15 of Other Inc w/s don't agree with Inc Alloc w/s to Line 15 Column A" How to fix?

First, may I assume that you had HSA contributions through your employer (i.e., code W in box 12 on your W-2)?

Second, did you allocate that amount to Yonkers or NYC or both?

Third, can you see the Other Inc Wks (Other Income worksheet) and the Inc Alloc Wks (Income Allocation worksheet)? What numbers are there referring to Other Income (line 15)?

To see these worksheets, you need either to be using the CD/download product or have already paid for the Online product.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY. IT360.1 Line 15 Other Inc shows HSA Emp'er Cont'n $750. Error is "Amt in line 15 of Other Inc w/s don't agree with Inc Alloc w/s to Line 15 Column A" How to fix?

Hi, I am getting this error as well. On the worksheet, in Column A (Federal), the HSA contributions are being pulled in to line 15, but they are not being included in the sum in Line 16.

How can I get the total in Line 16 to update? It should just be a simple sum, but I have no way of modifying it from my end. I have gone through everything multiple times and restarted my taxes from scratch to try to remedy this issue with no luck. Is it possible this is a system error?

Thanks for any help you can provide!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY. IT360.1 Line 15 Other Inc shows HSA Emp'er Cont'n $750. Error is "Amt in line 15 of Other Inc w/s don't agree with Inc Alloc w/s to Line 15 Column A" How to fix?

Are HSA contributions showing up as an income item on your federal return? Probably on line 8 of Schedule 1 (1040)? HSA contributions are not normally income items unless you had excess contributions.

Alternatively, if you had HSA contributions on your W-2 (in box 12 with a code of 12) but had not gone through the HSA interview yet in order to show that you had HDHP coverage, then the code W amount will appear on form IT-360.1 as income (even though it won't be income when you properly complete your return).

So let's figure out why your HSA contributions are income first, then we can work on New York.

When you reply, at the bottom of your reply, please enter @ BillM223 (without the space in between) so that I will be notified.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY. IT360.1 Line 15 Other Inc shows HSA Emp'er Cont'n $750. Error is "Amt in line 15 of Other Inc w/s don't agree with Inc Alloc w/s to Line 15 Column A" How to fix?

Hi Bill, thanks so much for the reply!

My HSA contributions are not being counted as income on my federal return (and I did not contribute over the limit). My HSA contributions are on my W-2 and I have gone through the HSA interview already and confirmed my HDHP coverage.

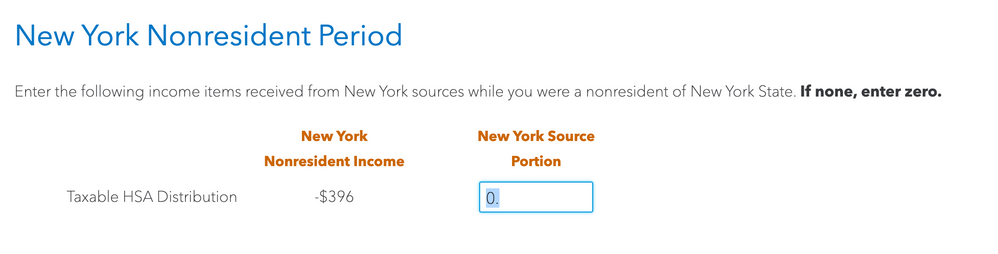

Are there any other reasons my HSA contributions could be incorrectly coming through as income? I am not sure if this helps but I attached one of the sections of my NY state return that I found peculiar, and perhaps is related to the issue. I'm not sure why there is a "taxable HSA distribution"... and also I did not have any HSA distributions during 2020 (which I confirmed during my interview for federal) -- I only had contributions to my HSA. Thanks for any help you can provide!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY. IT360.1 Line 15 Other Inc shows HSA Emp'er Cont'n $750. Error is "Amt in line 15 of Other Inc w/s don't agree with Inc Alloc w/s to Line 15 Column A" How to fix?

A taxable HSA distribution is, as you know, when you enter a 1099-SA and indicate that some or all of it was NOT for qualified medical expenses.

Can you see your 8889? If so, what are the numbers on lines 14-17 in Part II on the 8889?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY. IT360.1 Line 15 Other Inc shows HSA Emp'er Cont'n $750. Error is "Amt in line 15 of Other Inc w/s don't agree with Inc Alloc w/s to Line 15 Column A" How to fix?

Lines 14-17 on my 8889 are all blank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY. IT360.1 Line 15 Other Inc shows HSA Emp'er Cont'n $750. Error is "Amt in line 15 of Other Inc w/s don't agree with Inc Alloc w/s to Line 15 Column A" How to fix?

I am mystified as to what that NY line is referring to. I can reproduce the line your are seeing ("Taxable HSA Distribution") only by creating a taxable HSA distribution on the federal return. However, this should have created at least an entry on line 16 of the 8889, which you say isn't there.

So, if you are game, let's try this.

Delete all your HSA data on the federal return, re-add it, then run through the New York interview again. Perhaps at some point there was a taxable gain which snuck into New York, but now it's not on the federal return, but New York has not forgotten.

***HSA Reset***

1. make a copy of your W-2(s) (if you don't have the paper copies)

2. delete your W-2(s) (use the garbage can icon next to the W-2(s) on the Income screen)

*** Desktop***

3. go to View (at the top), choose Forms, and select the desired form. Note the Delete Form button at the bottom of the screen.

*** Online ***

3. go to Tax Tools (on the left), and navigate to Tools->Delete a form

4. delete form(s) 1099-SA (if one), 8889-T, and 8889-S (if one)

5. go back and re-add your W-2(s), preferably adding them manually

6. go back and redo the entire HSA interview.

After this, run through the New York interview, and see if that Taxable HSA Distribution is still there.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY. IT360.1 Line 15 Other Inc shows HSA Emp'er Cont'n $750. Error is "Amt in line 15 of Other Inc w/s don't agree with Inc Alloc w/s to Line 15 Column A" How to fix?

Hi @BillM223 , I followed the steps you provided and unfortunately am still getting this error. Please let me know if there is anything else I can try.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY. IT360.1 Line 15 Other Inc shows HSA Emp'er Cont'n $750. Error is "Amt in line 15 of Other Inc w/s don't agree with Inc Alloc w/s to Line 15 Column A" How to fix?

I'm going to need your help to get more information. Please send me a diagnostic file which is a copy of your tax return that has all of your personal information removed. You can send one to us by following the directions below:

***Online Product***

- Sign into your online account.

- Locate the Tax Tools on the left hand side of the screen.

- A Drop down will appear. Click on Share my file with agent.

- This will generate a message that a diagnostic copy will be created. Click on OK, the tax file gets sanitized and transmitted to us.

- Please provide the Token Number that was generated onto a response to this thread.

***Desktop Product***

- Click into your return.

- Click Online and select "Send Tax File to Agent".

- This will generate a message that a diagnostic copy will be created. Click on OK, the tax file gets sanitized and transmitted to us.

- Please provide the Token Number that was generated onto a response to this thread.

Also again, enter @ BillM223 (without the space in between) to notify me when you post the token number...

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY. IT360.1 Line 15 Other Inc shows HSA Emp'er Cont'n $750. Error is "Amt in line 15 of Other Inc w/s don't agree with Inc Alloc w/s to Line 15 Column A" How to fix?

Hi @BillM223 , the token number is 810370

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY. IT360.1 Line 15 Other Inc shows HSA Emp'er Cont'n $750. Error is "Amt in line 15 of Other Inc w/s don't agree with Inc Alloc w/s to Line 15 Column A" How to fix?

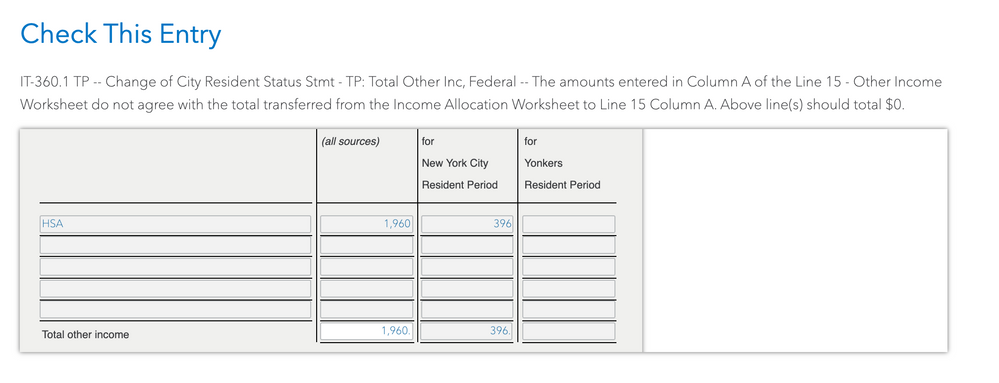

I am looking at your IT-360.1 lines 1 through 16 and it appears to be correct.

Note that there is an entry for line 15 that says "HSA" and $396...then there is a total at the bottom of the line 15 entries that also reads $396. So if you add line 1, line 2, line 3, and just the total for line 15, you will get the number that you see on line 16. Do you see that?

As for the screenshot you gave above, notice that the HSA distribution (which is actually the New York percentage of the HSA employer contribution) is represented as a negative number since it reduces your income, which is true.

Do you see the same thing that I see?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY. IT360.1 Line 15 Other Inc shows HSA Emp'er Cont'n $750. Error is "Amt in line 15 of Other Inc w/s don't agree with Inc Alloc w/s to Line 15 Column A" How to fix?

Hi @BillM223 . Yes, those are the numbers for NY on my end as well. I agree that everything on the form itself looks correct. this is the error message

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY. IT360.1 Line 15 Other Inc shows HSA Emp'er Cont'n $750. Error is "Amt in line 15 of Other Inc w/s don't agree with Inc Alloc w/s to Line 15 Column A" How to fix?

Thank you for the screenshot. I did not realize that we were talking about column A, not B.

Yes, this seems to be a problem. I tried overriding the total for column A, but then TurboTax told me that you could no longer e-file your New York return.

Let me discuss this internally and see what options we have.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY. IT360.1 Line 15 Other Inc shows HSA Emp'er Cont'n $750. Error is "Amt in line 15 of Other Inc w/s don't agree with Inc Alloc w/s to Line 15 Column A" How to fix?

Thank you, @BillM223 . Please keep me posted.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bkeenze1

New Member

user17548411845

New Member

RyanK

Level 2

soccerfan1357

Level 1

mulleryi

Level 2