- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Why is Turbo Tax asking to double click "Schedule C" on a 1099-NEC. What is this for since there is not a Schedule C box on the 1099-NEC?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Turbo Tax asking to double click "Schedule C" on a 1099-NEC. What is this for since there is not a Schedule C box on the 1099-NEC?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Turbo Tax asking to double click "Schedule C" on a 1099-NEC. What is this for since there is not a Schedule C box on the 1099-NEC?

before you enter 1099-NEC, you should add a Schedule C so you can link them up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Turbo Tax asking to double click "Schedule C" on a 1099-NEC. What is this for since there is not a Schedule C box on the 1099-NEC?

This is TurboTax's way of linking the Form 1099-NEC to a particular Schedule C because an individual can have more than one business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Turbo Tax asking to double click "Schedule C" on a 1099-NEC. What is this for since there is not a Schedule C box on the 1099-NEC?

What is required in the box next to Schedule C on Box 1 of1099-NEC? Support Representative could not answer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Turbo Tax asking to double click "Schedule C" on a 1099-NEC. What is this for since there is not a Schedule C box on the 1099-NEC?

That box is used to link the 1099-NEC to the Schedule C that is associated with the business that received the Form 1099-NEC. If the Schedule C box is blank, clicking on that box will bring up a link button. Clicking the link button will allow you to link the Form 1099-NEC to an existing Schedule C or to a new Schedule C if one has not yet been created for this business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Turbo Tax asking to double click "Schedule C" on a 1099-NEC. What is this for since there is not a Schedule C box on the 1099-NEC?

How to you do this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Turbo Tax asking to double click "Schedule C" on a 1099-NEC. What is this for since there is not a Schedule C box on the 1099-NEC?

Clicking the box does not bring up a Schedule C to link to. I'm sure I don't have something correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Turbo Tax asking to double click "Schedule C" on a 1099-NEC. What is this for since there is not a Schedule C box on the 1099-NEC?

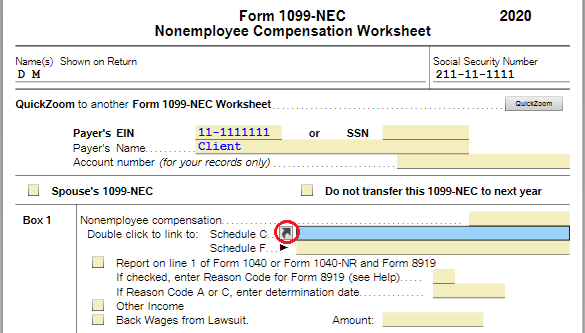

After clicking the box you must click the link button or just double-click the box:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Turbo Tax asking to double click "Schedule C" on a 1099-NEC. What is this for since there is not a Schedule C box on the 1099-NEC?

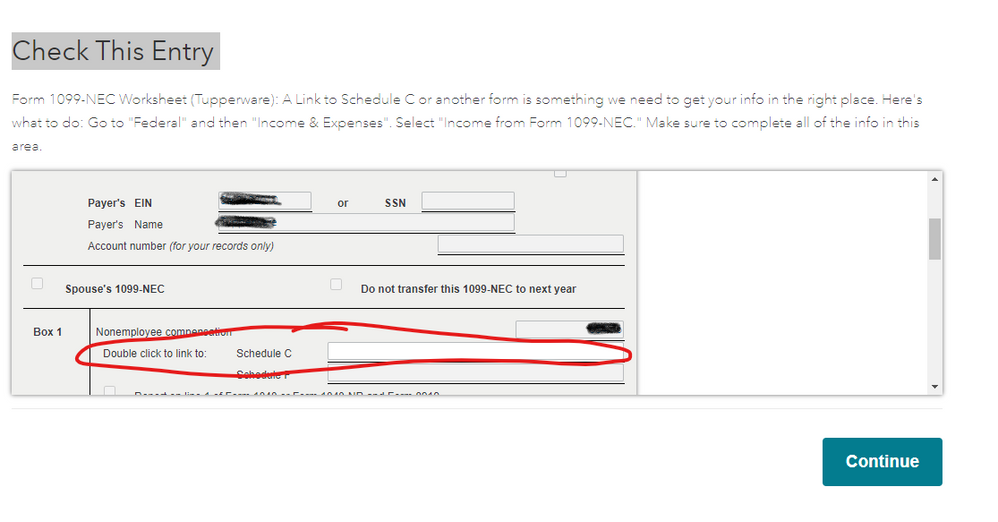

I'm having the same issue. Nothing happens when I double click the link/drop down. This is the only screen that I can actually see the Schedule C form at all. Any suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Turbo Tax asking to double click "Schedule C" on a 1099-NEC. What is this for since there is not a Schedule C box on the 1099-NEC?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Turbo Tax asking to double click "Schedule C" on a 1099-NEC. What is this for since there is not a Schedule C box on the 1099-NEC?

I see, the problem is with the online version when Smart Check flags the error. The only thing that you might be able to do is delete the Form 1099-NEC and reenter it in the business section. When entered there, TurboTax will likely create the link to the business under which the Form 1099-NEC is being reported, eliminating the error, but I can't be certain since there are presently so many flaws in the implementation of this new form in TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Turbo Tax asking to double click "Schedule C" on a 1099-NEC. What is this for since there is not a Schedule C box on the 1099-NEC?

The problem I and many are having is that the link button you circled does not come up for us. In my situation I did Uber, Lyft to supplement income. This gave me opportunity to itemize. Being that itemization is higher then the standard and that I did some self employment work, I am required to file schedule C. I filled in all the info in Turbo Tax, however the linkage is not available. When I called support they came back "This is a known bug that they are urgently fixing"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Turbo Tax asking to double click "Schedule C" on a 1099-NEC. What is this for since there is not a Schedule C box on the 1099-NEC?

Apparently the link button not appearing is a problem in the online version of TurboTax. There are two options:

- Delete and reenter the Form 1099-NEC under Business Income and Expenses. The most recent version of online TurboTax appears to create the linkage properly there now. Do not enter the Form 1099-NEC under 1099-MISC and Other Common Income, that doesn't work at all.

- Delete the Form 1099-NEC, answer No when asked if you received any Forms 1099-NEC, then simply enter the income as income or sales not on a Form 1099-NEC or 1099-MISC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Turbo Tax asking to double click "Schedule C" on a 1099-NEC. What is this for since there is not a Schedule C box on the 1099-NEC?

I'm having the same problem. Here is the link to the TurboTax support page for this exact issue. Near the bottom, you can click to sign up for email updates as they resolve the problem. https://ttlc.intuit.com/community/tax-topics/help/why-can-not-link-my-1099-nec-in-turbotax-online/01...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is Turbo Tax asking to double click "Schedule C" on a 1099-NEC. What is this for since there is not a Schedule C box on the 1099-NEC?

Currently there is a known issue when using TurboTax Online that is related to the program asking you to double-click to link to Schedule C.

Please review the article below and use the link in the article to enter your email address to be notified once this is resolved:

TurboTax: Why Am I Unable to Link my 1099-NEC?

Also you can review the information below for a possible steps to solve the issue.

Income reported on Form 1099-NEC must be reported on Schedule C, the program is trying to link these two forms together to be sure that it is reported correctly and on the right form.

Revisit the section where you entered the Form 1099-NEC if you entered it on its own and delete that entry, by following these steps:

- Open TurboTax.

- On the top right corner of TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner).

- Type in “1099-NEC” (or for CD/downloaded TurboTax, click Find),

- Click on “Jump to 1099-NEC”

- Click on the blue “Jump to 1099-NEC” link

This will bring you a summary of all Form 1099-NEC that you have entered. Click Delete or the trash can icon next to each one.

Next, you will re-enter the Form 1099-NEC as part of the Schedule C so that the income is reported directly as part of your Business Income and Expenses and within the correct form and section of your return.

Follow these steps to go to the Schedule C section of your return:

- On the top right corner of TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner).

- Type in “schedule c” (or for CD/downloaded TurboTax, click Find).

- Click on “Jump to schedule c”.

- Click on the blue “Jump to schedule c” link

If you already have created a Schedule C in your return, click on edit and go to the section to Add Income. This is where you will re-enter the Form 1099-NEC.

If you do not already have a Schedule C in your return, follow the prompts and enter the information about your work/business for which you received the Form 1099-NEC. Then continue through that section to Add Income and enter the Form 1099-NEC along with any additional income you received for that business.

Once you have completed this, the error should be eliminated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hativered

Level 2

nisa004

New Member

apollocoulis

New Member

user17634012947

New Member

chrissyo

New Member