- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Hi Dave,

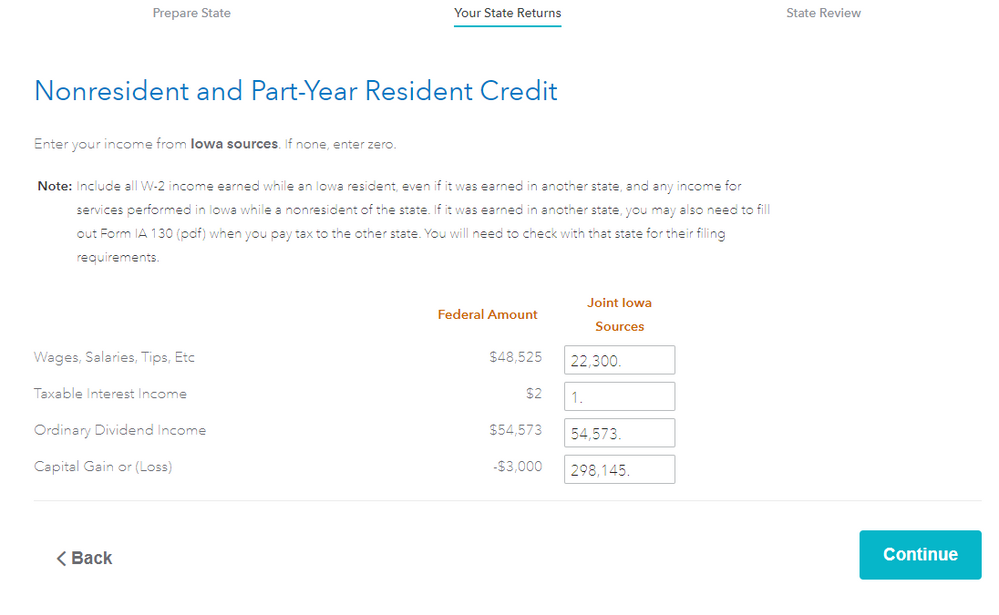

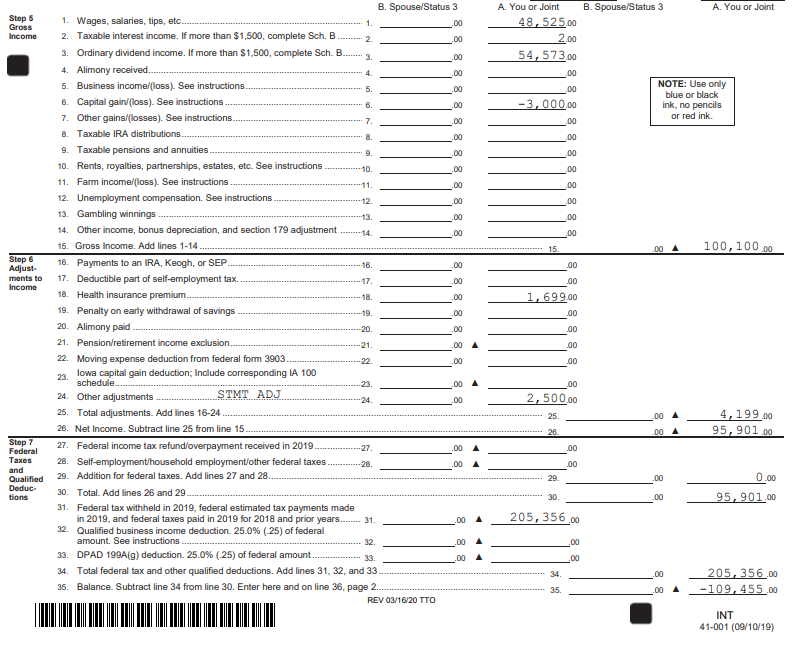

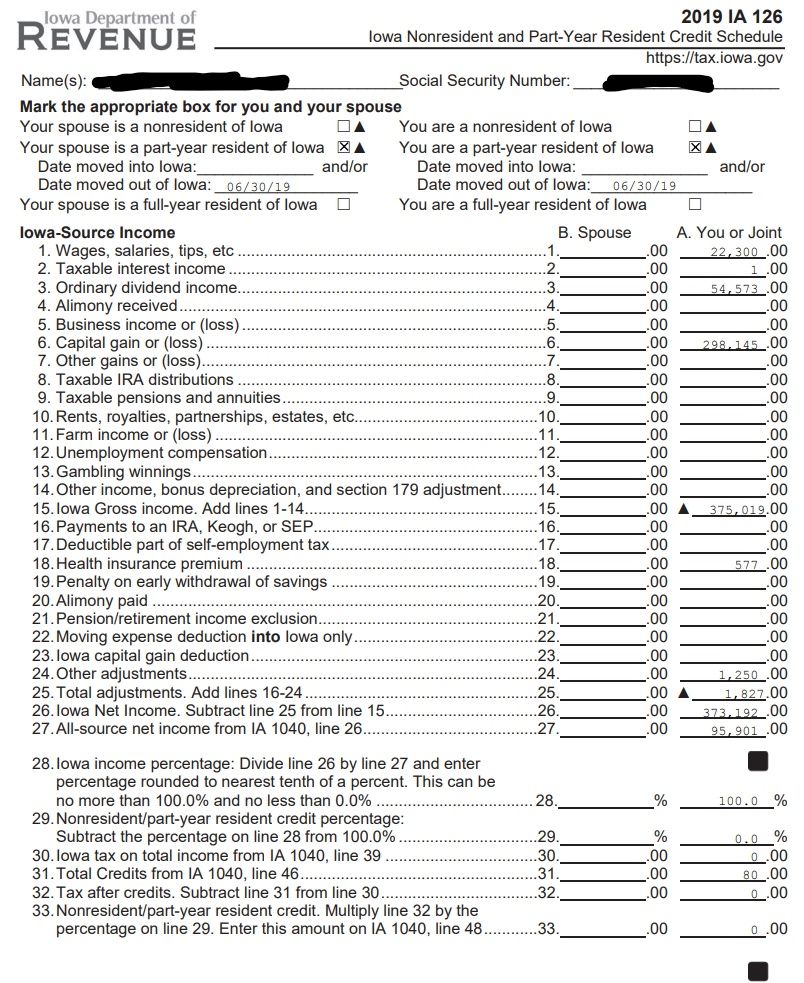

I already made income allocations on the screen you mention (attached). Those entries are only carried over to the "Iowa-Source Income" section of the "Iowa Nonresident and Part-Year Resident Credit Schedule", not to my Iowa State 1040 (attached). Is this how it should be? It seems wrong to me. Our wages, salaries, tips, etc. should be lower on the 1040 by $26,225. Our capital gain income should be higher on the 1040 by $301,145. I would love to be wrong!

March 26, 2020

1:07 PM