- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Do I enter the state in which I live in regarding the earned exempt-interest dividends in for the 1099DIV?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I enter the state in which I live in regarding the earned exempt-interest dividends in for the 1099DIV?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I enter the state in which I live in regarding the earned exempt-interest dividends in for the 1099DIV?

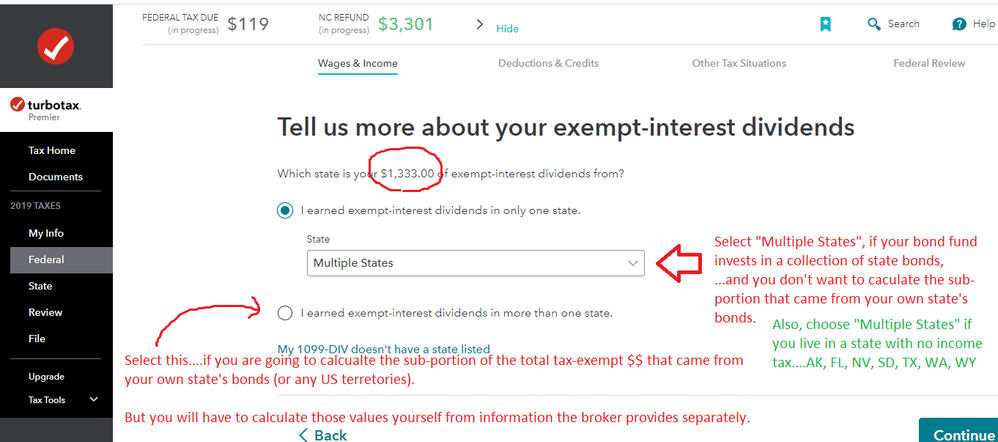

NO...that refers to the states that issued the interest. Unless you invested in a bond fund that specifically only bought bonds from your own state...then it's a mixture (Multiple States).

__________________________________________________

Unless you are willing to go thru the calculation to break out JUST the amount from your own state's bonds, you would select "Multiple States" for all of it

___________________________________________

_____________________________________

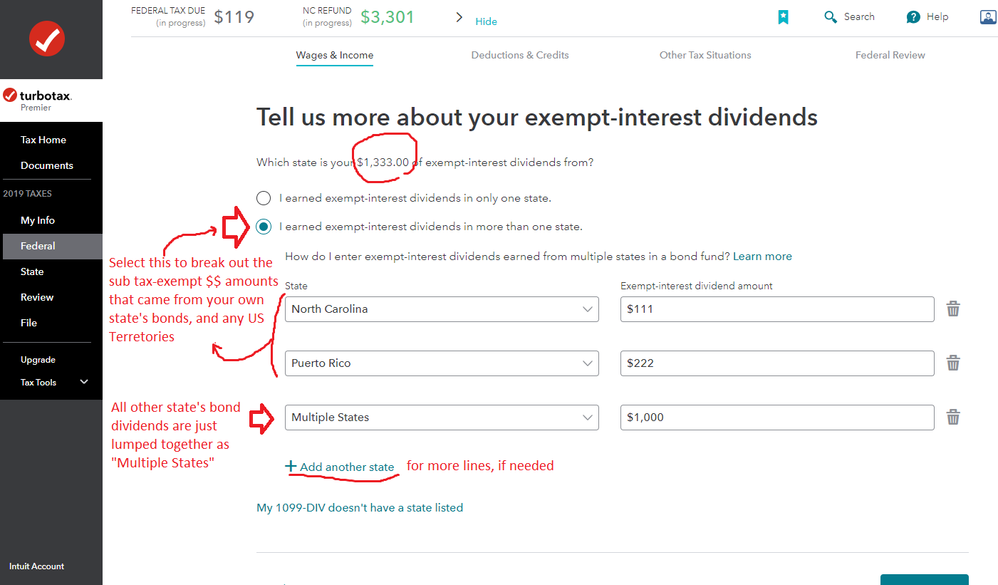

IF you are going to break out your own state's $$ then you check the selection that displays the extra boxes

(note, for a 1099-DIV, box 11, this is not allowed by Illinois, and CA & MN have severe restrictions on when it is allowed). The amount actually from your own state's bonds would have to be more than ~$50 or $100 before it had much of an effect.

____________________

Example is for a NC resident:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I enter the state in which I live in regarding the earned exempt-interest dividends in for the 1099DIV?

Thanks for the reply. I did all of that, breaking out my home state's (NY) from other states' dividends as per the second illustration you provided. The problem is that the other states' amount is not flowing through to my NYS return as an addition to my federal AGI.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I enter the state in which I live in regarding the earned exempt-interest dividends in for the 1099DIV?

Are you working with the 2020 Desktop software right now??

____________________________

If so

....1) MAC or Windows OS?

....2) have you installed all the available TTX updates

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I enter the state in which I live in regarding the earned exempt-interest dividends in for the 1099DIV?

No, I'm using the recently released online version for 2021. I also used the 2020 online version and had the same issue. I used the workaround I mentioned in my original post to get the desired outcome for 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I enter the state in which I live in regarding the earned exempt-interest dividends in for the 1099DIV?

Well, the "Online" version for 2021 is only in a very crude condition....many, many internal software links are still not connected. People really shouldn't get all worked up and started in on the tax software until mid-Jan or later ( yeah, just a personal opinion)

We won't know if the 2021 software really deals with it properly until perhaps...late January. Only then can any real error tickets be issued to get it corrected...only IF it still remains a problem....and then you would contact Customer Support to get it actually logged and corrected with official TTX channels. (which this forum is not)

What is the TurboTax phone number? (intuit.com)

___________________________________________

Other things (workarounds below) to try in the future.....but I have no idea if this would really work or even be necessary until late January of 2022

_____________

Whether a 1099-DIV or a 1099-INT:

IF you had multiple states for the Municipal Bond tax-exempt interest, try breaking out the NY bond amount into it's own 1099-DIV or 1099-INT form.

For instance. box 8 on a 1099-INT is $1000, of which $100 is from NY bonds, and $900 is from all other states.

Create two 1099-INT forms,

........one with all the other boxes and box 8 being $900 and all of it tagged as "Multiple States".

.........and a second 1099-INT with $100 in box 8 and tagged as being from NY bonds. (If you have any box 13 amounts ...you may have to include those in the proper 1099-INT form)

_____________________

Similar for the 2021 1099-DIV if you have mixed states for it's box 12 amounts. (for a 2021 1099-DIV, tax-exempt interest has moved to box 12, at least on the IRS Draft forms....in 2020, they were in box 11).

BUT...the TTX "Online" software 1099-DIV forms for 2021 are still showing the 2020 box numbering (today, 12 Dec)...i.e. box 11 for exempt interest/dividends. Might be best to delete your 1099-DIV forms (if using them) and revisit AFTER TTX actually changes them to the proper box numbering formats....a guess??? mid-late January.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

igor5927

Level 2

Landr42

Level 1

Careyac

New Member

BrokeLoser

Level 1

brelaz99

New Member