- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- New Jersey: NJ-1040NR - Reporting of Income Interview

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey: NJ-1040NR - Reporting of Income Interview

I have searched this forum and seem to get mixed messaging here, hopefully someone can assist and provide some direction.

Background: Live in NY, but worked in in various states throughout the year (including NJ), and my employer withheld state taxes for the states I did work in.

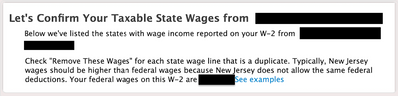

During the NJ interview, I get to the following screen:

It's not clear what this means. I am supposed to check (i.e., "Remove These Wages") all the states except NJ, or am I supposed to check all states except my state of residence (i.e., NY) which is the same as my federally taxable wage?

Thank you in advanced

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey: NJ-1040NR - Reporting of Income Interview

Remove all except NJ. NJ requires software programming to not automatically exclude income reported to other states from being transferred to the return. However, if you don't select these boxes, your NJ income will be reported much higher than what it actually was.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey: NJ-1040NR - Reporting of Income Interview

@DanielV01 Thank you for the speedy reply.

Once clarifying point: If select everything except NJ, as you've mentioned, the amount reported on line 15(a) is equal to the my State Wages (i.e., Box 16 on W-2) - which is significantly lower than the amount reported in Box 1 on W-2.

However, per the NJ-1040NR, it seems like Line 15(a) should include all income; which i assume means total wages - which would be the amount in Box 1.

Hopefully that makes sense.

Thanks again in advanced!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey: NJ-1040NR - Reporting of Income Interview

Unfortunately we don't have access to your return, so we can't see what information the program is giving you nor what you have input. However, your premise is correct. New Jersey uses Column A to determine how much they would tax all of the income, and column B is to prorate to the amount of income attributable to NJ. You might want to contact customer service to make sure your inputs are correct and, if so, then if the program is calculating correctly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

emuehle

Level 2

Tuser101

New Member

in Education

Fiberglass72

Level 2

juham2013

Level 3

MZVA

Level 2