- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey: NJ-1040NR - Reporting of Income Interview

I have searched this forum and seem to get mixed messaging here, hopefully someone can assist and provide some direction.

Background: Live in NY, but worked in in various states throughout the year (including NJ), and my employer withheld state taxes for the states I did work in.

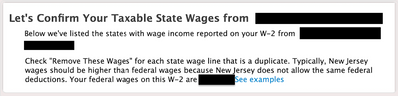

During the NJ interview, I get to the following screen:

It's not clear what this means. I am supposed to check (i.e., "Remove These Wages") all the states except NJ, or am I supposed to check all states except my state of residence (i.e., NY) which is the same as my federally taxable wage?

Thank you in advanced

Topics:

January 22, 2021

8:40 PM