- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

NYS updates are in. I was able to e-file both Federal and NY State just now. I also heard that Michigan is fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

One error fixed...and now some of us have a new error! Now it won't efile STATE without the federal. I already filed the Federal. Now it won't let me get past the new error!!! For goodness sake turbo tax....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

I am getting the same error, and already filed my Federal as well! Also, after doing the update to get the state fixed, It looks like I should have gotten a bigger refund from Federal and State.........now what? Do I have to amend my return to get that extra money?? Wow TT, this year is a mess!!!! How frustrating

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

I went front no problems last year to all the problems this year! I understand COVID made things complicated but you would think they would be quick to fix.....I have already received my federal in my checking and still have not submitted my state LOL. That's always the opposite for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

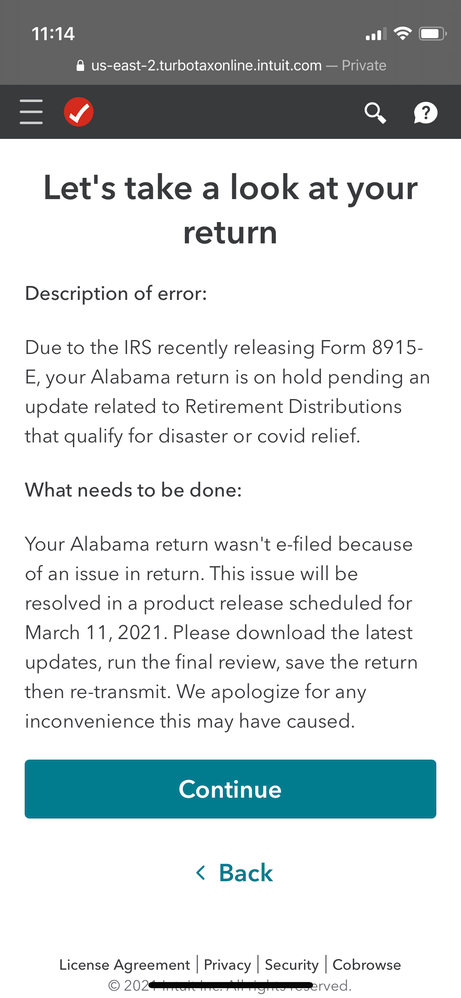

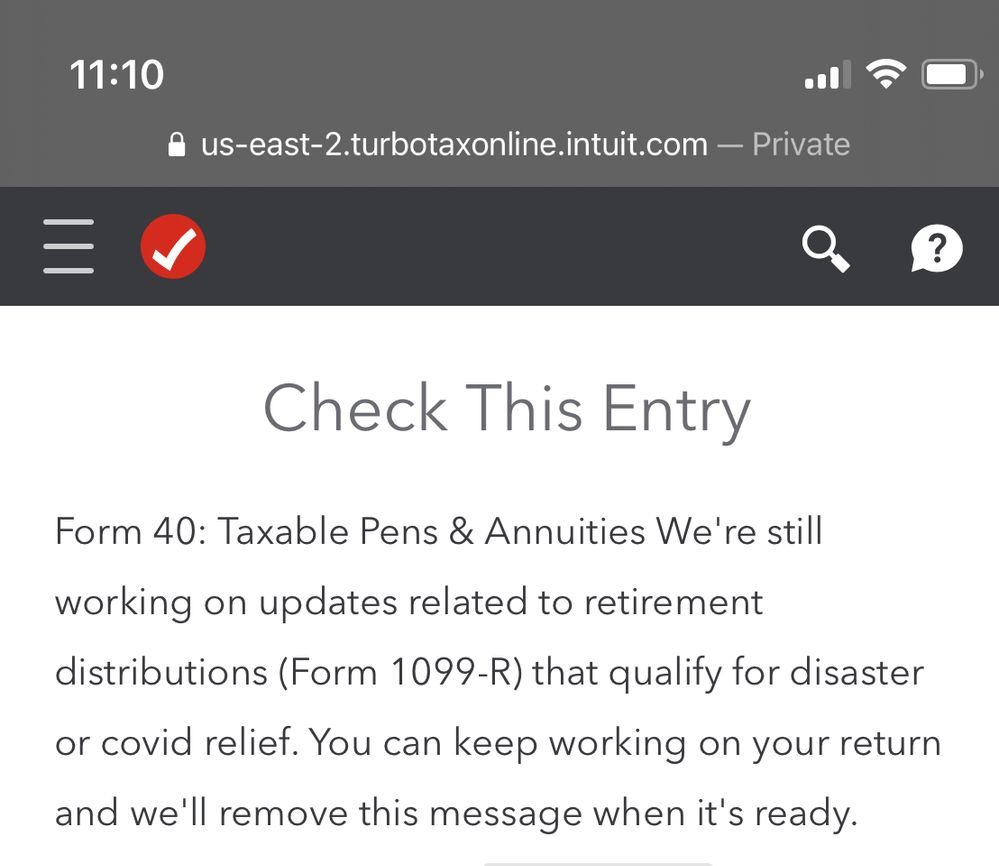

I am having this issue as well for Alabama. I e-filed both federal and state at the beginning of March using the online version. Federal was accepted within two days on March 5th. State bounced back March 7th with an ‘action needed’ email but when I looked at the error, it said it was going to be fixed with an update scheduled for March 11th. I have been checking every day since and keep getting the same error. I talked with someone in support and they could not really give me any helpful info. I really want to be done with 2020 taxes! I don’t know what else to do except wait on TT, I’ve gotten the message that I can file by mail but when I walk through the steps for possibly doing that I get a warning about the 8915-e form not being ready, so I don’t want to mail it in and then have a problem anyways.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

Same issue for NY state. My federal filing has the 8915-E in it, so I don't see why there's a hold up with the state filing. Must be a TurboTax bug and they're just blaming on the form not being ready.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

The States are working to update their tax forms for the changes to Pensions per the CARES Act. Many state forms are not yet ready.

TurboTax will get the forms into the state programs as soon as possible after the states have released them.

Click this link for info on Filing Federal and State Returns Separately.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

Thank you @MarilynG1!

Is there a way to see which states have their form ready? And will TT notify you when you can move forward, or do you have to keep returning to that screen to check?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

Michigan seems to be working fine now, i filed about 4 days ago. Good luck to the rest of you guys who are having problems.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

You can use this chart to check state form availability. All states use their own form numbers, even though, they do generally line up with the federal form descriptions. TurboTax will not send out 'ready' notifications unless you signed up to receive them through a Help Article. However, these are only available for particular forms that have been released but needed to be modified after release. @four_beans

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

My error is when I go to file the New York state return, the program says you must select the Federal return also. I've already filed the federal return and there is no place to select it again. Nothing about missing forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

TurboTax is aware of and investigating the issue with not being able to e-file the state after e-filing the federal. Here is an updated article with a link to get updates when this is resolved:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

When I go to check the entry Turbotax says the withheld tax ($3,420.50) cannot exceed the state distribution, (which is $87,195.78). Then it refuses to email it because I didn't fix it, but it was correct as I typed it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

Did actually you put the $87+k value in box 16?

Some states require that the value of box 2a go into box 16, even if box 16 is empty on your physical 1099-R.

(if box 2a is empty, then it's the Federally-taxable amount of box 1 instead....which ends up usually as just the box 1 $$value, unless you made some after-tax contributions to that retirement account).

Go back and edit that 1099-R and look at the box values showing in the software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax keeps sending me to a Check this entry screen/Pension Deduction Worksheet for my Michigan taxes re Covid19 401k withdrawal. Why wont it let me correct it?

Arizona state forms are not working either. I update to state pension in TT and when I return to it, the federal pension box is marked again.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

wilsonbrokl

New Member

ddm_25

Level 2

v8899

Returning Member

user17558084446

New Member

Omar80

Level 3