- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

NO...that refers to the states that issued the interest. Unless you invested in a bond fund that specifically only bought bonds from your own state...then it's a mixture (Multiple States).

__________________________________________________

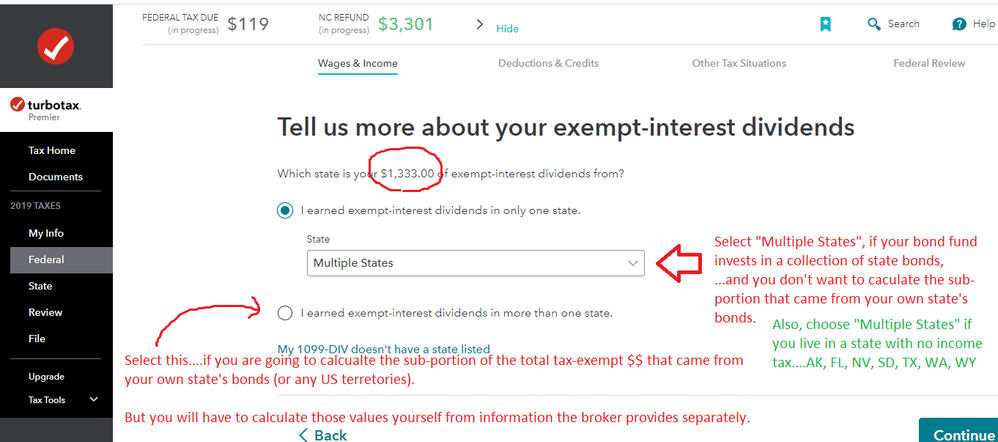

Unless you are willing to go thru the calculation to break out JUST the amount from your own state's bonds, you would select "Multiple States" for all of it

___________________________________________

_____________________________________

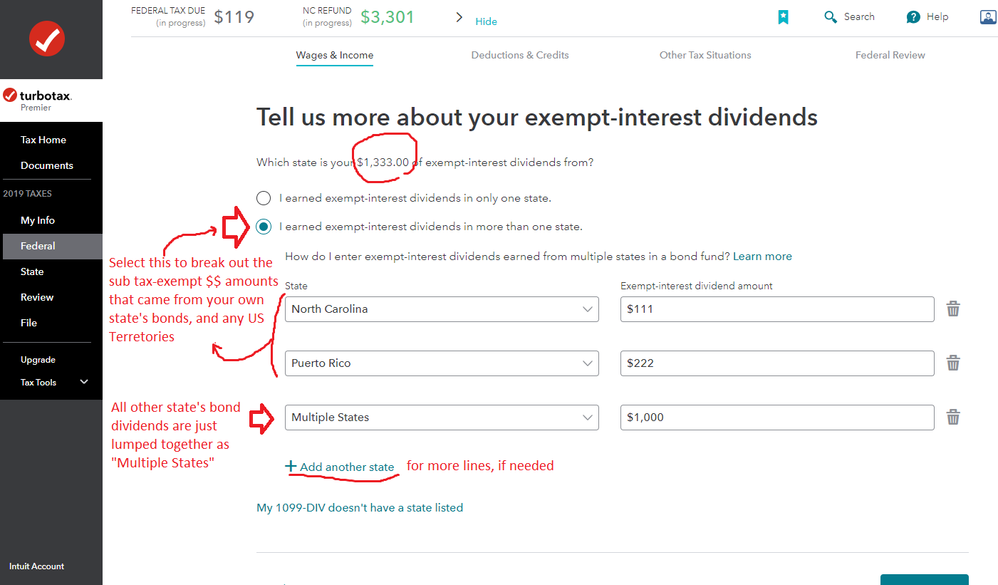

IF you are going to break out your own state's $$ then you check the selection that displays the extra boxes

(note, for a 1099-DIV, box 11, this is not allowed by Illinois, and CA & MN have severe restrictions on when it is allowed). The amount actually from your own state's bonds would have to be more than ~$50 or $100 before it had much of an effect.

____________________

Example is for a NC resident: