- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part-Time Resident State Tax in TurboTax Premier

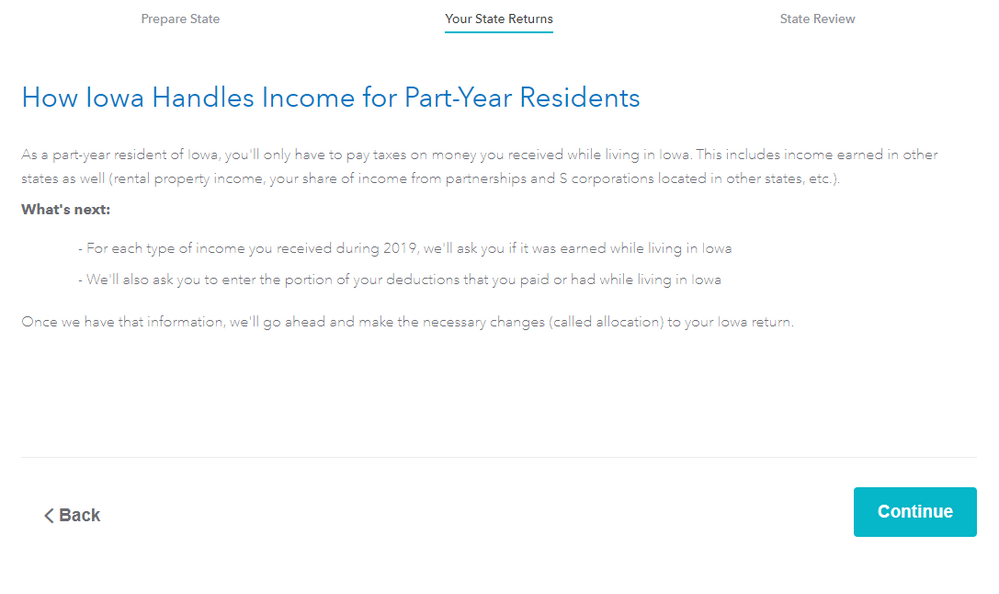

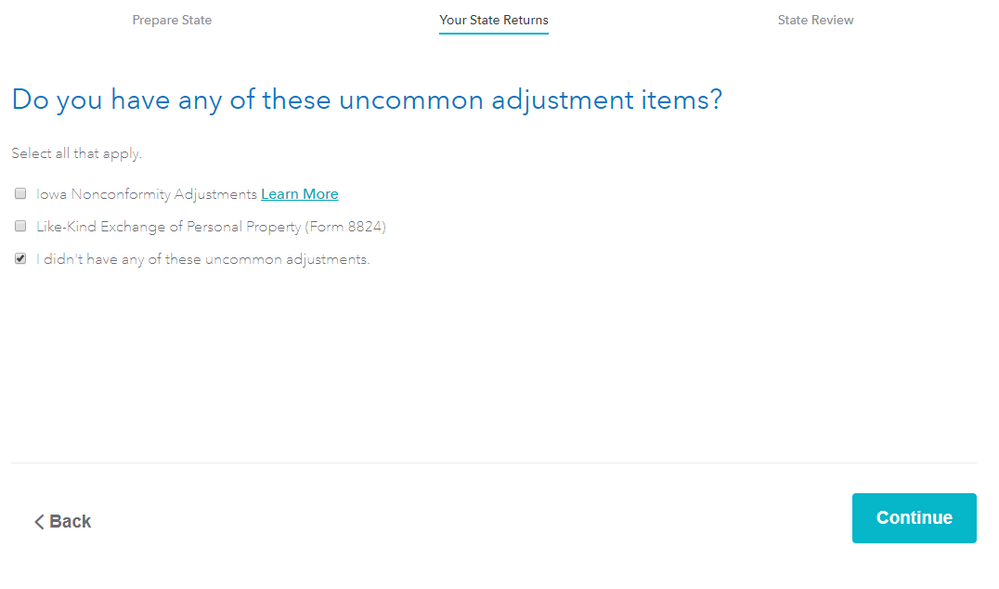

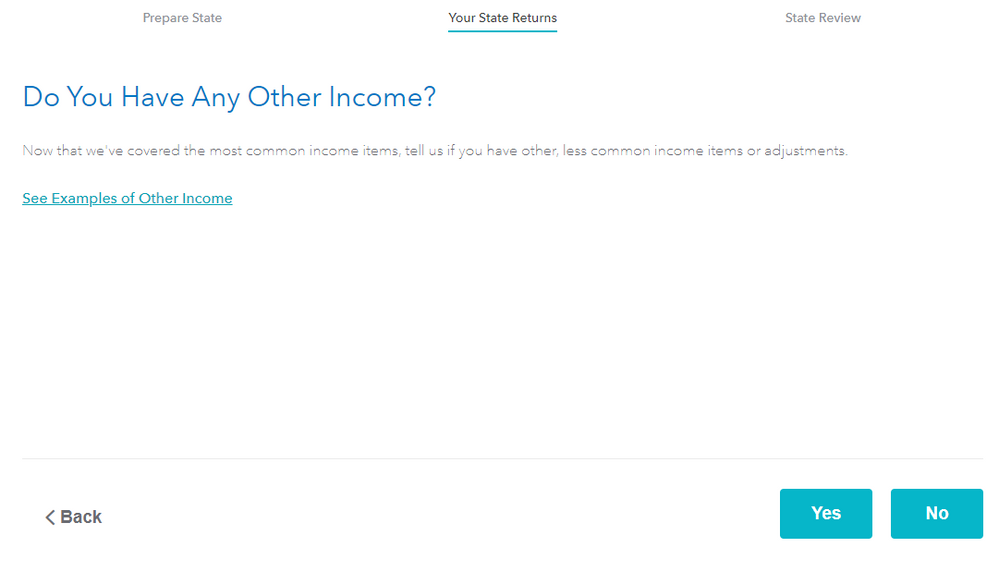

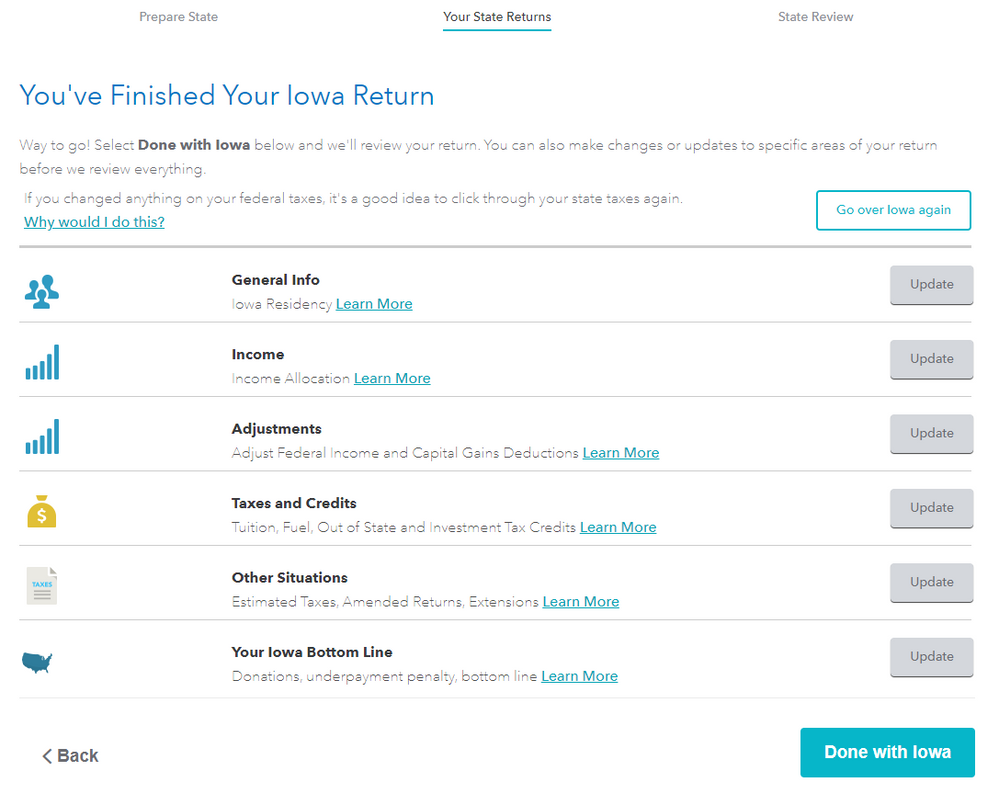

I'm trying to file state tax returns and believe TurboTax isn't allowing me to answer what I think is the crucial question for part-time residents: how much income did my spouse and I make while residents in each state? I've attached screenshots to show how TurboTax says it wants this information but provides no opportunity to give it. The first screenshot is where it says it'll ask for this information. The other screenshots are the only two questions it asks me before saying I've successfully completed the 'income' section.

This could be a big deal for me, as I had a lot of short-term capital gain income in one state and an equal amount of short-term capital loss in the second state. As such, my capital gain income on my federal tax return (~$0) does not represent how much money I made or lost while a resident of each state. Is something missing?