- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Ga return - social security was included in AGI

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ga return - social security was included in AGI

Both my husband and I are 65. Georgia does not tax social security, but my AGI from my 1040 (which transferred over to Ga), included our social security, therefore causing us to 'owe' taxes in Georgia. Ga also excludes 65,000 of retirement income for each person over 65. I have already submitted the taxes, so wondering if there's a mistake in the TT software? This exclusion should be on 500 Schedule 1, but don't see this in my downloaded completed forms. TIA for any hep, SB

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ga return - social security was included in AGI

If your return has been transmitted and rejected by Georgia, you can correct your tax return and re-transmit.

I am able to enter Social Security income and pension income in a Georgia state tax return.

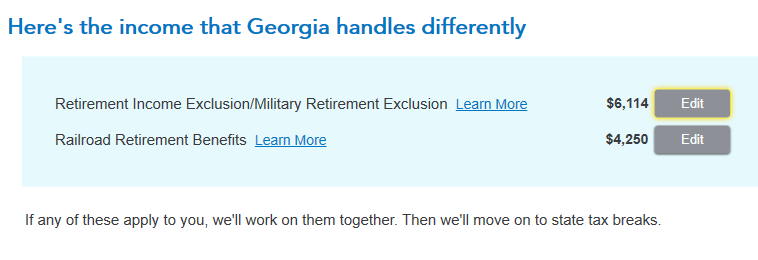

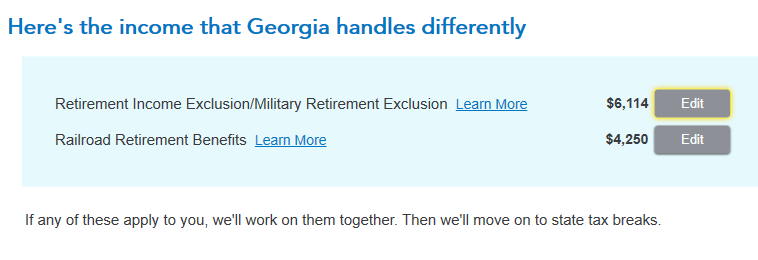

In the Georgia state tax return, the reductions in Social Security and pension income was reported at the screen Here's the income that Georgia handles differently.

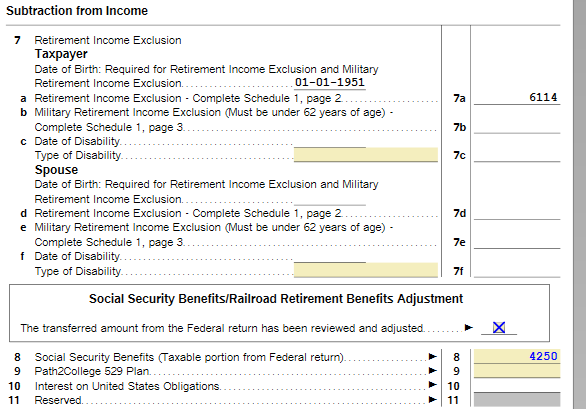

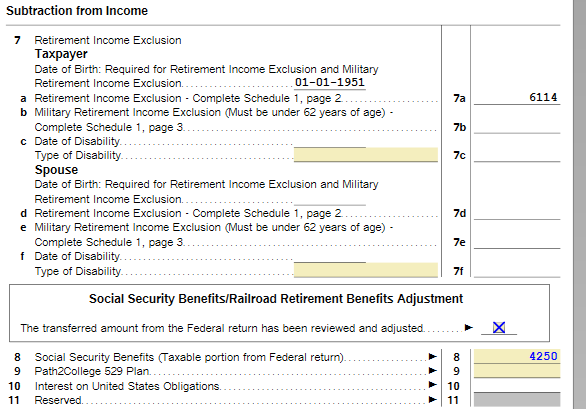

Schedule 1 reports both the Retirement Income Exclusion and the non-taxable Social Security benefits.

If your return has been transmitted and accepted by Georgia, you will have to amend your Georgia state tax return. You will not have to amend your Federal 1040 tax return.

However, before amending your tax return, do not enter the return and do not enter the return and make any changes.

Amended tax returns will not be available before February 23. See forms availability here.

If you used TurboTax Online, simply log in to your account and select Amend a return that was filed and accepted.

If you used the CD/download product, sign back into your return and select Amend a filed return.

You must file a separate Form 1040-X for each tax return you are amending.

See also this TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ga return - social security was included in AGI

If your return has been transmitted and rejected by Georgia, you can correct your tax return and re-transmit.

I am able to enter Social Security income and pension income in a Georgia state tax return.

In the Georgia state tax return, the reductions in Social Security and pension income was reported at the screen Here's the income that Georgia handles differently.

Schedule 1 reports both the Retirement Income Exclusion and the non-taxable Social Security benefits.

If your return has been transmitted and accepted by Georgia, you will have to amend your Georgia state tax return. You will not have to amend your Federal 1040 tax return.

However, before amending your tax return, do not enter the return and do not enter the return and make any changes.

Amended tax returns will not be available before February 23. See forms availability here.

If you used TurboTax Online, simply log in to your account and select Amend a return that was filed and accepted.

If you used the CD/download product, sign back into your return and select Amend a filed return.

You must file a separate Form 1040-X for each tax return you are amending.

See also this TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ga return - social security was included in AGI

Thank you - it appears Turbo Tax did not fill out a schedule 1 - it's not with my downloaded documents.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ga return - social security was included in AGI

You should wait until your state return has been processed prior to amending it, especially if you are getting a refund.

You can amend and e-file a Georgia State return in TurboTax.

Click here for information regarding e-filing your amended state return.

Click here for detailed instructions and a helpful video on amending your state return in Turbo Tax.

To view your State Return in TurboTax if you want to check your entries:

- Select Tax Tools in the left menu (if you don't see this, select the menu icon in the upper-left corner).

- With the Tax Tools menu open, you can then:

- Select Print Center and then Print, Save, or Preview This Year's Return to preview your entire return, including all forms and worksheets (you may be asked to register or pay first).

- View only your 1040 form by selecting Tools. Next, select View Tax Summary in the pop-up, then Preview my 1040 in the left menu.

Please click here for a TurboTax Help link to watch a video to help walk you through the steps.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

michelle_duarte

New Member

pnberkowtaxes201

New Member

Kimrnmadison

Returning Member

jamesmac007

Level 3

marisavelasco22

New Member