- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Part-Time Resident State Tax in TurboTax Premier

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part-Time Resident State Tax in TurboTax Premier

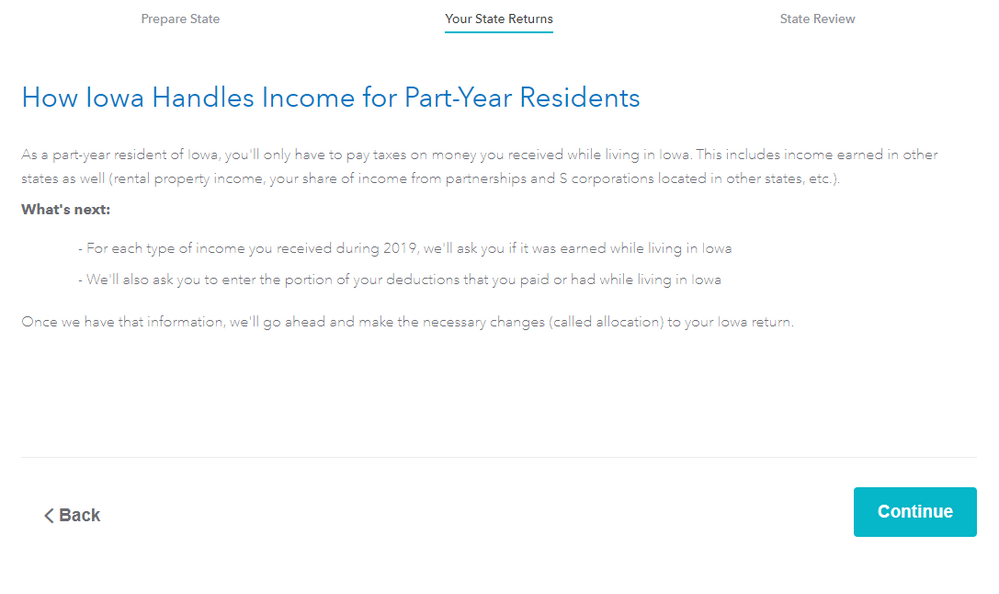

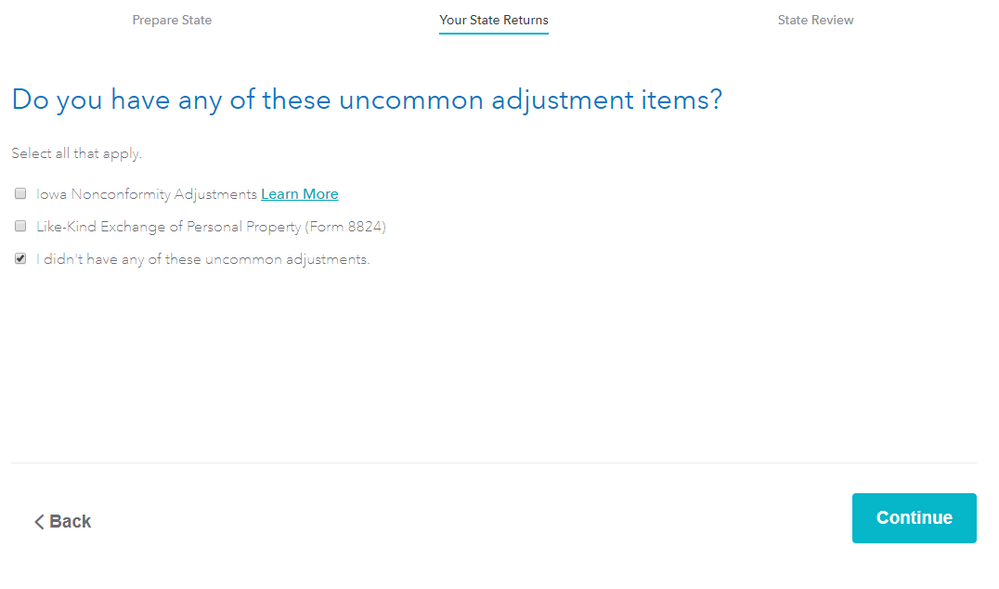

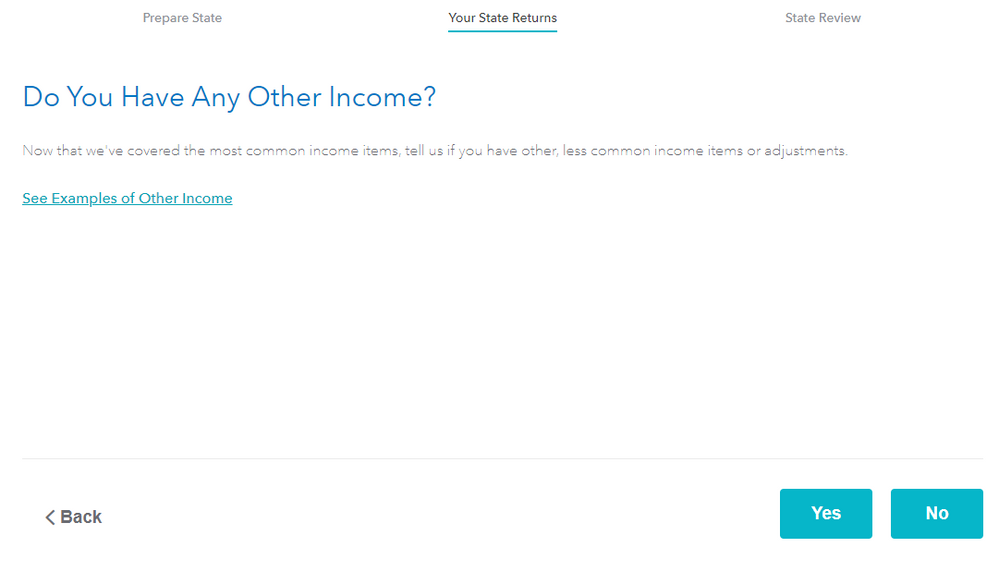

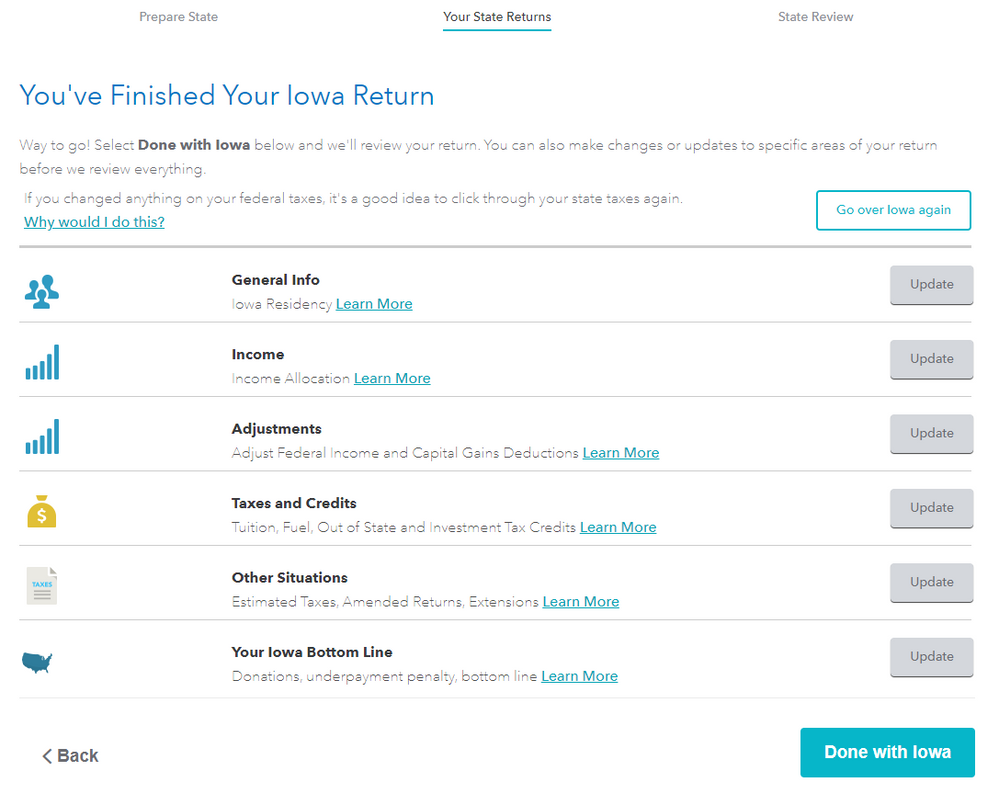

I'm trying to file state tax returns and believe TurboTax isn't allowing me to answer what I think is the crucial question for part-time residents: how much income did my spouse and I make while residents in each state? I've attached screenshots to show how TurboTax says it wants this information but provides no opportunity to give it. The first screenshot is where it says it'll ask for this information. The other screenshots are the only two questions it asks me before saying I've successfully completed the 'income' section.

This could be a big deal for me, as I had a lot of short-term capital gain income in one state and an equal amount of short-term capital loss in the second state. As such, my capital gain income on my federal tax return (~$0) does not represent how much money I made or lost while a resident of each state. Is something missing?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part-Time Resident State Tax in TurboTax Premier

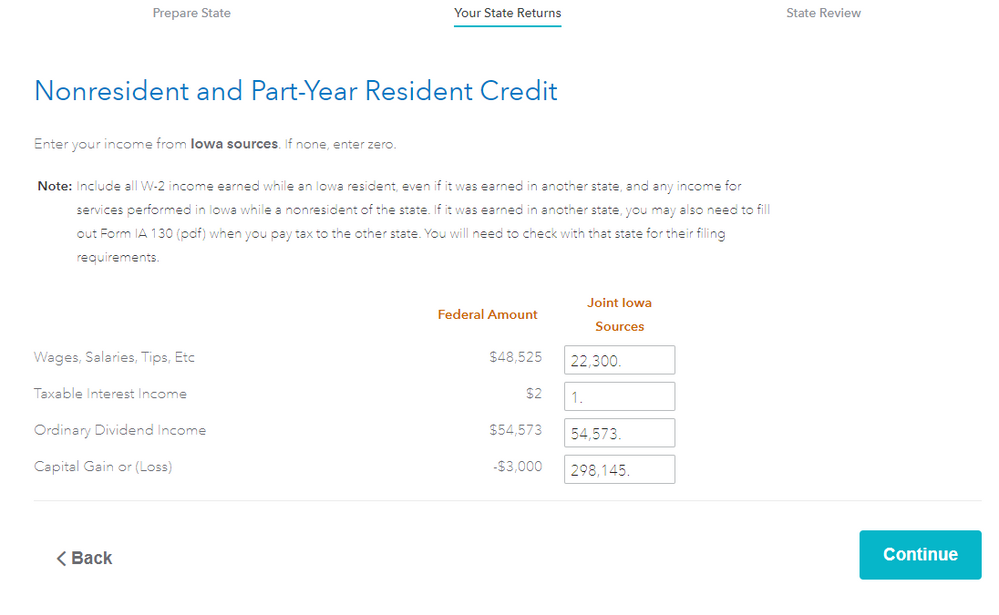

You are playing around in the wrong screens. You will need to move past the adjustments screens as these are not relevant in allocating your income. Move past these screens and continue to navigate through the Iowa State return. You will eventually reach a screen entitled Nonresident and Part-Year Resident Credit. This is the screen where you will make your income allocations.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part-Time Resident State Tax in TurboTax Premier

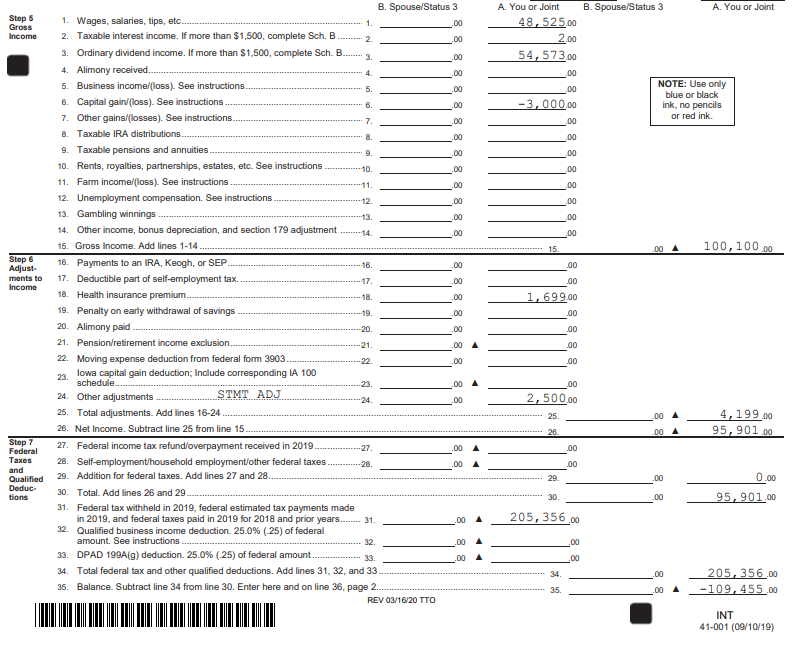

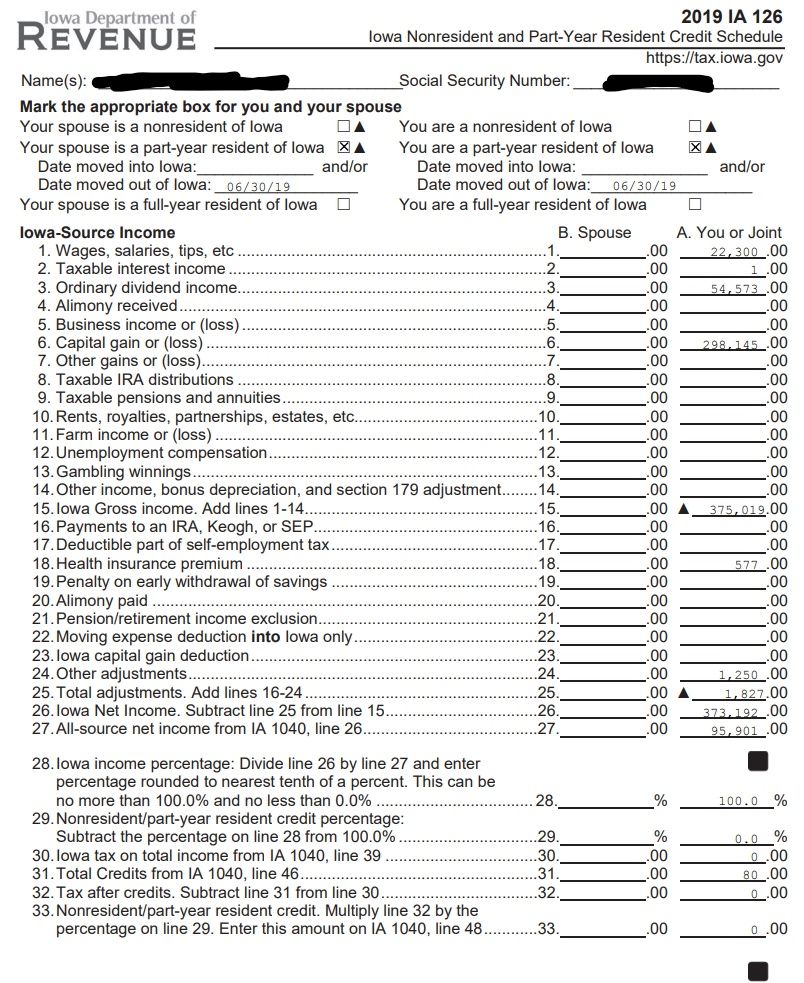

Hi Dave,

I already made income allocations on the screen you mention (attached). Those entries are only carried over to the "Iowa-Source Income" section of the "Iowa Nonresident and Part-Year Resident Credit Schedule", not to my Iowa State 1040 (attached). Is this how it should be? It seems wrong to me. Our wages, salaries, tips, etc. should be lower on the 1040 by $26,225. Our capital gain income should be higher on the 1040 by $301,145. I would love to be wrong!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Smithy4

New Member

Tax_Padawan

Returning Member

Amanda106

New Member

DoctorJJ

Level 2

jsefler

New Member