- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

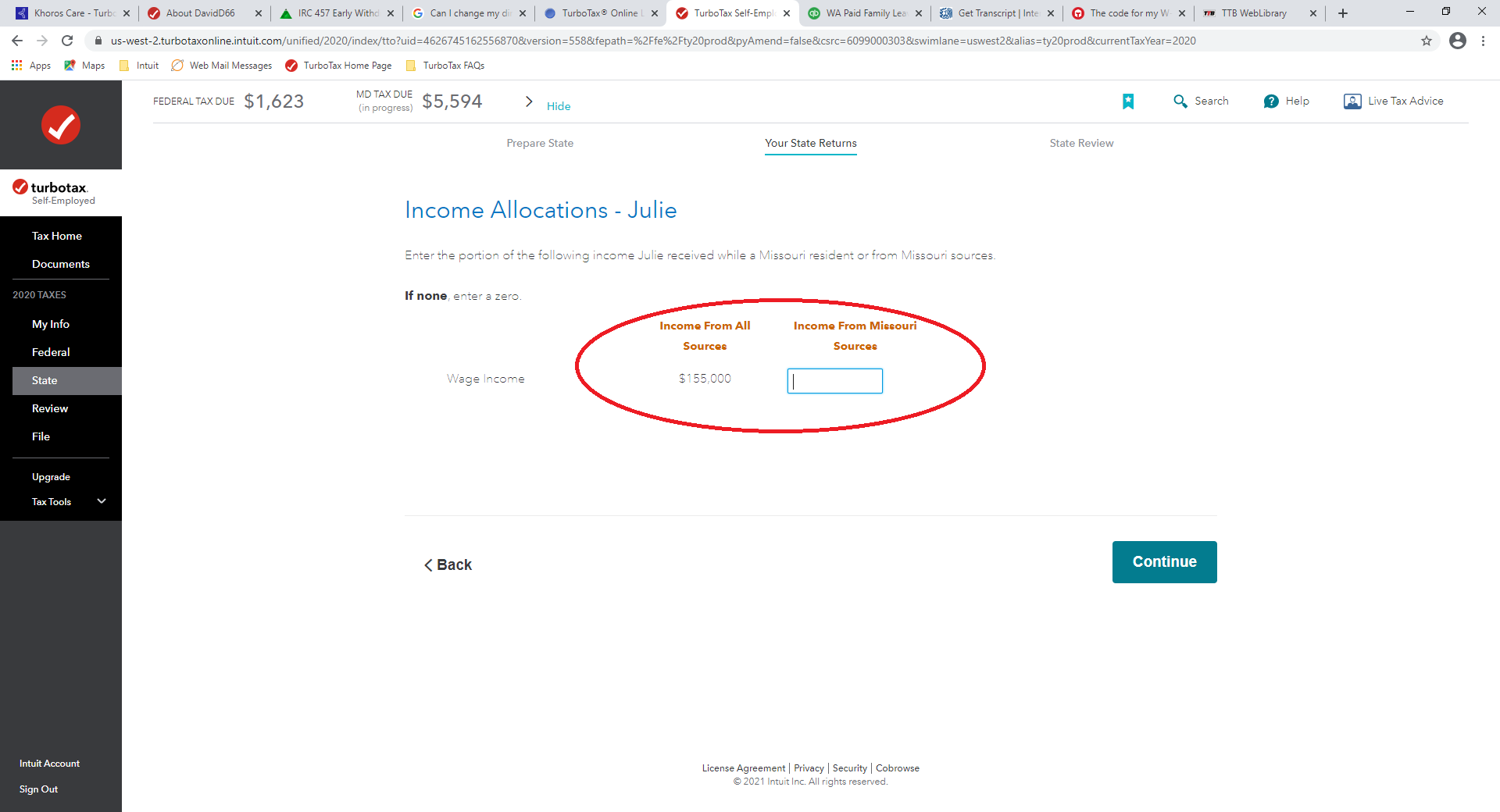

You only have to pay tax on the income you earned while living/working in Missouri. Since your other state doesn't have an income tax, you won't have to file a return for that state. You have to tell the program you were a part year resident. You also have to tell the program how much of your income you earned while a Missouri resident. You make this allocation on one of the screens in the Missouri state tax section. See screen shot below:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 9, 2021

5:06 PM