- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Wrong calculation of allowed subtraction of annuity income by TurboTax in Colorado forms

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wrong calculation of allowed subtraction of annuity income by TurboTax in Colorado forms

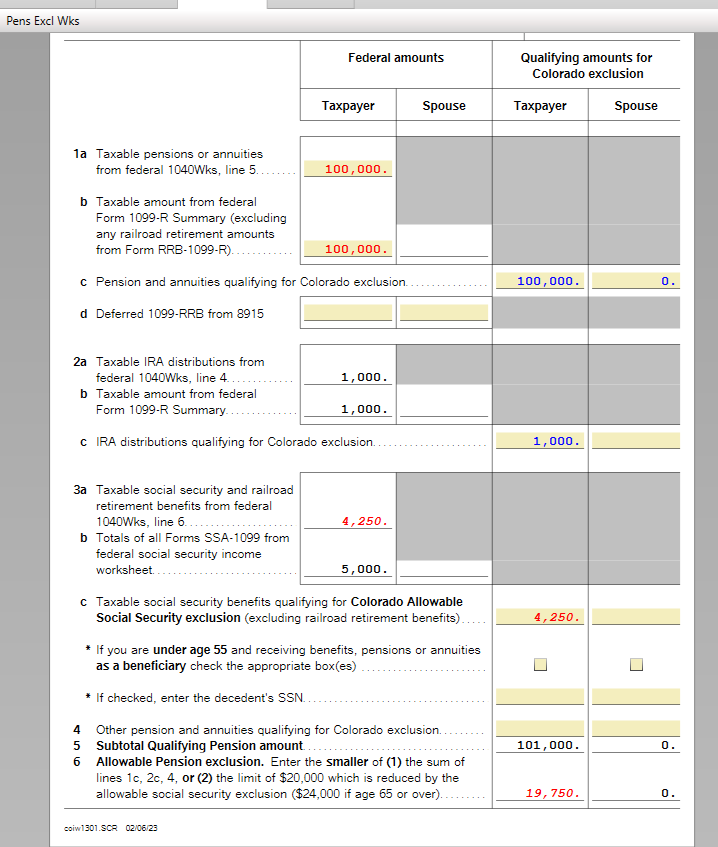

I am over 65 and have significantly more annuity income than the $24,000 allowed annuity income subtraction. This larger amount is reported as taxable on my Federal income form. However, Turbotax tells me I can only subtract 19,000 on my 1040AD form. I cannot change this to the maximum amount on the form. Turbotax does not give me any explanation for this. I have read all the instructions for filling out Colorado form DR0104AD and I see no reason not to be able to subtract this amount.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wrong calculation of allowed subtraction of annuity income by TurboTax in Colorado forms

Yes, tax law changes allow you to exclude the full amount of taxable Social Security from your Federal return, which you will see on Line 3 of Form 104AD.

On the Pension and Annuity Exclusion Worksheet, the Allowable Pension Exclusion amount on Line 6, is the smaller of the sum of Lines 1c, 2c, and 4, or the limit of 24,000 if over 65, reduced by the amount of the Social Security Exclusion. This may account for the difference in the amount you are expecting.

This transfers to Line 4 on the 104AD.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ethanol denver

Level 1

Socal Guy

Level 1

Tegridy2025

New Member

pcnyc

Returning Member

ryhartmuller

Level 2