- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

If your return has been transmitted and rejected by Georgia, you can correct your tax return and re-transmit.

I am able to enter Social Security income and pension income in a Georgia state tax return.

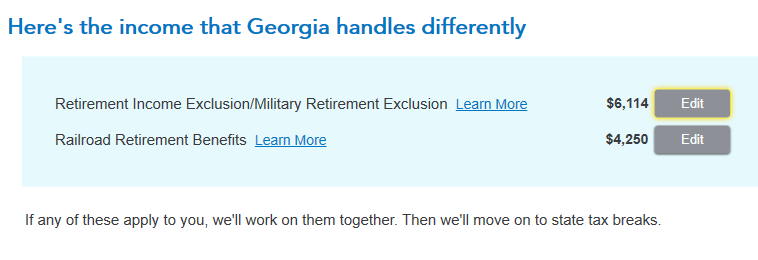

In the Georgia state tax return, the reductions in Social Security and pension income was reported at the screen Here's the income that Georgia handles differently.

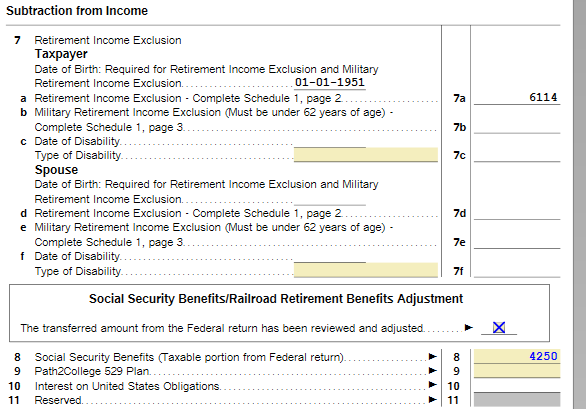

Schedule 1 reports both the Retirement Income Exclusion and the non-taxable Social Security benefits.

If your return has been transmitted and accepted by Georgia, you will have to amend your Georgia state tax return. You will not have to amend your Federal 1040 tax return.

However, before amending your tax return, do not enter the return and do not enter the return and make any changes.

Amended tax returns will not be available before February 23. See forms availability here.

If you used TurboTax Online, simply log in to your account and select Amend a return that was filed and accepted.

If you used the CD/download product, sign back into your return and select Amend a filed return.

You must file a separate Form 1040-X for each tax return you are amending.

See also this TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"