- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

I had the same experience as those above. I live in IL and had my returns rejected on April 6, like others said on this thread. There was a fix scheduled to be released on April 7. I went back through (the online version of) TT and found that one issue was indeed fixed, but another issue was not fixed! My taxes are still incorrect.

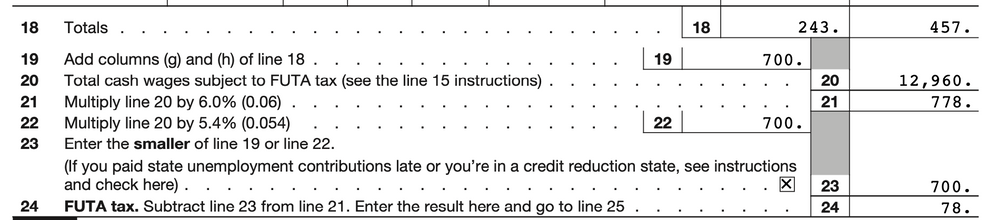

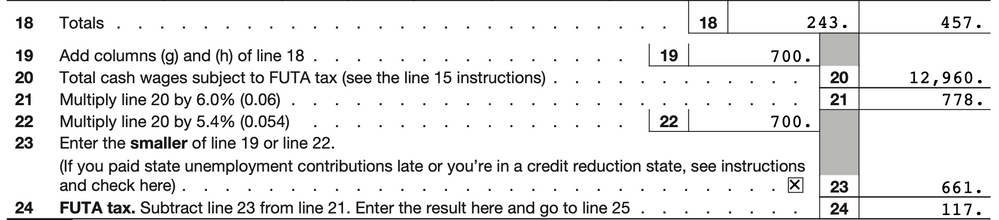

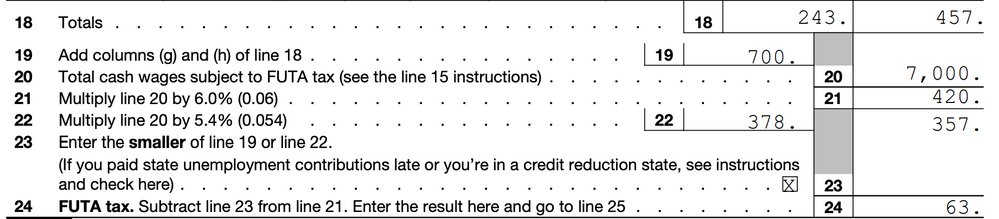

Initially, as noted above, for line 23, TT was filling in the smaller of line 19 and 22 instead of following instructions for credit reduction states (first screenshot below). This was fixed around Apr 7. However, my new pdf return generated by TT today (Apr 10) still makes the other mistake of using 12,960 for line 20 (second screenshot below). Care.com does it correctly, using 7,000 instead of 12960 (third screenshot below).

This situation is completely unacceptable. Intuit, please fix this other bug! Or give us the ability to override the buggy logic in your program so that we can fix the forms ourselves.