- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

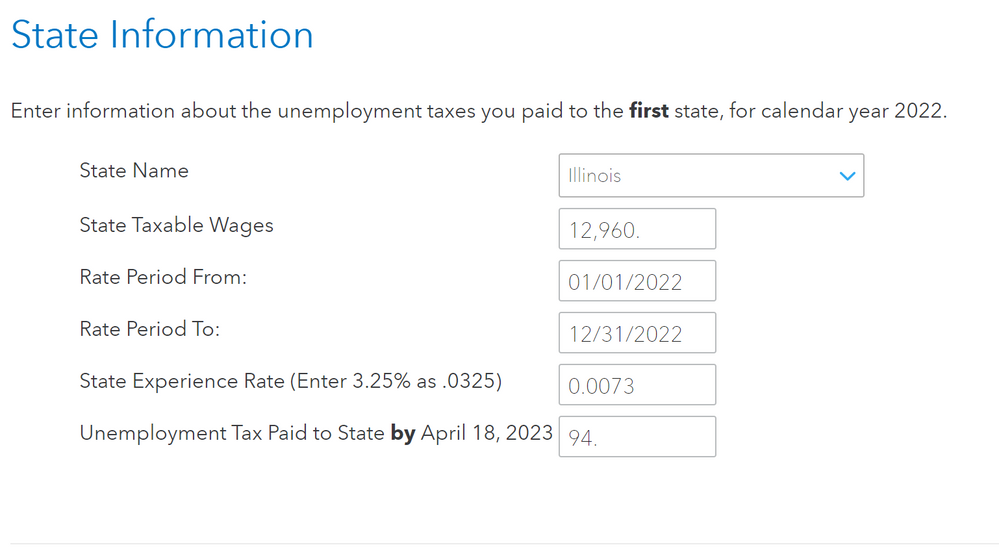

Thank you for your reply, but I think this still isn't right. I've attached a screenshot of the State Information screen.

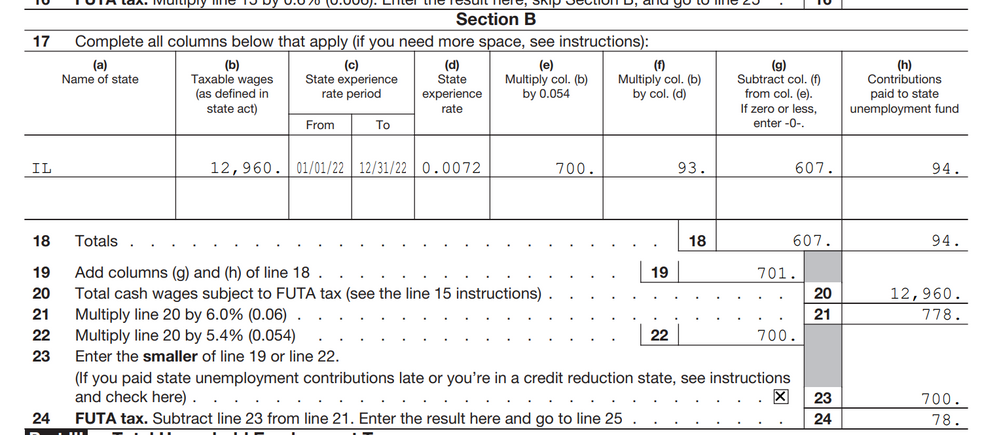

I've then attached a screenshot of the return that TurboTax generates.

There are multiple errors on it:

1. Line 20 should be 7,000, not 12,960. If you read the line 15 instructions like Schedule H says to do for line 20, it says to only enter the first 7,000 of wages paid. This then creates errors in all the calculations following line 20.

2. Also, line 23 doesn't just say "Enter the smaller of line 19 or line 22." It says that if you're in a credit reduction state (which Illinois is), you should see the instructions. The instructions then tell you to enter a smaller number for line 23.

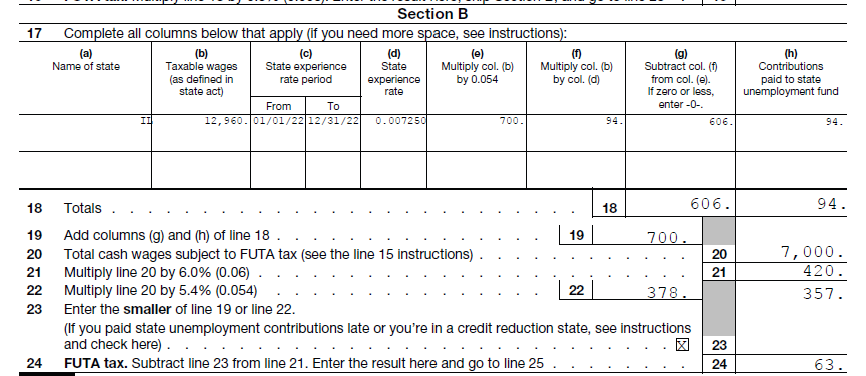

I pay my nanny taxes through Care.com, and every year they send me a filled-out version of Schedule H showing me what that form should look like. I've attached that here too so you can see what it should look like.

But I can't get TurboTax to enter the values on Schedule H correctly. I would be very grateful for your help, please.