- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Live in different states

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in different states

I lived in Colorado for the entire 2020 calendar year. My wife lived in Minnesota the entire year. When I go to do Minnesota state tax the taxes and credits summary page says our Minnesota taxable income is $127,000. My wife's Minnesota income was $73,500. I had no Minnesota taxable income.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in different states

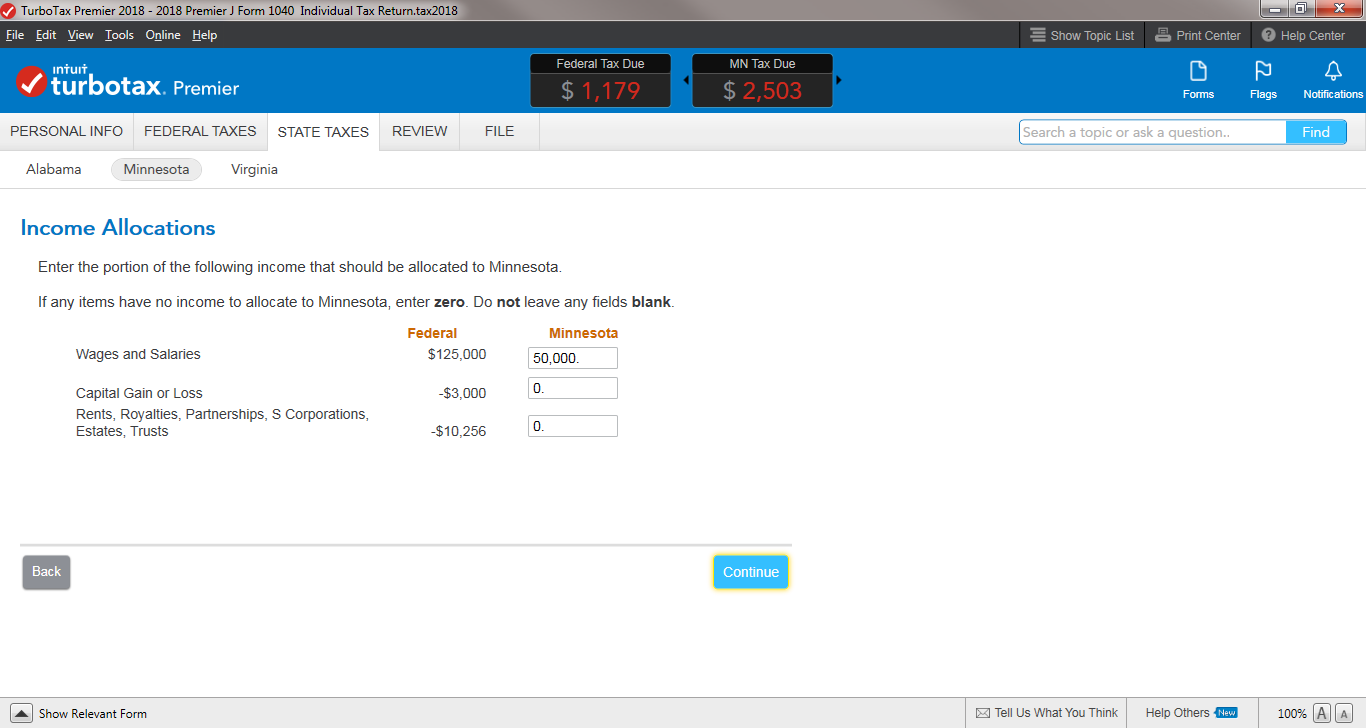

You have to allocate the applicable portion of your Federal income to Minnesota in the state tax return. There is a screen in the Minnesota tax return where you do that allocation. See screenshot below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in different states

I did that but the taxes and summary page shows an additional $54000 for Minnesota Taxable income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in different states

Check what was entered for the Colorado allocation. The taxpayer's state of residence on December 31, 2020 should be entered last.

Since you are getting unexpected results, if you did not enter them in this sequence, I recommend deleting the states entirely and re-entering them using that sequence.

For more details, see: How do I file a nonresident state return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in different states

How do you delete states

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in different states

In the desktop program, click on the File menu in the top left corner. Then choose Remove State Return. You will be able to start a clean return after that.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in different states

I've tried it both ways. It says my minnesota taxable income is 127,000. That means it is taxing a portion of my salary that I earned in Colorado.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in different states

Minnesota and/or Colorado will include your total income if you file a joint state tax return, even if you lived in different states. Both states will give you credit for tax paid to the other state. A joint tax return does not allow you to remove any out of state income because every state taxes residents on income earned everywhere. By filing a joint state, you are considered a “resident,” with includible out of state income.

Minnesota and Colorado require you to use the same filing state as on your federal return. You can file married in both states and claim offsetting tax credits since each of you is a resident of a different state. Or you can file separately for both state and federal.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RyanK

Level 2

edis-tokovic

New Member

Arkiewhale

New Member

claire-hamilton-aufhammer

New Member

tsosgood5

New Member