- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Letter 6419 has $1162.5 for my wife and I each. TT rounds these up to $1163 and asks if $2326 is the correct total. $2325 is the correct total. Will this delay my return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Letter 6419 has $1162.5 for my wife and I each. TT rounds these up to $1163 and asks if $2326 is the correct total. $2325 is the correct total. Will this delay my return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Letter 6419 has $1162.5 for my wife and I each. TT rounds these up to $1163 and asks if $2326 is the correct total. $2325 is the correct total. Will this delay my return?

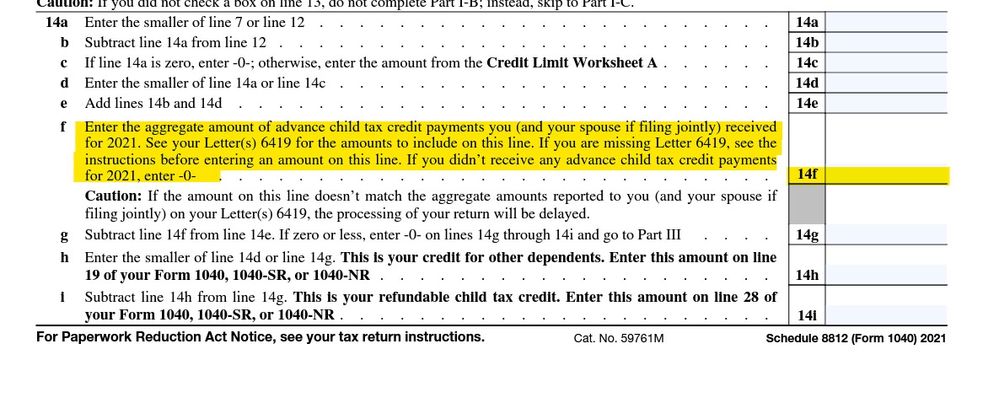

Only a Total whole dollar amount can be entered on the federal tax return. All you need to do is enter $1,162 for one spouse and $1,163 for the other spouse.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Letter 6419 has $1162.5 for my wife and I each. TT rounds these up to $1163 and asks if $2326 is the correct total. $2325 is the correct total. Will this delay my return?

Same problem for me. I actually called TurboTax and the tax expert told me it was normal for the rounding and to leave it. But I am going to do what you recommended so the total amount is accurate and not off by a $1.

TurboTax shouldn't round the numbers for this section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Letter 6419 has $1162.5 for my wife and I each. TT rounds these up to $1163 and asks if $2326 is the correct total. $2325 is the correct total. Will this delay my return?

I have a the exact same situation; two amounts ending in $x,xxx.50 and the amount is $1 higher. How can I check the box to say this is right when it's not? I don't know the right answer, but I'd really appreciate if TT would validate, in writing, how to handle this situation. If it totaled the amounts vs. rounding first, I feel it would address the issue. I want some confidence when I submit that this won't be delayed. I may have to go somewhere else this year...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Letter 6419 has $1162.5 for my wife and I each. TT rounds these up to $1163 and asks if $2326 is the correct total. $2325 is the correct total. Will this delay my return?

@DoninGA Although I considered this suggestion, and it would add up to the actual amount, it won't match the 6419 forms we received, exactly. There has been several discussions and feedback that if amounts do not match what is on the forms, then your return will be delayed. I don't know if that is true either, but are you able to confirm that if we do as suggested the IRS won't delay our returns as a result? I am having a hard time believing the feedback that the government systems only works with whole dollars when they send out the forms with cents. If that were the case, I would expect them to round these quantities as well.

*I don't mean to sound confrontational above but rather looking for clarity.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Letter 6419 has $1162.5 for my wife and I each. TT rounds these up to $1163 and asks if $2326 is the correct total. $2325 is the correct total. Will this delay my return?

I actually signed up for another tax filing website to see how they handled this section and it only wanted me to enter the total amount received. I think the tax form is only listing "total amount received" and not breaking it out one person got x and one got x. But I could be completely wrong.

I also wish TurboTax would give some clarification as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Letter 6419 has $1162.5 for my wife and I each. TT rounds these up to $1163 and asks if $2326 is the correct total. $2325 is the correct total. Will this delay my return?

@Cheff640 When you report the advance child tax credit received only the Total amount received from the IRS is reported. Nothing is reported on the tax return as to which spouse received the tax credit in 2021. All the IRS wants to see on the 2021 tax return for the child tax credit is the amount you are eligible to receive less the amount of advanced credit that was received for the child in 2021.

If you have correctly entered the advance received then amount on your 2021 tax return Form 1040 Line 28 is what the IRS expects to see on the tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Letter 6419 has $1162.5 for my wife and I each. TT rounds these up to $1163 and asks if $2326 is the correct total. $2325 is the correct total. Will this delay my return?

Ok ... married couples who have 50 Cents at the end of their number just need to be smarter than the program ... so either add the 2 payments together and enter it all under one person and put a zero under the other OR round one up and one down. Say you got 300.50 on each letter ...

601 + 0 = 601

300.50 + 300.50 = 601

301 + 300 = 601

Remember the IRS only gets the total on the form 8812 ... how the correct total gets there is immaterial...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Letter 6419 has $1162.5 for my wife and I each. TT rounds these up to $1163 and asks if $2326 is the correct total. $2325 is the correct total. Will this delay my return?

@Critter-3 That's the part I didn't realize; the split quantities are not reported, only the total quantity. That makes sense and makes me feel better about submitting my information so that the final amount is reflected properly.

Thanks @DoninGA and @seadiel2k5 for your feedback as well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Letter 6419 has $1162.5 for my wife and I each. TT rounds these up to $1163 and asks if $2326 is the correct total. $2325 is the correct total. Will this delay my return?

It looks like an issue with TurboTax, the software wants you to put exact amount from each Letter 6419, but round up the amount of each line, before sums it up, which is wrong.

I did summited my return with the "wrong" autogenerated total, which is +$1 and got my return, so IRS would not flag it as an issue. The only lost is you will be getting $1 less on your return.

TurboTax should fix this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Letter 6419 has $1162.5 for my wife and I each. TT rounds these up to $1163 and asks if $2326 is the correct total. $2325 is the correct total. Will this delay my return?

You are correct. $1 is not going to make a difference in return processing and you would actually get back $1 more on the refund. I recommend following @Critter-3 advice and do the rounding yourself to make the total advance child tax credit received correct.

In the example provided by the original poster, enter 1163 for one taxpayer and 1162 for the other taxpayer for a total of 2325.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chiroman11

New Member

kragby

New Member

ddm_25

Level 2

gerardh

New Member

Idealsol

New Member