- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Reporting IRA recharacterization when form 1099-R not available yet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting IRA recharacterization when form 1099-R not available yet

I made $3000 contributions to my Roth IRA for 2021 throughout the year 2021 and then realize that I won't qualify due to income limit.

I recharacterized all of that $3000 (with loss) to Traditional IRA on Feb 14, 2022, but form 1099-R won't be available until 2023.

I tried to enter that recharacterization into TurboTax 2021, but it then asks me for the info on form 1099-R, which I don't have.

What should I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting IRA recharacterization when form 1099-R not available yet

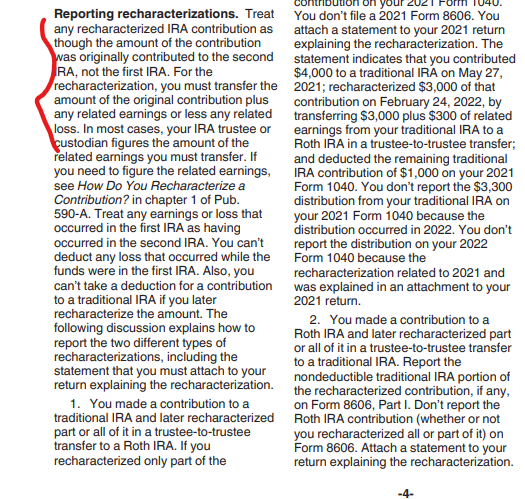

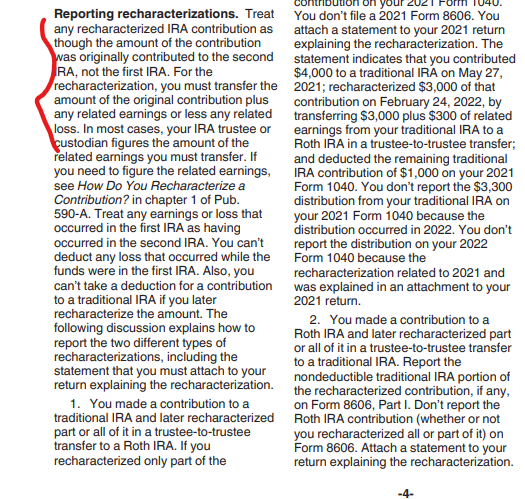

Here is what IRS says about recharacterization:

If you recharacterized your original Roth IRA contribution to Traditional IRA, it is treated that you only contributed to the Traditional IRA. So, do not enter the Roth IRA contribution in TurboTax, enter $3,000 for the Traditional IRA. Form 8606 will show that you have a basis in Traditional IRA of $3,000, ignore the losses.

@ThomasM125 is correct.

2021 Instructions for Form 8606. See page 4 for more details regarding recharacterization.

Here is a paragraph from IRS Instructions for Form 8606 regarding recharacterization:

@Anonymous

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting IRA recharacterization when form 1099-R not available yet

You just need to report a traditional IRA contribution in 2021 if you had the recharacterization apply to 2021. You will get a 1099-R in 2023 for 2022 but it won't show any taxable income since your didn't make any money on the funds contributed. It also won't show the IRA distribution as being taxable since it is from a ROTH IRA. So, you report the form 1099-R on next year's tax return but it won't affect anything.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting IRA recharacterization when form 1099-R not available yet

Thanks.

Just to clarify: The $3000 contribution to Roth IRA become only $2886 when being transferred to Traditional IRA. So are you suggesting me to:

1. Not report the $3000 contribution to Roth IRA. Only report $2886 contribution to Traditional IRA.

2. Report $3000 contribution to Roth IRA. Also report $2886 contribution to Traditional IRA.

If I follow #2, my total contribution to all IRA for 2021 will exceed $6000 (due to other contributions to Traditional IRA that I made for 2021) and I think TurboTax will make me pay the fine.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting IRA recharacterization when form 1099-R not available yet

Here is what IRS says about recharacterization:

If you recharacterized your original Roth IRA contribution to Traditional IRA, it is treated that you only contributed to the Traditional IRA. So, do not enter the Roth IRA contribution in TurboTax, enter $3,000 for the Traditional IRA. Form 8606 will show that you have a basis in Traditional IRA of $3,000, ignore the losses.

@ThomasM125 is correct.

2021 Instructions for Form 8606. See page 4 for more details regarding recharacterization.

Here is a paragraph from IRS Instructions for Form 8606 regarding recharacterization:

@Anonymous

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting IRA recharacterization when form 1099-R not available yet

Thank you. Very clear & concise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting IRA recharacterization when form 1099-R not available yet

Oh, and there's this in TurboTax...

I follow that instruction to enter my Roth & Traditional contributions separately. Then I look at all the generated forms and confirm that TurboTax is smart enough to do as what has been suggested: put them all into the Traditional IRA and none in Roth IRA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting IRA recharacterization when form 1099-R not available yet

You are still on the recharacterization screen. Leave it.

Follow these steps instead:

Enter the Non-deductible contribution to a Traditional IRA:

- Open or continue your return

- In the search box, type ira contributions and hit the Enter key, select the Jump to ira contributions link in the search results

- Select Traditional IRA on the Traditional IRA and Roth IRA screen and Continue

- Answer No to Is this a Repayment of a Retirement Distribution?

- On the Tell Us How Much You Contributed screen, enter the amount contributed and continue

- Enter $3,000 for Your total 2021 traditional IRA contributions

- If you plan to add another $3,000 before 4/18, enter it in the second box

- Answer No on the Did You Change Your Mind? screen

- Answer No on Any Excess IRA Contributions Before 2021?

- Answer Yes, I made and tracked nondeductible contributions to my IRA

- Enter $0 (or whatever amount you contributed before 2021 and you did not take a deduction) for Total Basis as of December 31, 2020 on the next screen

- Answer the questions on the following screens, until you reach Choose Not to Deduct IRA Contributions. Select Yes, make part of my IRA contribution nondeductible and enter $3,000 in the box.

Let us know if you need further assistance.

@lntnam

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SomebodyInGNV

Level 2

ckhathawaymt

New Member

AlexSagrat

Level 3

moraedson1604

New Member

vr2svim

Returning Member