- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- 2020 Virginia tax return question on subtraction of $32,000 Code 31 on schedule ADJ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Virginia tax return question on subtraction of $32,000 Code 31 on schedule ADJ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Virginia tax return question on subtraction of $32,000 Code 31 on schedule ADJ?

A Code 31 subtraction on your VA return is a deduction for retirement plan income that was taxed by another state. In the VA state interview in the "Income" section in the list of "Retirement" topics you will find the "Retirement Income Adjustment" topic. "Revisit" that topic to review the subtraction. Below are some details on that subtraction.

Basically, some states (PA, for example) tax contributions to retirement plans even though those contributions are not taxed at the federal level. In those state the distributions are then not taxed whereas at the federal level they are taxed. VA conforms to the federal rules and taxes distributions, but then allows a deduction for the contribution amount that was taxed by another state that you may have lived in and made taxable contributions while living there.

" A Virginia subtraction is allowed for individuals who receive distributions from retirement plans when they contribute to and are taxed by another state.

Conditions for Qualification:

Contributions must have been made to an IRS Qualified Plan (a qualified pension, stock bonus, or profit-sharing plan as described by IRC Section 401, an individual retirement account or annuity established under IRC Section 408, a deferred compensation plan as defined by IRC Section 457, or a federal government retirement program.)

- the contributions must have been deductible for federal income tax purposes

- the contributions occurred in another state

- the contributions must have been subject to income tax in another state"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Virginia tax return question on subtraction of $32,000 Code 31 on schedule ADJ?

you told me something, but it did not fully answer my question - in 2020 tax return it shows $32,000 under this code - I don't recall entering this...where did it come from? and was it taxed elsewhere?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2020 Virginia tax return question on subtraction of $32,000 Code 31 on schedule ADJ?

The credit is based on your input.

These are the steps:

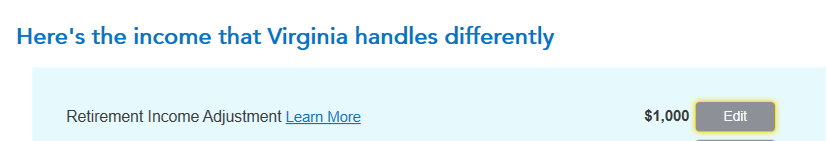

While going through the VA return, there is a screen that says, Here's the income that VA handles differently.

- Under Retirement, you select Retirement Income Adjustment, start

- Have you ever lived outside VA? select Yes, continue

- Did you make contributions to a plan when you did not live in VA? select Yes

- Did your state tax your contributions? select Yes

- You get a deduction! Enter the amount taxed by another state

You can see details at VA subtractions under Retirement Plan Income Previously Taxed by Another State.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Av74O0OhzB

Returning Member

Av74O0OhzB

Returning Member

hjw77

Level 2

ponsuke

New Member

Robert2035

Level 1