- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Self-Employed with Social Sec. Income - Where enter Medicare B payments?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-Employed with Social Sec. Income - Where enter Medicare B payments?

Hi, Just checking. I'm self-employed. I receive monthly social security where the Medicare B payments are deducted each month. For the year's total of Medicare B pymts, where do I enter?

Is it: Under Business Expenses, Health Insurance Premiums section?

Or: Somewhere on Schedule A?

And what about Schedule C?

Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-Employed with Social Sec. Income - Where enter Medicare B payments?

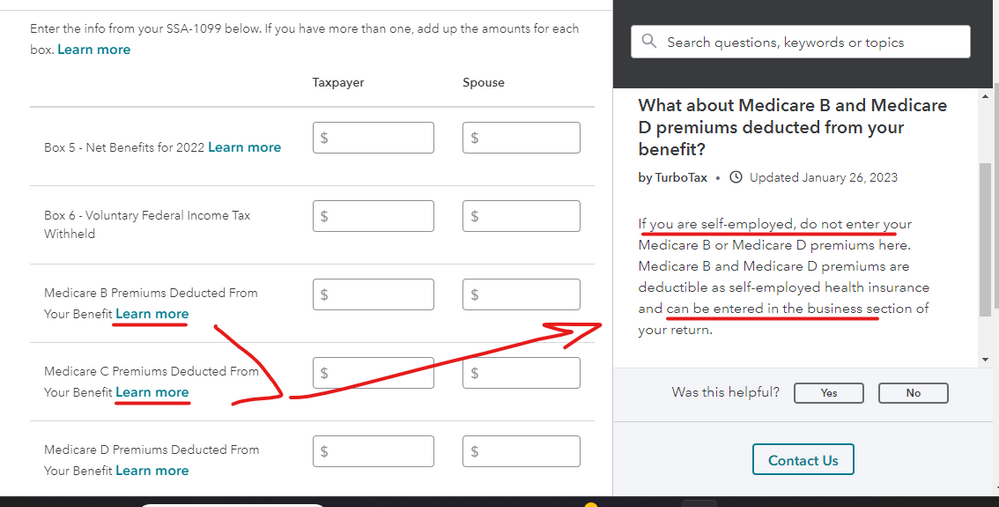

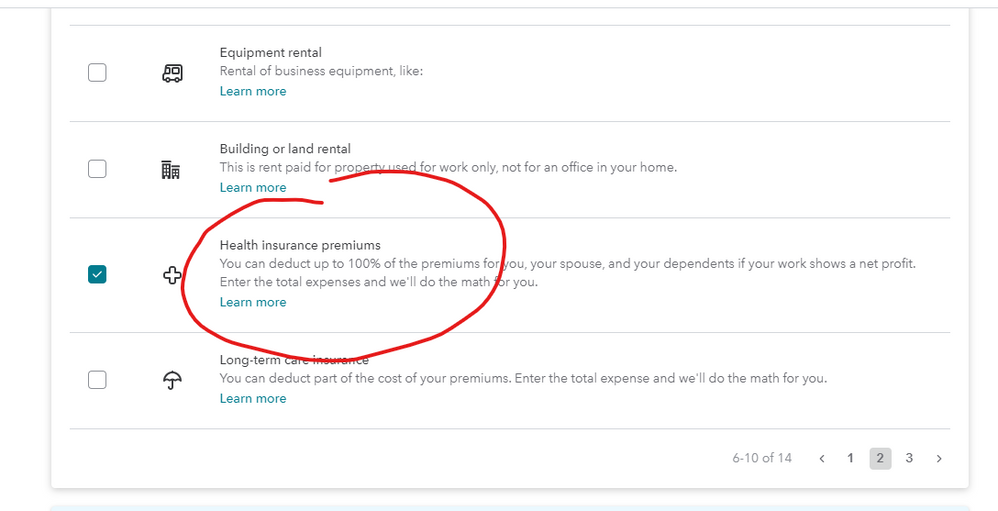

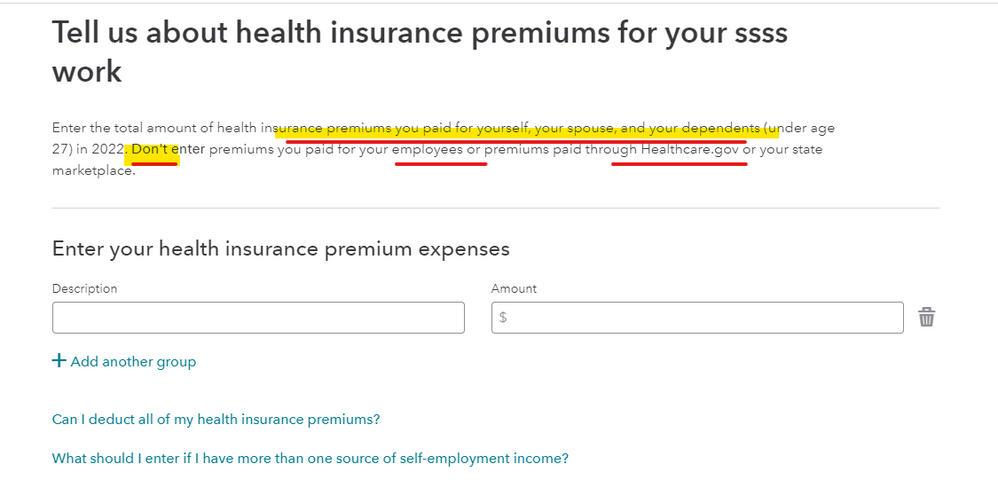

Medicare plan B payments are qualified as Self-employed medical insurance premiums and should be entered under Business instead of in the SSA-1099 Social Security Benefits section.

Go back and delete it from the SSA-1099 entry screen. Try going to the search box by My Account and type in Social Security Benefits. That will give you a Jump To link to take you directly to it.

OR

Enter a SSA-1099, SSA-1099-SM or RRB-1099 under

Federal Taxes tab

Wages and Income tab

Choose Explore on my own or I'll choose what to work on (if it comes up)

Then scroll down to Retirement Plans and Social Security

Social Security (SSA-1099. RRB-1099) - click the Start or Update button

Self-employed health insurance deduction goes on Form 1040 Schedule 1 line 17 (then to 1040 10), as long as the expense is not greater than your net self-employment income. If it does exceed your net self-employment income it gets split automatically. An amount equal to your net self-employment income goes on Form 1040 and the remainder gets added in to medical expenses on Schedule A.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-Employed with Social Sec. Income - Where enter Medicare B payments?

When you enter the SS benefits note the LEARN MORE where it tells you exactly where to enter it ... when in doubt anywhere in the program simply click on the help screens for the information you seek...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-Employed with Social Sec. Income - Where enter Medicare B payments?

Hello Critter and Volvo, I want to followup. I'm not sure I made it clear. As we know, social sec. monthly benefits deduct the payment for Medicare. The soc.sec.1099 indicates both amounts. It's the Medicare portion that I couldn't be sure will be automatically calculated by Turbo when you enter the full soc.sec. amount you receive. So I pretty much followed Critter's amazing diagrams. And I also tried simply following the Turbo guide me. They lead to the same place. I didn't break the numbers down. I entered the soc.sec.1099 amount in full. And Turbo somehow figured out how much went to Medicare. And the number is correct!

Thank you both. Sorry about my delay. The return had me up so late that yesterday was thrown off.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-Employed with Social Sec. Income - Where enter Medicare B payments?

The gross amount of SS benefits in box 5 of the SSA1099 form is to be entered in the program and on the return then the taxable portion of the SS benefits will be determined based off your other income entered. The benefits are not reduced by the amount paid to medicare in any way ... just follow the screen instructions carefully and let the program do all the work for you.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

JeffAndMartina

Level 1

stelarson

Level 1

wresnick

New Member

E-Rich333

Level 1

lzbwilcox

Level 1