- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Head of Household in California for RDP

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Head of Household in California for RDP

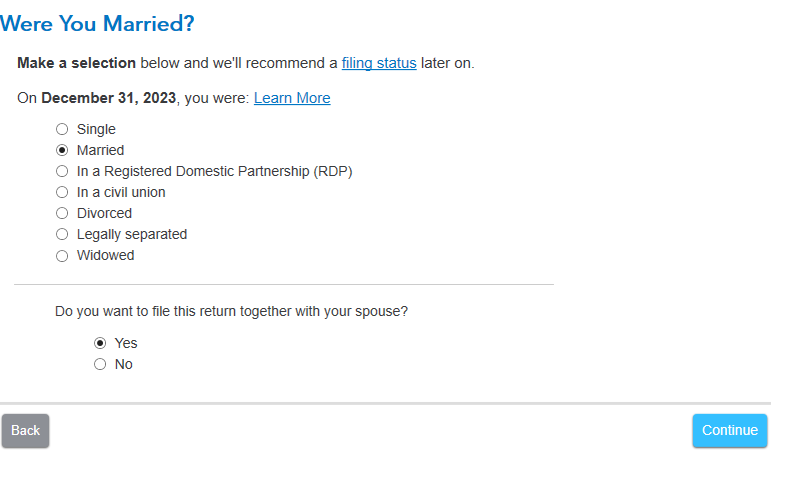

I want to file my federal tax return as head of household since I am providing more than 50% support for my child and I am not married.

I am also a registered domestic partner in California and I am living with my partner.

However, California does not allow to claim the Head of Household status if you live with a RDP.

How can I claim the heard of household status on my federal tax return and married filling separately status on my CA taxes using turbotax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Head of Household in California for RDP

As you walk through the personal info section and add your dependents, you will be asked a series of questions that will determine if you are eligible for Head of Household. You will be able to select that you are in a a RDP. If you are, then TurboTax will tell you the best filing status for you is Head of Household. Then continue on through your return.

When you get to the CA return, you will be given the opportunity to answer more questions and change your filing status and note that you are in a RDP and filing MFS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

powelltyler95

New Member

littlelindsylue

New Member

user17558730698

New Member

pv

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

user17537417318

Returning Member