- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Turbo tax form asks for state tax withheld in box 14 but it is shown in box 12 on my 1099R, i...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax form asks for state tax withheld in box 14 but it is shown in box 12 on my 1099R, is this the same?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax form asks for state tax withheld in box 14 but it is shown in box 12 on my 1099R, is this the same?

Please double check the year of your 1099-R. The 1099-R for 2020 has state taxes withheld in box 14, but the 1099-R from 2019 has the state taxes withheld in box 12.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax form asks for state tax withheld in box 14 but it is shown in box 12 on my 1099R, is this the same?

Make SURE it's just a plain 1099-R form, and not a CSA- or CSF-1099-R, nor a RRB-1099-R .

The 2020 1099-R forms were renumbered for 2020.

Last year's boxes 12,13,14, are now numbered 14,15,16.

.....................( While CSA/CSF-1099-R forms still use boxes 12,13,14 )

IF your standard 1099-R form is using 12,13,14 for the state entries...then either

a) it is a 2019 tax form, that shouldn't go in this year

...or.....

b) the issuer failed to update their forms to the Proper 2020 format for those boxes.

for b) you need to call the issuer, and find out if they are going to correct their screw-up.

_________________________

IF numbered properly, box 16 is commonly empty on most 1099-R forms. Usually because the value of box 2a is automatically used in it's place (or the Federally-taxable amount of box 1 if box 2a is empty).

NY is especially picky about this, and entering the value of box 2a into box 16 should fix that (or the federally-taxable amount of box 1 if box 2a is empty).

__________________________

My Federal+NC software automatically back-fills box 16 with the value in box 2a, as I proceed to properly answer the pages that follow the main form...if I left box 16 empty the first time thru.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax form asks for state tax withheld in box 14 but it is shown in box 12 on my 1099R, is this the same?

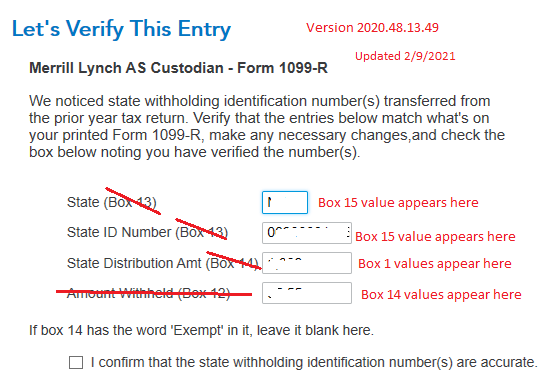

I have three1099R forms. When I finish the input of each form Turbotax prompts me with a "Let's verify this entry" window. The window displays fields for boxes 13-14 as... (note they are ordered 13, 14 then 12)...

State (box 13)

State ID Number (box 13)

State Distribution Amt (Box 14)

Amount Withheld (Box 12)

The problem I see is that the field descriptions do not match the input field descriptions. So that the values I have entered are not aligned with the correct box numbers in the verification window. For instance I inputted $55.55 in box 14 but the "Let's verify this entry" window displays $55.55 in box 12. It seems like Turbotax has typo's in the verification window. I am very confused and need help before I can complete this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax form asks for state tax withheld in box 14 but it is shown in box 12 on my 1099R, is this the same?

Yes...that was just a text display issue on the verification page...from a couple weeks ago.

You need to run your software updates again since that display has been fixed now an should now display the correct box numbers. Run your software update....every Friday !

(at the top of the software page click on <Online...<<Check for Updates )

_____________________

Once you are sure the numbers and boxes match......check the box that you've verified the values....then that page won't show up again....and box 16 should end up with the value of box 1 or 2a in it, (( as long as 2a isn't empty or "undetermined" (mine uses 2a ))

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax form asks for state tax withheld in box 14 but it is shown in box 12 on my 1099R, is this the same?

Yes, it is known issue because the Form 1099-R was changed in 2020, and not all financial institutions use the new format yet. Enter information form your 1099-R according the field descriptions. It does not have to match the box numbers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax form asks for state tax withheld in box 14 but it is shown in box 12 on my 1099R, is this the same?

thanks for the hint, but I have done that already and just did it now and there is no change to the issue.

Does the update only work on other versions? I have the TurboTax Deluxe version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax form asks for state tax withheld in box 14 but it is shown in box 12 on my 1099R, is this the same?

I'm using Desktop Premier...but different versions shouldn't be a problem.

I'd recommend the Manual Update...but right now that's set as one update behind, and I'm not sure rev 15.1 fixed it. ( https://ttlc.intuit.com/community/updating/help/manually-update-turbotax-for-windows-software-basic-... )

_____________________________________________

Up in he menu click

<Help

<<About Turbo Tax Deluxe 2020

Select the "Components" tab from the pop-up window

I think the TurboTax.exe component should show Version 2020.48.16.62

(but I'm a bit hazy on whether that's the right one to look at)

________________________

You might have to wait for the Manual update page to be updated itself to R16 or higher before you can use it.....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax form asks for state tax withheld in box 14 but it is shown in box 12 on my 1099R, is this the same?

Thanks. I continue to check online updates. As of 2/9/2021 my version of Turbotax is 2020.48.13.49 and the verification window still seems to show typo's in the description fields. See screenshot.

I see the link to the patch, but I will wait to get fixes using the updater.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax form asks for state tax withheld in box 14 but it is shown in box 12 on my 1099R, is this the same?

This issue seems resolved. I just completed an online update and found an updated released on 1/10/21.

This updated brought my version up to 2020.48.16.62

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax form asks for state tax withheld in box 14 but it is shown in box 12 on my 1099R, is this the same?

HELP? what am I suppose to do with is form or can I not file turbo tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax form asks for state tax withheld in box 14 but it is shown in box 12 on my 1099R, is this the same?

@Weathergal2 You can successfully file a 1099-R. All the updates are in. Be sure you are updated. Can you clarify what problem you are having now?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax form asks for state tax withheld in box 14 but it is shown in box 12 on my 1099R, is this the same?

I am replying to someone else's response. I just did my taxes today,3-5-2020. My New York return still has a glitch. 1099r box 14 is correct and shows the state tax that was with held on my form from the payer,but I keep getting the (review line 14) when it checks the return

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dkjk5657

New Member

CHEFJUDYS

New Member

fastesthorse

Level 2

eaglesfan22

Level 2

lnk-fr

Level 2