- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Yes. State residents are taxed on income earned everywhere, so your Massachusetts RSUs are taxed by Pennsylvania.

Additionally, since the RSUs were granted as a result of work done in MA, they are also taxed by the Bay State.

PA will give you a credit for tax paid to MA on the PA tax return. It is not full credit. PA has a flat tax rate of 3.07%. The MA rate on wages is 5%, so PA will give you credit for MA tax paid up to the 3.07%.

PA taxes 401(k) contributions, so PA wages are typically higher than federal.

Your PA state wages should be $221,000.

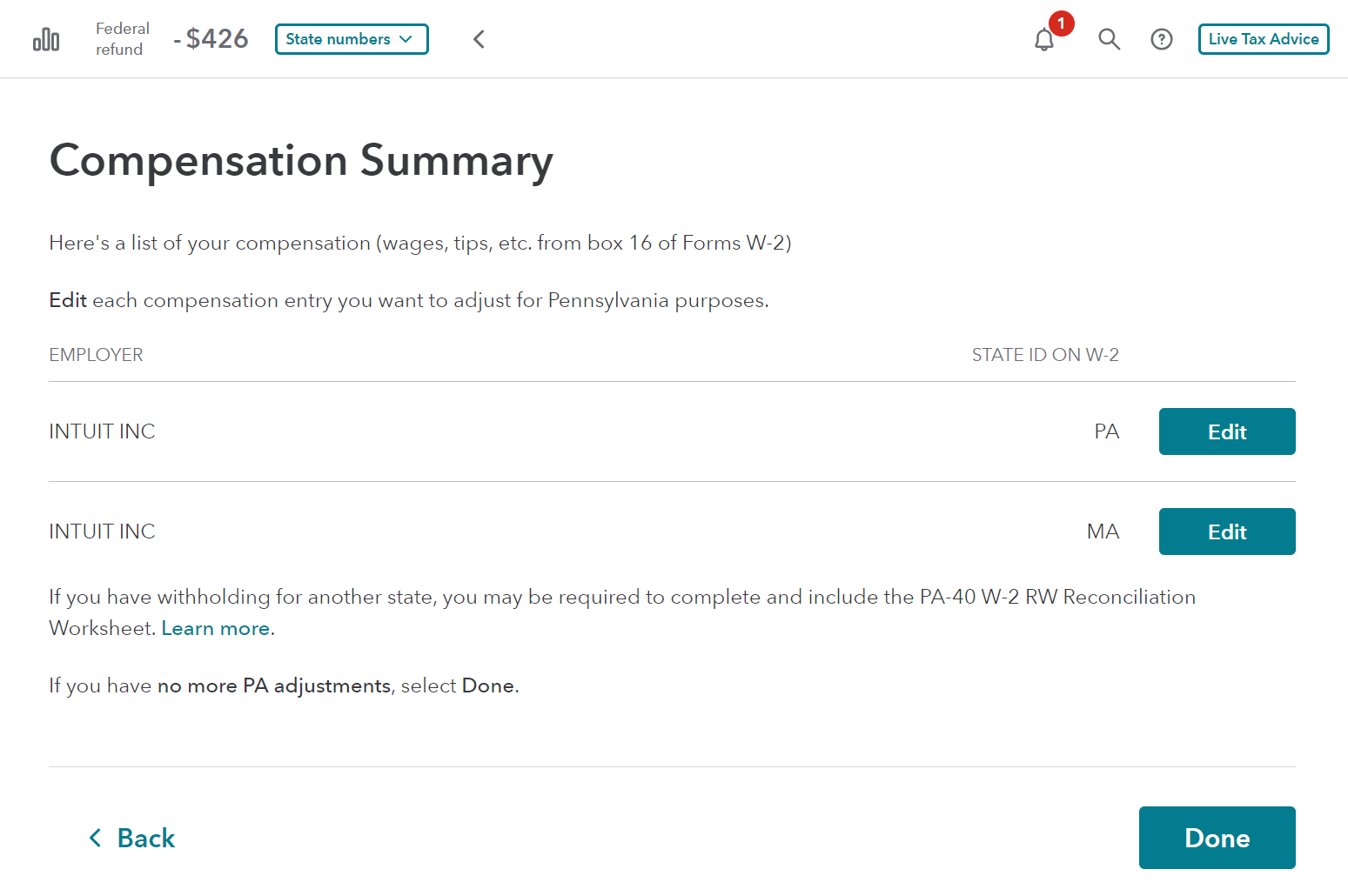

- On the screen “Compensation Summary,” select Edit on line for MA.

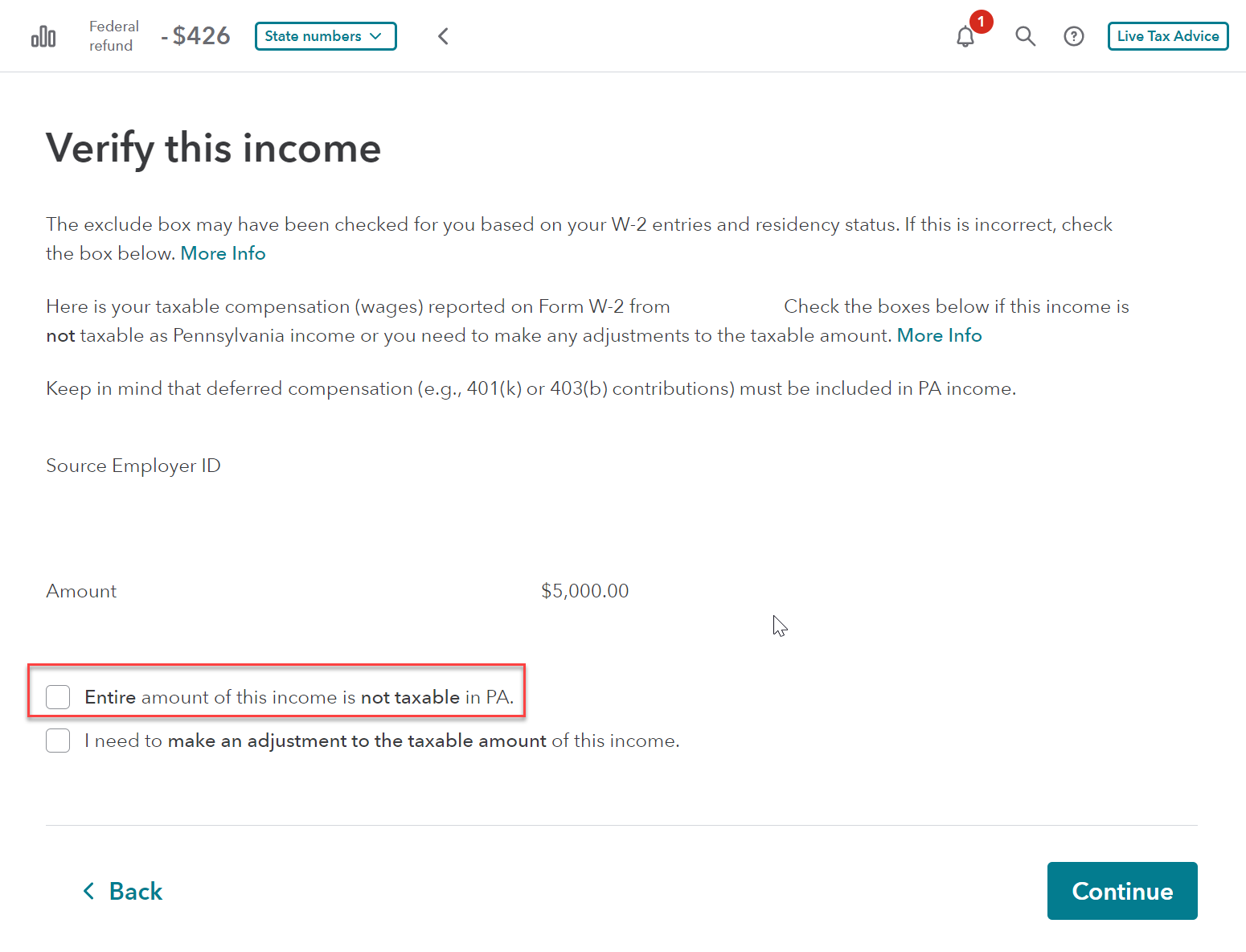

- On the screen “Verify this income,” select Entire amount of this income is not taxable to PA

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 3, 2023

4:24 PM