- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: I moved from a non income tax state to an income tax state. Since I can only file the Missour...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from a non income tax state to an income tax state. Since I can only file the Missouri return, it is charging me taxes on entire income. How do I fix this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from a non income tax state to an income tax state. Since I can only file the Missouri return, it is charging me taxes on entire income. How do I fix this?

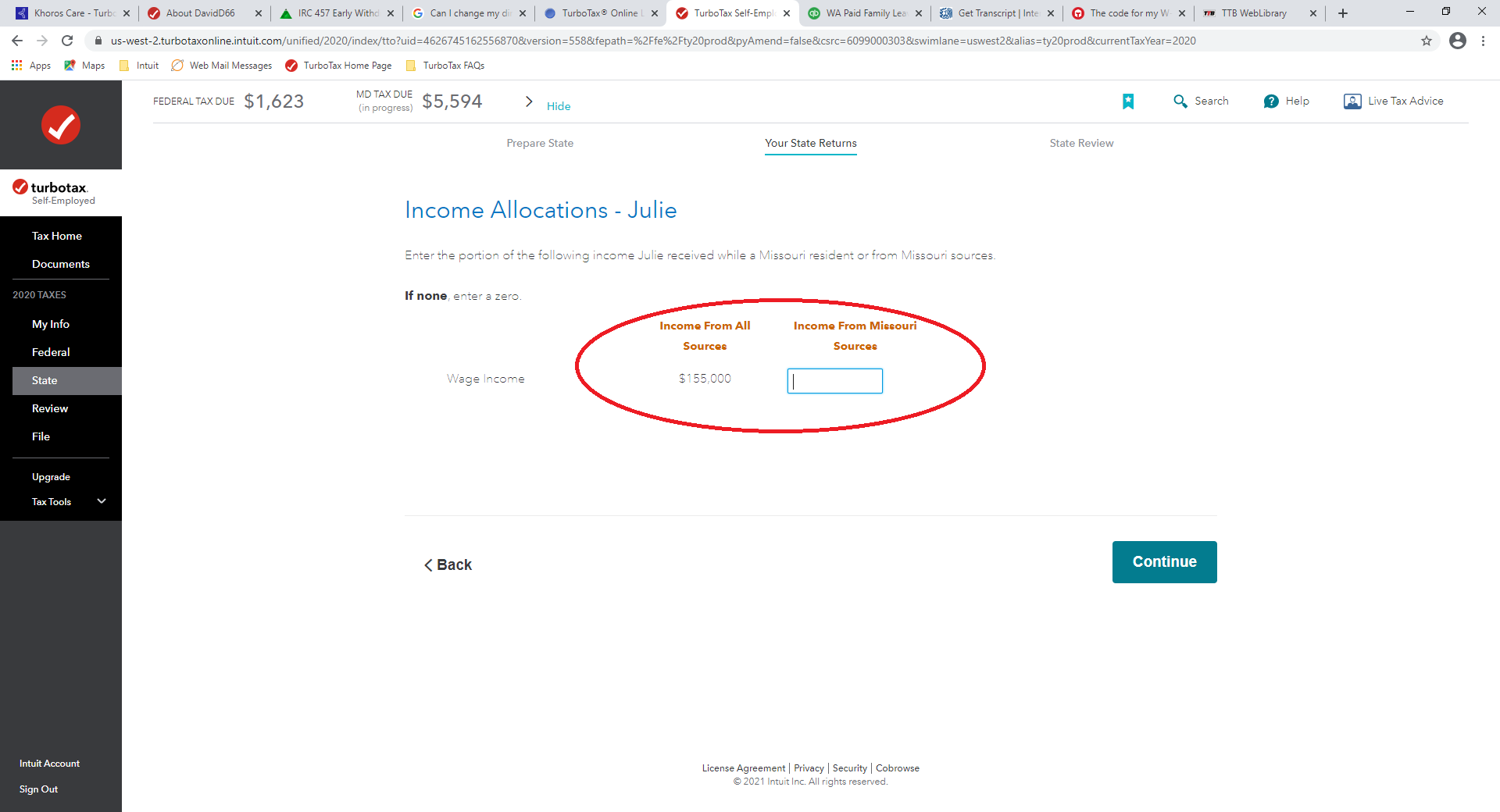

You only have to pay tax on the income you earned while living/working in Missouri. Since your other state doesn't have an income tax, you won't have to file a return for that state. You have to tell the program you were a part year resident. You also have to tell the program how much of your income you earned while a Missouri resident. You make this allocation on one of the screens in the Missouri state tax section. See screen shot below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from a non income tax state to an income tax state. Since I can only file the Missouri return, it is charging me taxes on entire income. How do I fix this?

Similar situation. I lived in DC all year, but also earned income from Texas. Both state incomes are listed on my w-2. Of course Texas has no state income tax, therefore no forms. How can I allocate the DC earned income only to the DC tax return form. I followed the TurboTax program but only found info for part time DC resident. Advice?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from a non income tax state to an income tax state. Since I can only file the Missouri return, it is charging me taxes on entire income. How do I fix this?

The general rule is that you owe tax to the state where you live and to any state(s) where you worked.

In your case, since you lived in DC all year, you should report your total annual income to DC.

The purpose of the credit for the other state is to prevent double taxation on the same income. But you don't have that, since, as you noted, Texas has no state income tax.

So, no double-taxation, no credit.

This is the way the system works.

In the case of the first poster, they were actually a resident (part-year) of two states, so they rightfully split the income between the two states they lived in (or used one state's tax paid as a credit for the other state, which mimics the income split). Your situation is different.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rogersdan164

Level 1

KarenL

Employee Tax Expert

april.supple

New Member

LynK

New Member

cramanitax

Level 3