- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

The credit is based on your input.

These are the steps:

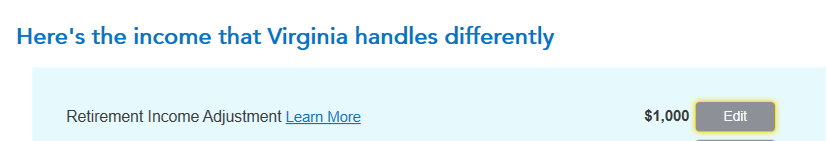

While going through the VA return, there is a screen that says, Here's the income that VA handles differently.

- Under Retirement, you select Retirement Income Adjustment, start

- Have you ever lived outside VA? select Yes, continue

- Did you make contributions to a plan when you did not live in VA? select Yes

- Did your state tax your contributions? select Yes

- You get a deduction! Enter the amount taxed by another state

You can see details at VA subtractions under Retirement Plan Income Previously Taxed by Another State.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 27, 2024

4:40 PM