- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: I live in Illinois, which is a credit reduction state, and I don't think TurboTax is correctl...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois, which is a credit reduction state, and I don't think TurboTax is correctly handling my Schedule H. Has anyone else noticed this problem?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois, which is a credit reduction state, and I don't think TurboTax is correctly handling my Schedule H. Has anyone else noticed this problem?

You're correct that Illinois was a credit reduction state in tax year 2022, but please clarify -- what's leading you to believe the computation is incorrect?

The calculation procedure for household employers in a credit reduction state can be found in Worksheet 2 in the Instructions for Schedule H.

If you can supply the figures from your Schedule H that are relevant in Worksheet 2 (i.e., lines 1 and 2 of the worksheet), perhaps we can help you determine what's going on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois, which is a credit reduction state, and I don't think TurboTax is correctly handling my Schedule H. Has anyone else noticed this problem?

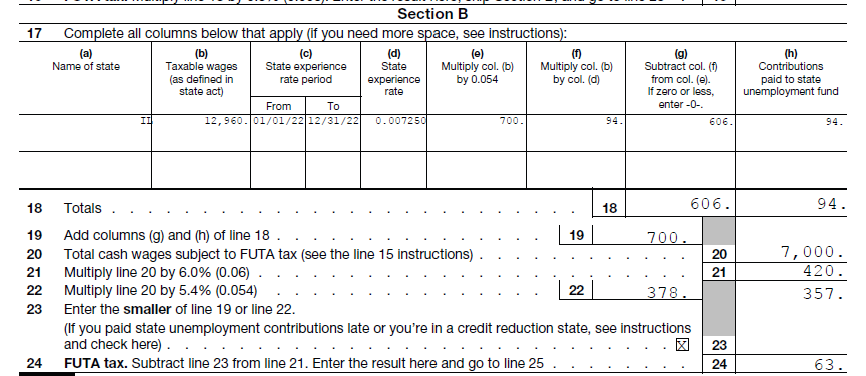

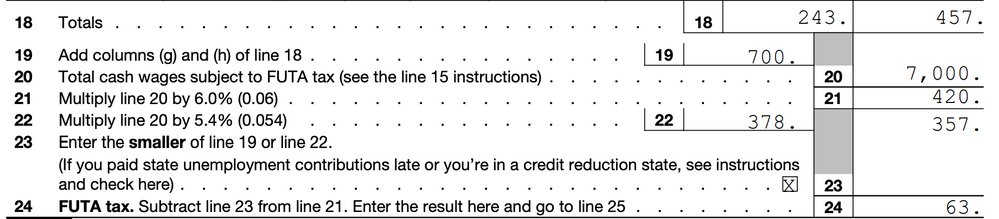

Thank you so much for responding. Schedule H lines 20, 21, and 22 all look correct. $7000 in wages subject to FUTA tax (line 20), and then the multiplication on line 21 ($420) and line 22 ($378) is accurate. But when I do Worksheet 2 on the instructions for Schedule H, it tells me that I should be putting $357 on line 23 because there is a credit reduction of $21 (I lived in IL all year and paid taxes there). However, TurboTax just enters $378 on line 23 of Schedule H, which I think is wrong. And then my eventual tax calculation is off by $21. I looked at the TurboTax smart worksheet for this section and it doesn't have any calculation on it.

I really think that I have this right and TurboTax is doing it wrong, but please tell me if that's not right. I really appreciate your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois, which is a credit reduction state, and I don't think TurboTax is correctly handling my Schedule H. Has anyone else noticed this problem?

There is one screen in federal that changes the figures on Sch H by filling in Section B lines 17-19. I have entered your information and my lines 21 and 22 match yours.

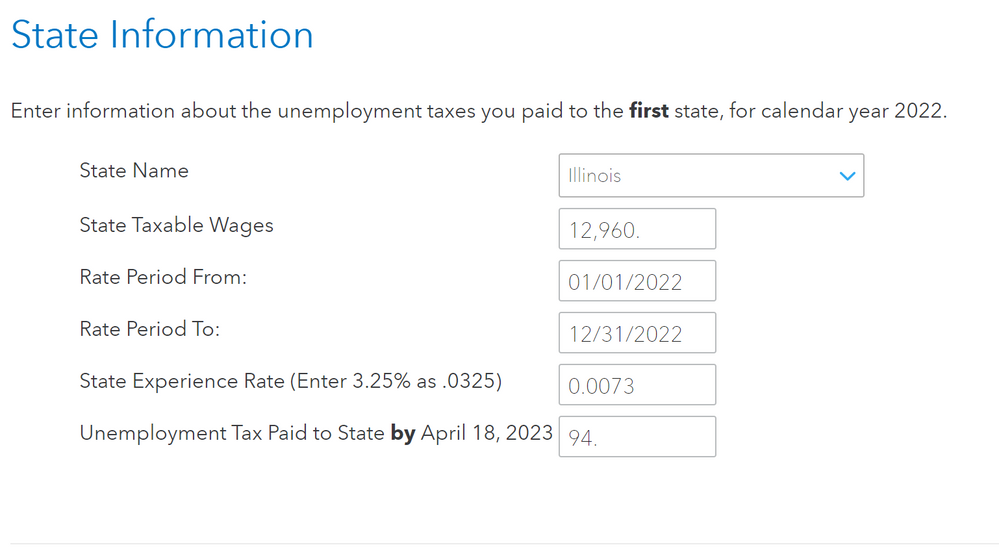

The problem has to be in the State Information screen as line 23 says to choose the smaller of line 19 or 22. The sch H line 23 changes each time I change a variable in this screen and then calculates properly.

Return to this federal screen and verify your entries. Both the state rate and tax paid are required. Both of these boxes must be filled in for the program to work.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois, which is a credit reduction state, and I don't think TurboTax is correctly handling my Schedule H. Has anyone else noticed this problem?

Thank you for your reply, but I think this still isn't right. I've attached a screenshot of the State Information screen.

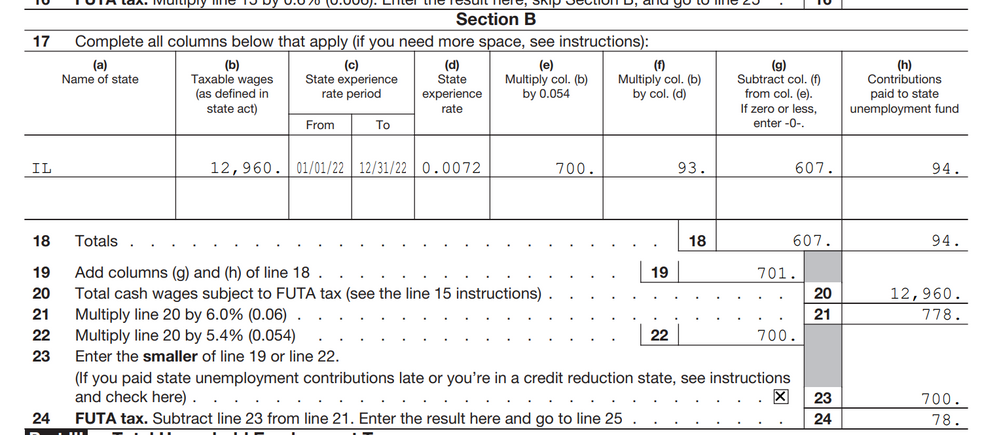

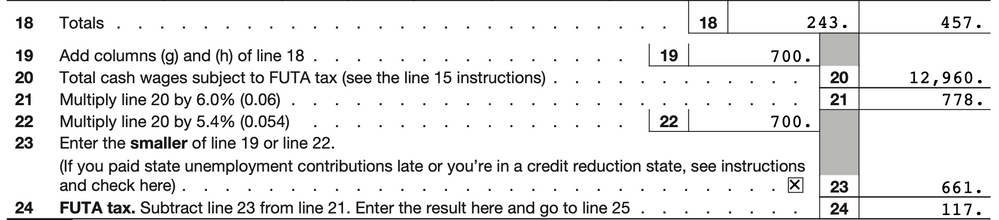

I've then attached a screenshot of the return that TurboTax generates.

There are multiple errors on it:

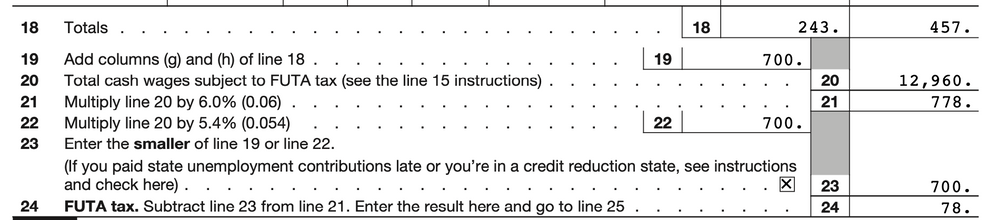

1. Line 20 should be 7,000, not 12,960. If you read the line 15 instructions like Schedule H says to do for line 20, it says to only enter the first 7,000 of wages paid. This then creates errors in all the calculations following line 20.

2. Also, line 23 doesn't just say "Enter the smaller of line 19 or line 22." It says that if you're in a credit reduction state (which Illinois is), you should see the instructions. The instructions then tell you to enter a smaller number for line 23.

I pay my nanny taxes through Care.com, and every year they send me a filled-out version of Schedule H showing me what that form should look like. I've attached that here too so you can see what it should look like.

But I can't get TurboTax to enter the values on Schedule H correctly. I would be very grateful for your help, please.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois, which is a credit reduction state, and I don't think TurboTax is correctly handling my Schedule H. Has anyone else noticed this problem?

You are correct. Illinois (IL) is one of the states that has an outstanding loan with the federal government. For this reason the FUTA rate is higher in your state.

- As Illinois has an outstanding loan balance, Illinois employers will have a FUTA tax increase of 0.3%, applied to payroll paid from January 1, 2022, through December 31, 2022 (click below for the IL rates).

Also, IL uses the first $12,960 paid to each employee, so as far as IL, the full wage amount must be used to determine the FUTA rate. Review the state question section to be sure you answer correctly.

- Part II, box 10 should be selected as 'No'.

- Line 23 - Employers in a Credit Reduction State Smart Worksheet, Line 3 must have the state two letter code and the full amount of the wages subject to FUTA (The first $7,000 to each employee for the year).

- You may need to switch to TurboTax CD/Download version to insert this entry.

Please update with additional details here if you need further assistance and one our tax experts can help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois, which is a credit reduction state, and I don't think TurboTax is correctly handling my Schedule H. Has anyone else noticed this problem?

I spoke with 4 different members from the Turbo Tax Live team (with 52+ combined years of tax experience), and they just couldn't understand what to do to help us. I also employ a nanny through care.com, and they supplied me an already-filled-out Schedule H. I have read the instructions multiple times and ran care.com's numbers multiple times, and care.com's schedule H they supplied me with is correct. The online version doesn't take into effect worksheet 2 of Schedule H, which causes the $21 difference ($7,000 x 0.003 = $21). While, not substantial to some, it is wrong and changes everything.

The online version of TurboTax definitely calculates it incorrectly, and it's very frustrating! They also can't find a fix to it. As someone else suggested, the only way to fix this (through Turbo Tax) is to download the computer version of TT and use the "forms" option to fill out the form by hand. I wasted the better part of two days off work only to find out that the solution is IMPOSSIBLE on the online version. I ensured this would be free due to my circumstances. Luckily, the downloaded version pulls over all the information we had already filled out online.

One warning I can give you is that once you fill out the information correctly in the "forms" section, do not go through the same section on the downloadable version through the questions and prompts because it will then override what you had just input into the forms.

What worries me is the large amount of taxpayers using TurboTax who don't double check the numbers in a credit reduction state and who just file the wrong numbers and inadvertently commit tax fraud.

I hope this answer helps you and others. 🙂

Sincerely,

-Steve

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois, which is a credit reduction state, and I don't think TurboTax is correctly handling my Schedule H. Has anyone else noticed this problem?

Steve, thanks so much for your message. This whole business was incredibly frustrating, like you said. What I ended up doing was choosing to file by mail, then printing out the return that TurboTax generated, throwing away their Schedule H, and substituting the Schedule H that Care.com sent me. (I then made sure that the numbers on the 1040 were correct.) It felt odd to be mailing an actual paper return for the first time in years, but at least I was able to mail a return that was correct.

Anyway, there have to be lots of people in IL and other credit reduction states in this situation. Probably a lot of them just didn't notice the error. I've used TurboTax for a lot of years, but if they don't fix this problem, this is the last year. I'll take my business somewhere else.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois, which is a credit reduction state, and I don't think TurboTax is correctly handling my Schedule H. Has anyone else noticed this problem?

I thought about doing exactly what you did as well as mailing them in, but I wanted to be able to e-file, and I wasn't going to let them get out of this with my money. I have done business with them for 6-7+ years, but I agree with you, next year my money will go somewhere else, since they can't keep their online version updated for credit reduction states. What's so weird is that in the forms sections, there is an ENTIRE breakdown box for line 23. So they know it's a thing, but they just decide its not applicable to the online version for some reason. Its a shame...

From the heart of the Land of Lincoln, God bless, my brother.

-Steve

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois, which is a credit reduction state, and I don't think TurboTax is correctly handling my Schedule H. Has anyone else noticed this problem?

I think this need to be raised to higher level of the TT team. This is not a small issue. It will impact everyone who file schedule H in states total 75+ million in population (IL, CA, CT, NY). If IRS is going after this, they will have a very well defined target (any one who file using TT with schedule H resides in one of these four state are committing fraud). Is TT ready to pay for all the expense related to this audit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois, which is a credit reduction state, and I don't think TurboTax is correctly handling my Schedule H. Has anyone else noticed this problem?

I completely agree, but I don't know how to raise it. I looked for some button to contact TurboTax another way but didn't find anything. Do you know how to get this message to the people who can actually help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois, which is a credit reduction state, and I don't think TurboTax is correctly handling my Schedule H. Has anyone else noticed this problem?

I feel your frustration... i did not spend as much time "yet" but i lost 2-3 hours tonight as i was shocked to see my Desktop submission be rejected by the IRS and CA FTB. so went searching. I use SurePayroll to pay my nanny and (like care.com) they issue me a prefilled Sch H. the odd thing is the S/W did it correctly (CA has same 7K limit as fed so that part was lucky) ... but also the 0.003 reduction which amounts to $21 was also calculated properly ... and the TT form matched SurePayroll without any overrides... but my submission was rejected. i suspect that TT has been listening to you all and has put all Sch H in the 4 states on "reject" till they fix the issue. my concern is that a 4/7/2023 date which is too close to the deadline...so considering if i should mail them in

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois, which is a credit reduction state, and I don't think TurboTax is correctly handling my Schedule H. Has anyone else noticed this problem?

At least if they're aware of the error and trying to fix it that would represent progress. I've been worried that this will just persist into the future and I'll have to drop TurboTax because of it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois, which is a credit reduction state, and I don't think TurboTax is correctly handling my Schedule H. Has anyone else noticed this problem?

can someone report if they were able to file their taxes with the new fix release on 4/6/23?

still getting a rejection email with the following

what happened:

FED_SchH_FUTA - There is an issue related to Schedule H, Household Employee Taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Illinois, which is a credit reduction state, and I don't think TurboTax is correctly handling my Schedule H. Has anyone else noticed this problem?

I had the same experience as those above. I live in IL and had my returns rejected on April 6, like others said on this thread. There was a fix scheduled to be released on April 7. I went back through (the online version of) TT and found that one issue was indeed fixed, but another issue was not fixed! My taxes are still incorrect.

Initially, as noted above, for line 23, TT was filling in the smaller of line 19 and 22 instead of following instructions for credit reduction states (first screenshot below). This was fixed around Apr 7. However, my new pdf return generated by TT today (Apr 10) still makes the other mistake of using 12,960 for line 20 (second screenshot below). Care.com does it correctly, using 7,000 instead of 12960 (third screenshot below).

This situation is completely unacceptable. Intuit, please fix this other bug! Or give us the ability to override the buggy logic in your program so that we can fix the forms ourselves.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

HollyP

Employee Tax Expert

kkarnes

Level 2

Blue Storm

Returning Member

vmuralid

New Member

torrescharfauros

Level 1