- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Being asked to check the entry for Form MO-A TP-Kansas/St Louis Refund. Where do I check to see if this is applicable to me, and if so, where do I get the amount?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Being asked to check the entry for Form MO-A TP-Kansas/St Louis Refund. Where do I check to see if this is applicable to me, and if so, where do I get the amount?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Being asked to check the entry for Form MO-A TP-Kansas/St Louis Refund. Where do I check to see if this is applicable to me, and if so, where do I get the amount?

This would have been entered on a 1099-G. Look under Wages & Income Other Common Income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Being asked to check the entry for Form MO-A TP-Kansas/St Louis Refund. Where do I check to see if this is applicable to me, and if so, where do I get the amount?

I got this as well, when attempting to file my 2019 MO-A Form with TurboTax Online.

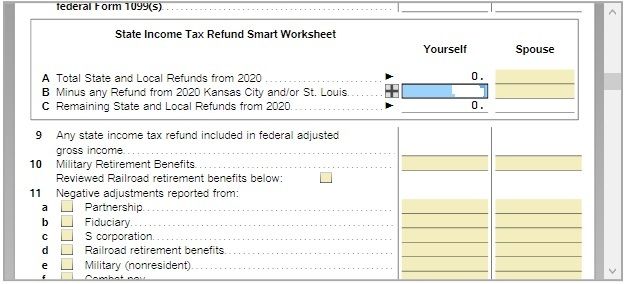

The State Income Tax Refund Smart Worksheet screen showed zeros for "Total State and Local Refunds from 2018" and "Remaining State and Local Refunds from 2018", so I entered a zero in "Minus any Refund from 2018 Kansas City and/or St. Louis".

I think TurboTax Online just doesn't handle local taxes as elegantly as it could, and the programmers missed this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Being asked to check the entry for Form MO-A TP-Kansas/St Louis Refund. Where do I check to see if this is applicable to me, and if so, where do I get the amount?

This has to be a bug in the TurboTax software. I've checked and rechecked all the input values, and the error keeps popping up. Same problem as the other two have reported, what is the resolution TurboTax???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Being asked to check the entry for Form MO-A TP-Kansas/St Louis Refund. Where do I check to see if this is applicable to me, and if so, where do I get the amount?

Yes, the issue has now been resolved. Please follow these steps:

- Before you can e-file, you will need to delete the Arizona Form 140PY from your return to get the form to recalculate correctly.

- Please see the following link for the steps to remove this form from your return.

Thank you for your feedback and offer to assist.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Being asked to check the entry for Form MO-A TP-Kansas/St Louis Refund. Where do I check to see if this is applicable to me, and if so, where do I get the amount?

I'm being asked for this as well on my 2021 return. I am not sure why as I received the amount that it is asking me to double-check. Please advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Being asked to check the entry for Form MO-A TP-Kansas/St Louis Refund. Where do I check to see if this is applicable to me, and if so, where do I get the amount?

First, I guess you saw this in the Missouri State Review? If so, can you continue past it or if you do the Review again, does it flag it again?

Second, were you told what line on form MO-A this message is referring to? There are many adjustments on form MO-A.

What is the amount that you say that you received? I don't mean the number, I mean the description.

Fourth, do you live in either St. Louis or Kansas City (or pay taxes to either one)?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Being asked to check the entry for Form MO-A TP-Kansas/St Louis Refund. Where do I check to see if this is applicable to me, and if so, where do I get the amount?

1) Correct, and it does flag it again.

2)

3) It is a refund from the city of KC for earnings tax.

4) I don't live or work in KC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Being asked to check the entry for Form MO-A TP-Kansas/St Louis Refund. Where do I check to see if this is applicable to me, and if so, where do I get the amount?

Do you have a 1099-G, showing a refund of tax from anyone? And are you using the CD/download software?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Being asked to check the entry for Form MO-A TP-Kansas/St Louis Refund. Where do I check to see if this is applicable to me, and if so, where do I get the amount?

Yes, a 1099G from the city of KC. I am using the CD version of the software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Being asked to check the entry for Form MO-A TP-Kansas/St Louis Refund. Where do I check to see if this is applicable to me, and if so, where do I get the amount?

OK. I am confused. You say that you got a 1099-G, that was for a Kansas City tax refund, and you are also saying that you weren't supposed to get that refund?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Being asked to check the entry for Form MO-A TP-Kansas/St Louis Refund. Where do I check to see if this is applicable to me, and if so, where do I get the amount?

No, I'm saying when I do the Missouri check in the software it comes back and says "TP - Kansas/St. Louis Refund should not exceed the prior state and local tax refund reported as taxable on your federal return." When I put the refund in while doing the federal return it said that it wasn't taxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Being asked to check the entry for Form MO-A TP-Kansas/St Louis Refund. Where do I check to see if this is applicable to me, and if so, where do I get the amount?

If the amount that was taxable on your federal return was $0, then the Kansas/St. Louis Refund should not be more than $0.

This particular message refers a taxable refund from St Louis. If your refund was taxable and included in your federal income, the amount of the refund would be subtracted from your state income. Since it was not taxable, the subtraction is $0.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Being asked to check the entry for Form MO-A TP-Kansas/St Louis Refund. Where do I check to see if this is applicable to me, and if so, where do I get the amount?

I talked to the State of Missouri tax person, and he said that if I took the standard deduction last year (which I did) then there's nothing to subtract. I just put in zero in TT, and it submitted fine. I think it's a bug in the software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Being asked to check the entry for Form MO-A TP-Kansas/St Louis Refund. Where do I check to see if this is applicable to me, and if so, where do I get the amount?

"When I put the refund in while doing the federal return it said that it wasn't taxable."

As Julie and the State of Missouri person said, yes, that 1099-G is not taxable.

"TP - Kansas/St. Louis Refund should not exceed the prior state and local tax refund reported as taxable on your federal return."

I don't know what is triggering this message, but entering 0 (zero) is the right answer.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

_John__

New Member

Desirae1289

Level 2

iyad-alsharif330

New Member

Pooda1234

New Member

jeezerz

New Member