- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Filing Fees

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Fees

I've been surprised by the third party delivery of my Federal refund. I've been disappointed in the fee structure, claiming "file for free", only to learn I owe $25 to file AND, because I elected to have the fee deducted from my return, I paid an additional $40!! $65 reduction in my refund. Let me know how I can avoid these fees in the future, or I'll be moving to a different preparation software that does a better job of full disclosure of the costs associated with filing a return.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Fees

While unusual in today's automated "customer service" environment, has anyone been able to reach a live party at TurboTax and get a straight answer on their filing fee structure? Shame on me for not paying enough attention to the details of my purchase. Buyer beware!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Fees

You must have used the Desktop installed program. Yes it is $25 ($20 before March 1) to efile a state return or you can print and mail state for free. There is a lot of confusion about this. For the Desktop Deluxe and above it's a free download of one state PROGRAM, not returns filed. You can prepare unlimited federal and unlimited state returns. Some people need to file in more than one state so they have to buy another state program. Check the box or online description. It should say Federal + Efile + State. Not state efile.

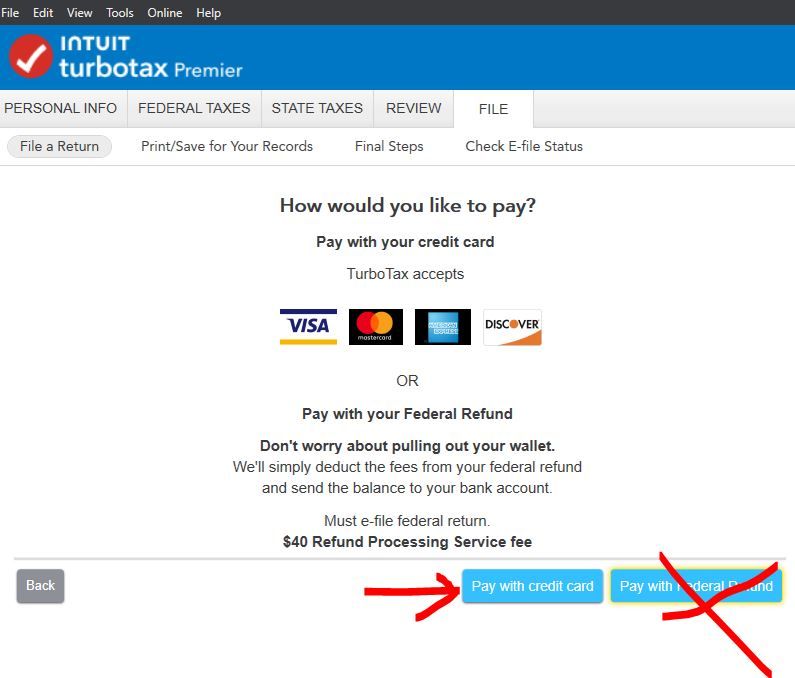

Then to have the fee deducted from your federal refund is an EXTRA $40 (45 in California) service charge. So pay with a credit card to avoid the extra charge.

You have to be careful what you click on when you file, go slowly. There is one screen that can trip you up. People get going to fast and click the bottom right button to continue. But to pay by credit card you need to check the Left button.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing Fees

When using the TurboTax desktop CD/Download editions there is a $25 e-file fee for the state tax return. This charge was noted on the screen in the File section where you selected e-filing.

Prior to actually e-filing the tax return there was another screen where you were asked to pay the state e-file fee. You were give the option to either pay the $25 with a credit card or pay the $25 with the federal tax refund. The pay with refund option had a $40 Refund Processing Service fee shown on the payment screen.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

heathermoushey87

New Member

plequerre

New Member

lkayehnert

New Member

slfry84

New Member

in Education

sal3033

New Member