- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Yes, tax law changes allow you to exclude the full amount of taxable Social Security from your Federal return, which you will see on Line 3 of Form 104AD.

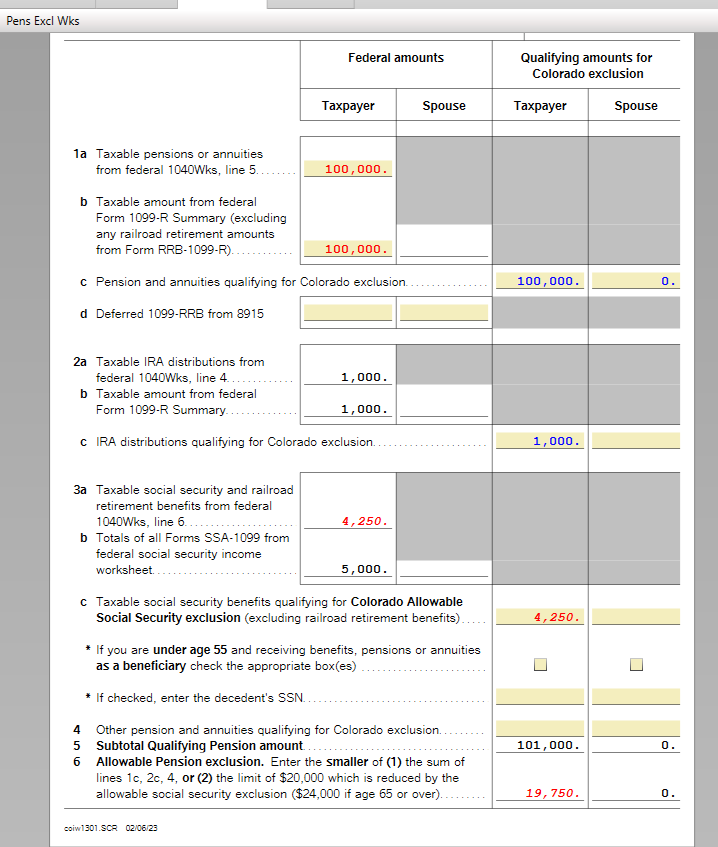

On the Pension and Annuity Exclusion Worksheet, the Allowable Pension Exclusion amount on Line 6, is the smaller of the sum of Lines 1c, 2c, and 4, or the limit of 24,000 if over 65, reduced by the amount of the Social Security Exclusion. This may account for the difference in the amount you are expecting.

This transfers to Line 4 on the 104AD.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 11, 2023

2:56 PM