- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I was a part resident in one state, worked and paid state taxes, then moved to a different state with a different job. Why do I owe excessive taxes in my old state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was a part resident in one state, worked and paid state taxes, then moved to a different state with a different job. Why do I owe excessive taxes in my old state?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was a part resident in one state, worked and paid state taxes, then moved to a different state with a different job. Why do I owe excessive taxes in my old state?

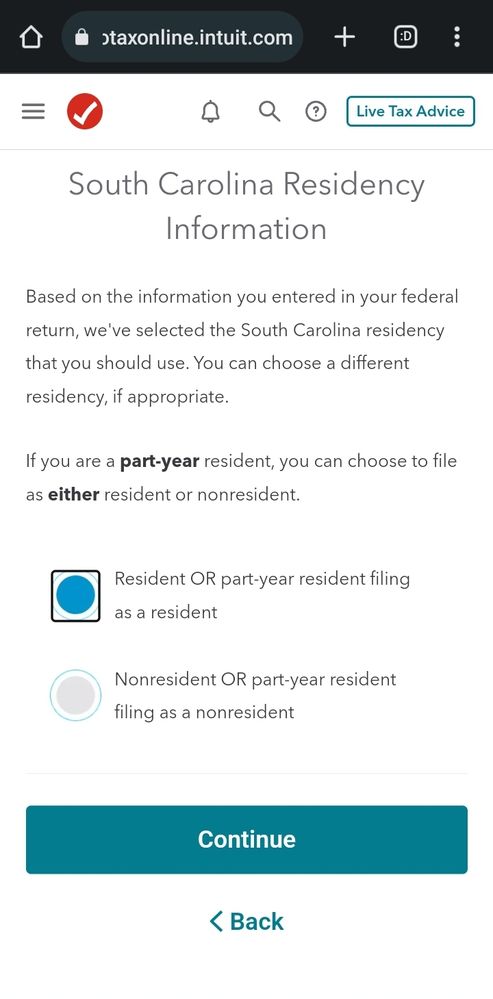

South Carolina allows you to choose the Resident or Nonresident for the first year that you move into or out of South Carolina so there is no problem if you choose the better outcome (in fact it would be more suspect if you choose to pay more in taxes.) @Bb17

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was a part resident in one state, worked and paid state taxes, then moved to a different state with a different job. Why do I owe excessive taxes in my old state?

You will in most cases file a Part Year resident return for each state. In the state section of TurboTax you will be able to allocate the wages you made in each state so only that income is taxed. If you have gone through and you are not seeing this, post which states and someone may be able to guide you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was a part resident in one state, worked and paid state taxes, then moved to a different state with a different job. Why do I owe excessive taxes in my old state?

I'm filing for MD and SC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was a part resident in one state, worked and paid state taxes, then moved to a different state with a different job. Why do I owe excessive taxes in my old state?

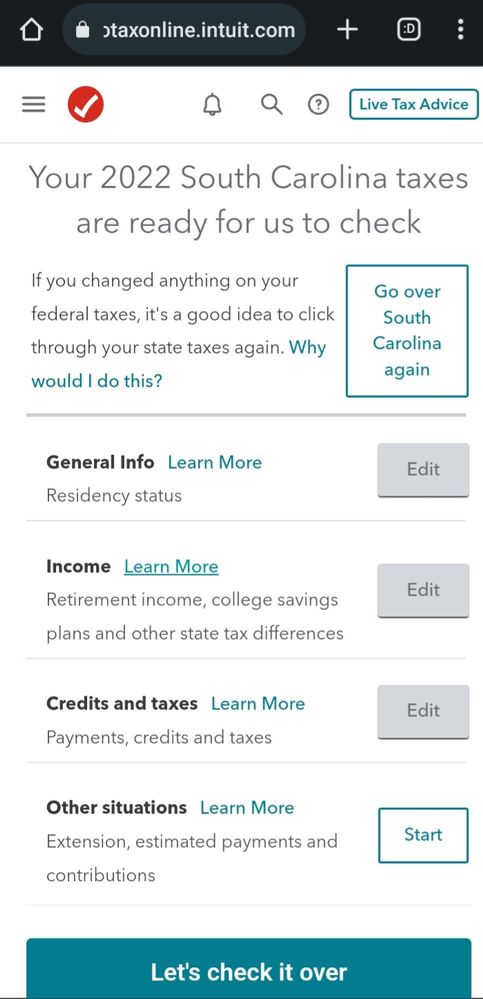

South Carolina does not have a separate Part Year resident tax return- you can elect to file as a Full Year resident or Nonresident (I am glad I added the "in most cases"). You may want to try both ways, but with most simple returns the results are the same. You should see the screen where they ask you the dates of South Carolina residency. Look for the screen below- this is where you want to enter the SC W2 amount. @Bb17

Maryland asks you to enter the non-Maryland income (which should be the same amount you entered for South Carolina wages).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was a part resident in one state, worked and paid state taxes, then moved to a different state with a different job. Why do I owe excessive taxes in my old state?

Thank you, I did see the Maryland question but it confused me. I thought it was asking me for outside income while being a Maryland resident. That seemed to fix the issue. The SC section did not ask me for earned income (I should mention that all of my W2 info is entered by this point, so maybe TurboTax realized the income earned in SC based on the entered W2 info?). Also, filing as a nonresident of SC has a considerably higher refund amount than a resident. Does this matter?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was a part resident in one state, worked and paid state taxes, then moved to a different state with a different job. Why do I owe excessive taxes in my old state?

Yes. How you file a part-year South Carolina tax return matters a lot. Filing part-year return as a resident will generally result in higher tax because it will use your total income for the year as a tax base. You'll only be taxed on SC income, but at a higher rate.

Filing as a part-year return as a non-resident will only use actual South Carolina income to set your tax return.

It’s always useful to try it both ways. You don’t have to do anything to change filing statuses but switch the button on “South Carolina Residency Information” and tap Continue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was a part resident in one state, worked and paid state taxes, then moved to a different state with a different job. Why do I owe excessive taxes in my old state?

@ErnieS0 So based on your explanation, it sounds like filing as a non resident this time around is the correct way to do this since I only made a part of my total income for the year in SC. However, I am concerned that the refund is much higher when I change the status to non-resident, and that this may somehow end up being incorrect and I'll have to deal with it later on. Keep in mind, we moved to SC as a permanent move, despite the tax definitions of residency. So, would filing as a non resident for this year be acceptable in the eyes of the state government?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was a part resident in one state, worked and paid state taxes, then moved to a different state with a different job. Why do I owe excessive taxes in my old state?

South Carolina allows you to choose the Resident or Nonresident for the first year that you move into or out of South Carolina so there is no problem if you choose the better outcome (in fact it would be more suspect if you choose to pay more in taxes.) @Bb17

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was a part resident in one state, worked and paid state taxes, then moved to a different state with a different job. Why do I owe excessive taxes in my old state?

@MaryK4 That's interesting. Why is it considered suspect?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I was a part resident in one state, worked and paid state taxes, then moved to a different state with a different job. Why do I owe excessive taxes in my old state?

When given an option, you should always choose the option that results in the lowest tax. There are situations in which a part-year SC resident would be better off by choosing to file as a full-year resident (if they only had SC income during the year and wanted tax breaks only residents get). But in your situation, having other state income, it is more beneficial to be a non-resident of SC. ''Suspect'' could describe anything that draws unnecessary attention to your tax return (like overpaying taxes).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

march142005

New Member

Dawnpm

Returning Member

jliangsh

Level 2

curlytwotoes

Level 2

AdamD1

Level 2