- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Live in PA. Have RSUs that were granted when I lived in MA. I think it's confusing software and my state taxes are getting messed up

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in PA. Have RSUs that were granted when I lived in MA. I think it's confusing software and my state taxes are getting messed up

In 2021 I moved from MA to PA. I have RSUs that were granted when I lived in MA that are showing up as MA related income on my W2. My W2s in 2022 looks roughly like this:

Box 1 (Wages, tips, other comp): 200,000

Box 5 (Medicare wages and tips): 220,000

MA:

Box 16 (Stage wages, tips, etc): 30,000

Box 17 (State income tax): 1600

PA:

Box 16 (Stage wages, tips, etc): 221,000

Box 17 (State income tax): 5,700

Why would by PA 16 be higher than my box 1 and even 5?

Does the above imply the taxes I paid in MA were double taxed in PA?

Both TurboTax (and other software I used to double check) seem to be having problems with this and I don't understand enough about taxes to know what i'm doing wrong. When doing PA/MA taxes my wages are listed as 250,000. It points out there may be an issue because my federal wages are only 200,000. I guess the 250 is the two box 16s combined but I don't understand if that's really correct or not.

Is it correct? Is there something im clicking incorrectly at some point? Would love any advice.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in PA. Have RSUs that were granted when I lived in MA. I think it's confusing software and my state taxes are getting messed up

Yes. State residents are taxed on income earned everywhere, so your Massachusetts RSUs are taxed by Pennsylvania.

Additionally, since the RSUs were granted as a result of work done in MA, they are also taxed by the Bay State.

PA will give you a credit for tax paid to MA on the PA tax return. It is not full credit. PA has a flat tax rate of 3.07%. The MA rate on wages is 5%, so PA will give you credit for MA tax paid up to the 3.07%.

PA taxes 401(k) contributions, so PA wages are typically higher than federal.

Your PA state wages should be $221,000.

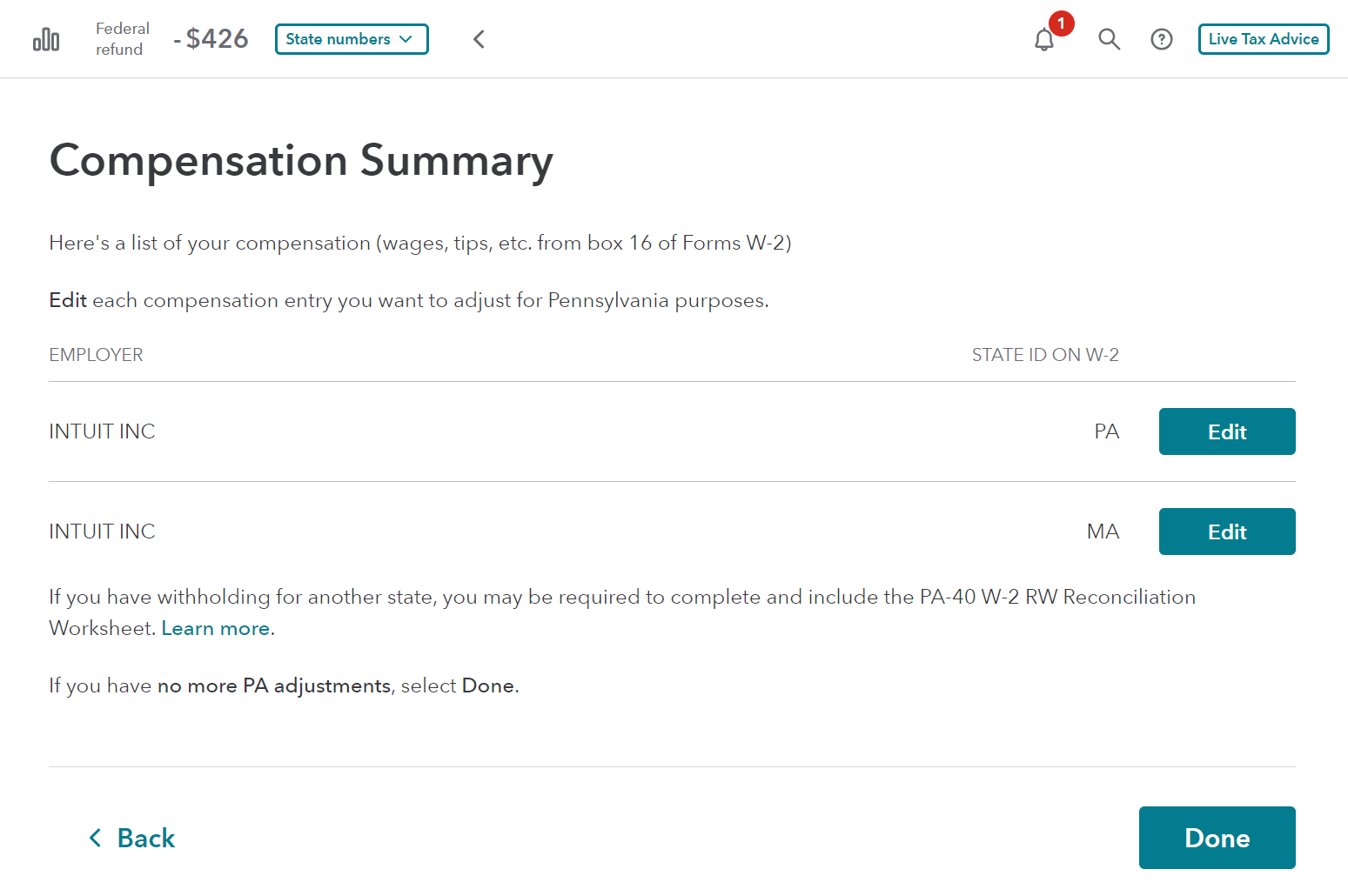

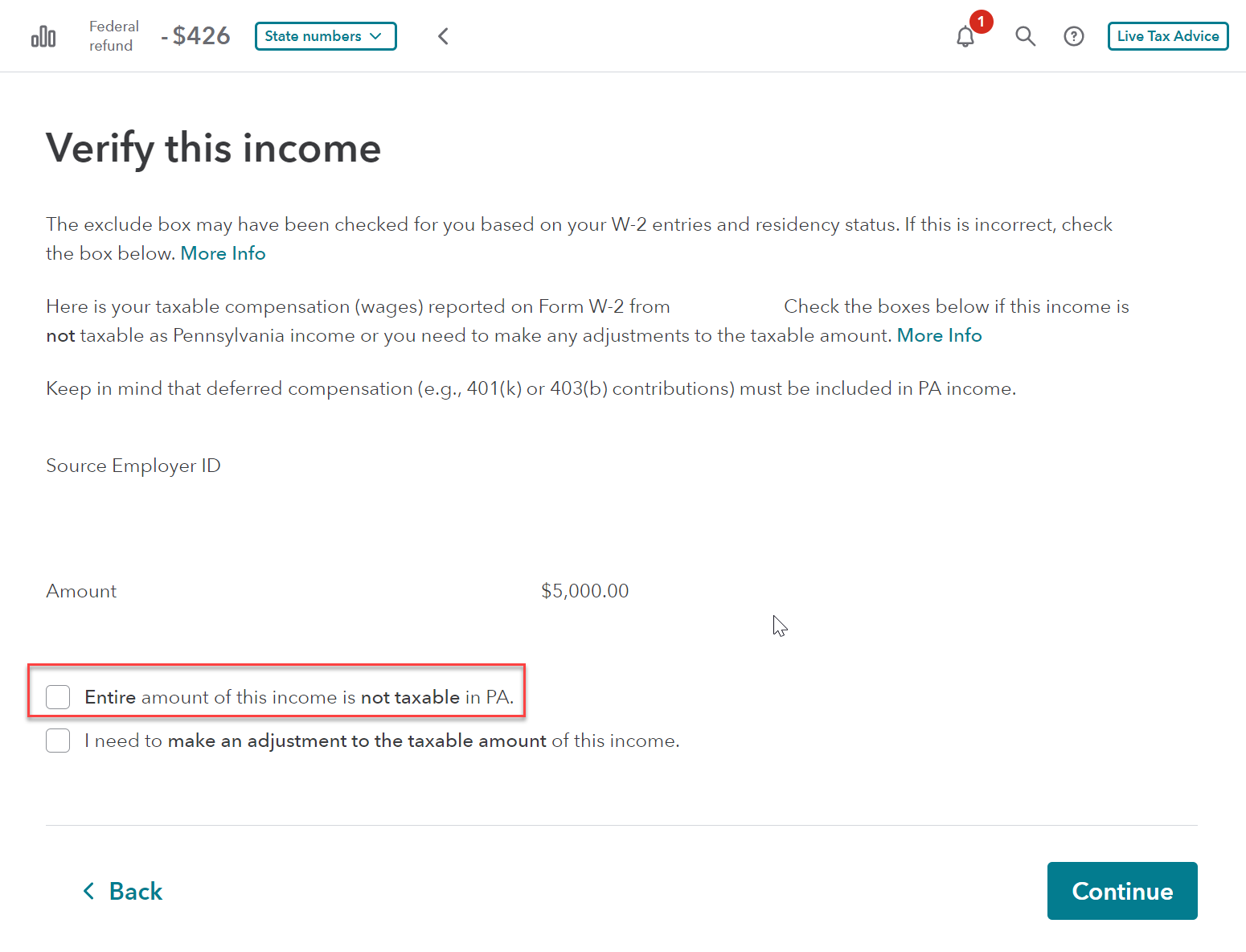

- On the screen “Compensation Summary,” select Edit on line for MA.

- On the screen “Verify this income,” select Entire amount of this income is not taxable to PA

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Folsom49er

New Member

mnhng1

Returning Member

ryan-j-delahanty

New Member

trust812

Level 4

Hpat

Level 2