- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Live in PA, work in NY. State return says I owe $0

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in PA, work in NY. State return says I owe $0

I live in Pa and work in NY. I did my taxes with Turbo Tax on my PC. When I did my state taxes, it says I'm getting back all of the taxes that were deducted by NY. I know this can't be right. What am I doing wrong?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in PA, work in NY. State return says I owe $0

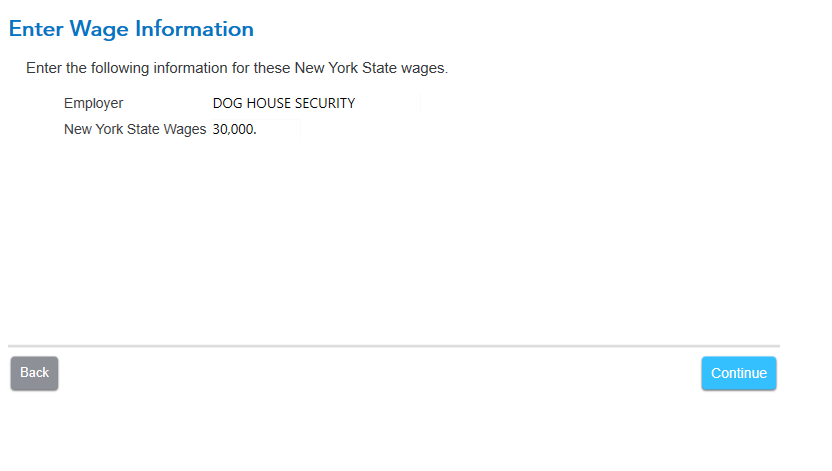

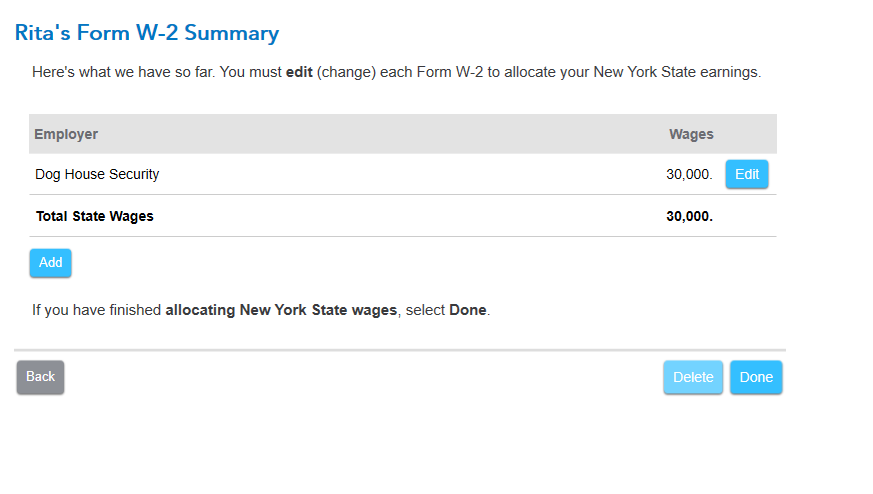

You should see a screen like that, but that includes wages.

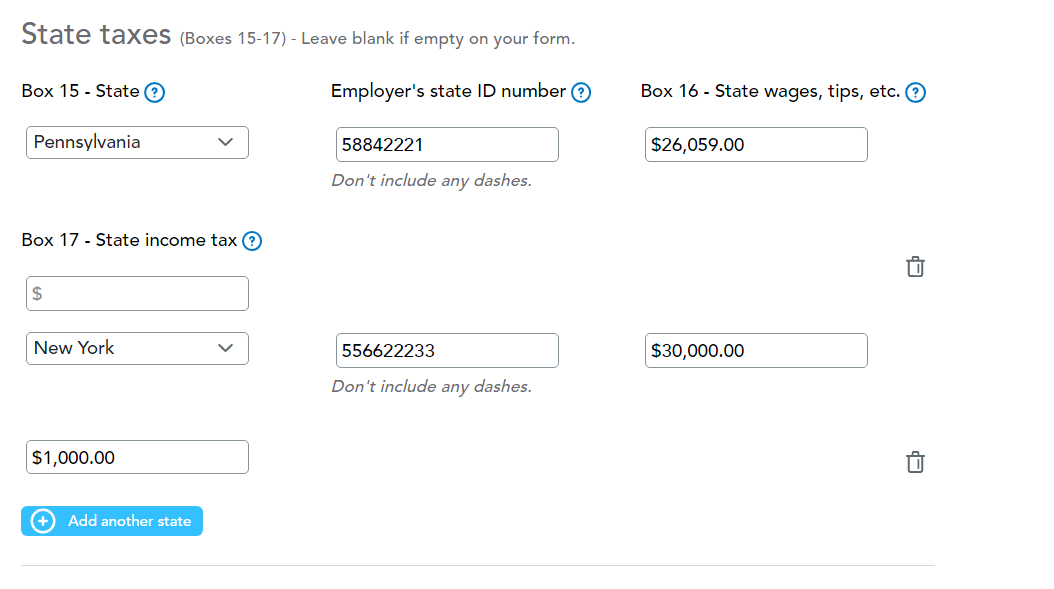

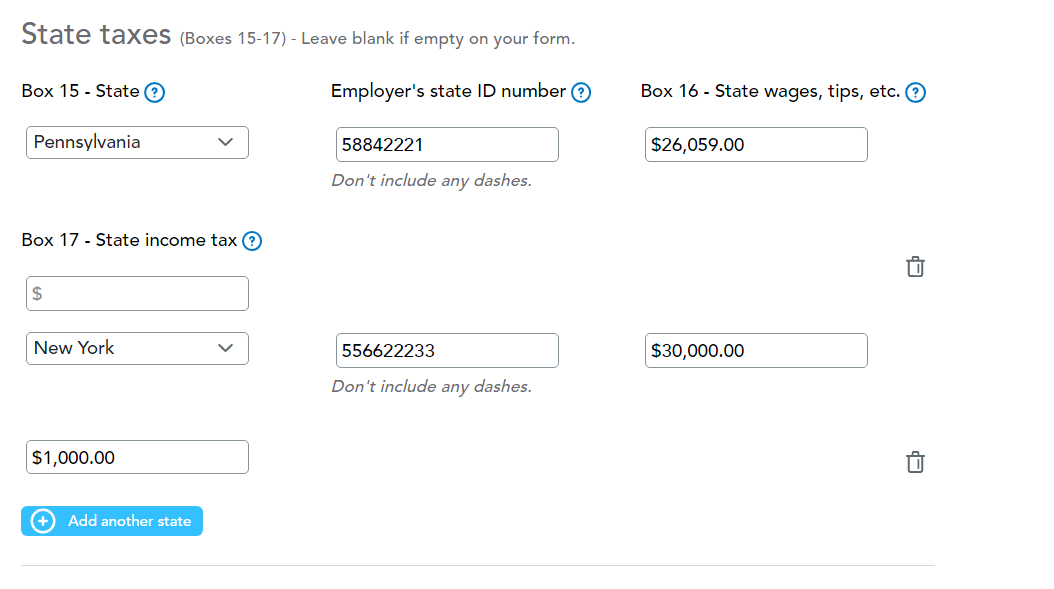

So start by going back to your Federal return. On your W-2 for the state section, did you list NY as a state for income? If not, then this will need to be added.

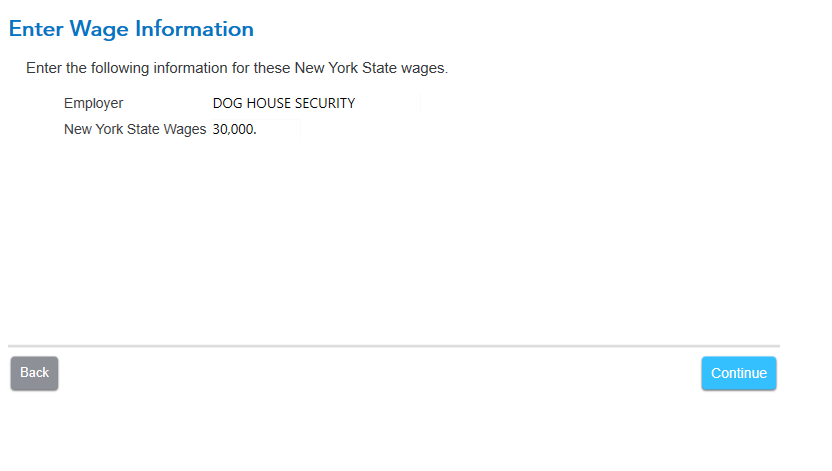

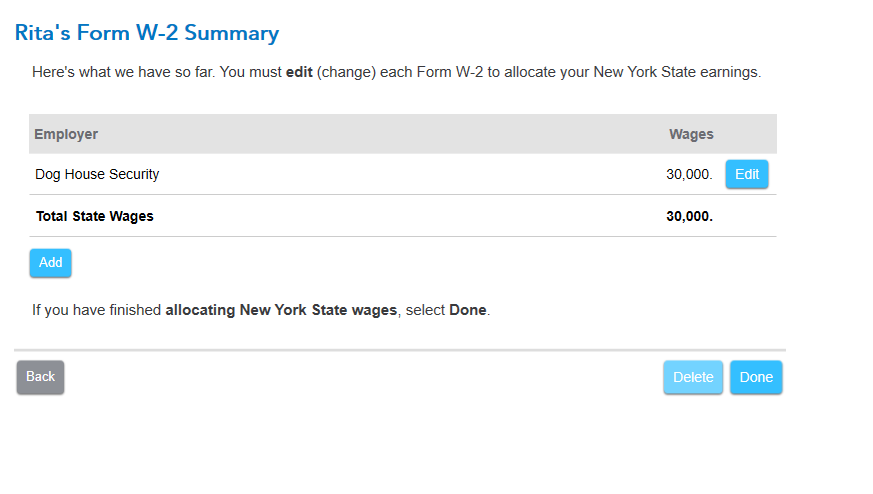

If you did, then there should be another screen in the NY section that shows your wage information, then the next screen will allow you to allocate your income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in PA, work in NY. State return says I owe $0

You are correct, that is not right.

Did you enter all of your income from work as taxable on your NY return? If you mistakenly told TurboTax to remove all of your income from your NY return, it would then result in a refund of your taxes withheld. Walk back through your NY return and be sure that all of the income that you earned at work is included in your NY taxable income.

Did you file NY first as your nonresident return or PA first or did you reverse the order? Be sure you file NY first and then you will claim a credit for taxes paid to NY on your PA return. You do not want to claim a credit for taxes paid on your NY return, only on your PA return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in PA, work in NY. State return says I owe $0

I did NY first as non-resident. I didn't start PA yet.

I have this screen when going through NY again. It's only showing interest and dividend income. Is there somewhere else to enter income? Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in PA, work in NY. State return says I owe $0

You should see a screen like that, but that includes wages.

So start by going back to your Federal return. On your W-2 for the state section, did you list NY as a state for income? If not, then this will need to be added.

If you did, then there should be another screen in the NY section that shows your wage information, then the next screen will allow you to allocate your income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in PA, work in NY. State return says I owe $0

Thank you! The problem was Box 16 - State wages, tips, etc was blank.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jenekane28

New Member

margaretp40

New Member

spunky_twist

New Member

levind01

New Member

kruthika

Level 3