- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Here is what IRS says about recharacterization:

If you recharacterized your original Roth IRA contribution to Traditional IRA, it is treated that you only contributed to the Traditional IRA. So, do not enter the Roth IRA contribution in TurboTax, enter $3,000 for the Traditional IRA. Form 8606 will show that you have a basis in Traditional IRA of $3,000, ignore the losses.

@ThomasM125 is correct.

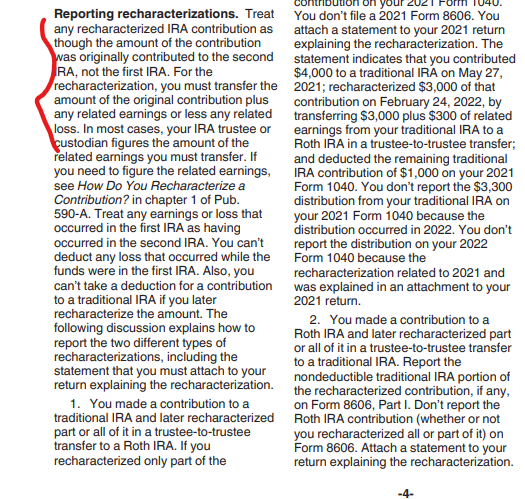

2021 Instructions for Form 8606. See page 4 for more details regarding recharacterization.

Here is a paragraph from IRS Instructions for Form 8606 regarding recharacterization:

@Anonymous

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 22, 2022

7:28 PM