- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Hi Bill, thanks so much for the reply!

My HSA contributions are not being counted as income on my federal return (and I did not contribute over the limit). My HSA contributions are on my W-2 and I have gone through the HSA interview already and confirmed my HDHP coverage.

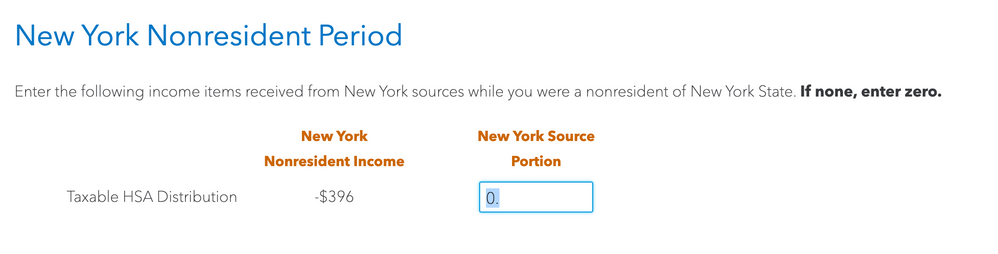

Are there any other reasons my HSA contributions could be incorrectly coming through as income? I am not sure if this helps but I attached one of the sections of my NY state return that I found peculiar, and perhaps is related to the issue. I'm not sure why there is a "taxable HSA distribution"... and also I did not have any HSA distributions during 2020 (which I confirmed during my interview for federal) -- I only had contributions to my HSA. Thanks for any help you can provide!!