- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Repayment of RMD Distribution - How to file?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of RMD Distribution - How to file?

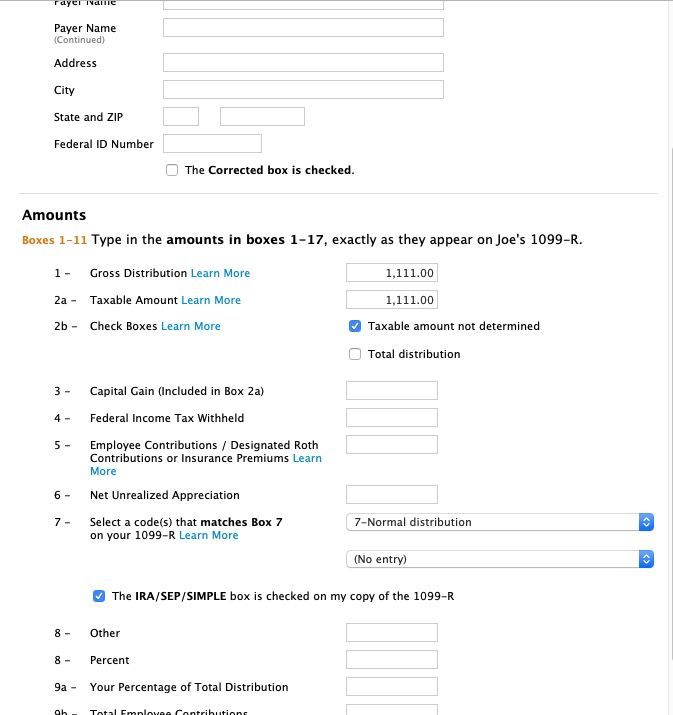

TurboTax EasyStep does not handle this situation very well which is why I didn't use it. Follow the steps in my note above and you won't get into any issues. By the way you are not changing the 1099-R. That is input exactly as it is sent. The Rollover is indicated on your Form-5498 which you should have also received from your investment company.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of RMD Distribution - How to file?

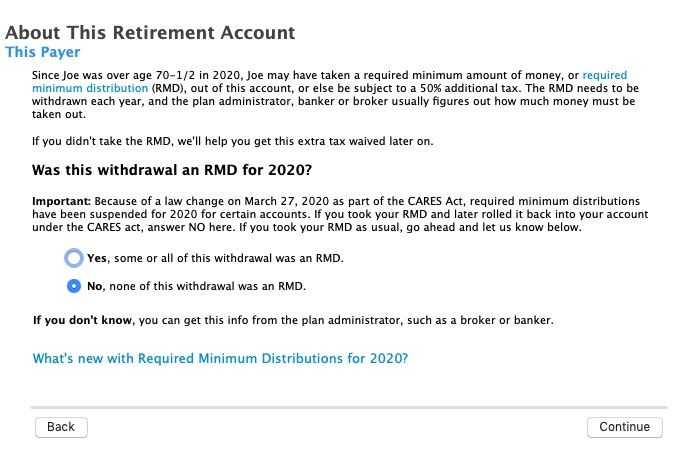

Yes, TurboTax will ask what you did with the money. After you enter the 1099-R, you want to mark that none of it was RMD. As you go through, you will mark, lump sum, rolled it over and so on through the program.

The IRS does have your 1099-R and knows it was distributed. The IRS also gets the 5498 with the contributions along with the value of your account at the end of the year. It all adds together and makes sense.

This is why your financial notebook of actual records is important.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of RMD Distribution - How to file?

How do I show the MRD was repaid?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of RMD Distribution - How to file?

Since there is no RMD required for 2020, after you enter the 1099R say it was NOT an RMD and then that you rolled it over (even if back into the same account). Was any withholding taken out? If it was then did you replace the withholding with your own money? Otherwise the withholding will be a taxable distribution itself. You will get credit for the withholding taken out.

If you already entered the 1099-R as RMD and changing your answer to the RMD question doesn't work then you have to delete and renter the 1099-R form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of RMD Distribution - How to file?

I HAVE THE SAME QUES5TION BECAUSE MY RETURN IS SHOWING A PENALTY FOR A INELIGABLE CONTRIBUTION WHEN I REPAY MY DISTRIBUTION . thought this was allowed!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of RMD Distribution - How to file?

I have tried as suggested but the RMD distribution repayment is still showing up as part of my taxable 1099 distribution. Can anyone provide assistance. I did scroll down and unchecked the RMD box and put 0.00 in but the repayment that I made is still showing up as taxable. I input the data from the 1099 issued from the brokerage 1099R, should I just manually deduct the payment amount in the form or will this trigger a mistake?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of RMD Distribution - How to file?

Sometimes just unchecking the RMD box doesn't work. You have to delete the 1099R and re enter it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of RMD Distribution - How to file?

@KAZMERSKI In the follow-up questions after entering your 1099-R, you are asked if you 'rolled over' any part of the distribution. Choose NO here so your repayment will not be considered a contribution.

Continue and you will be asked on another screen if you 'repaid' any part of your distribution (screenshot).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of RMD Distribution - How to file?

That answered half of the issue.

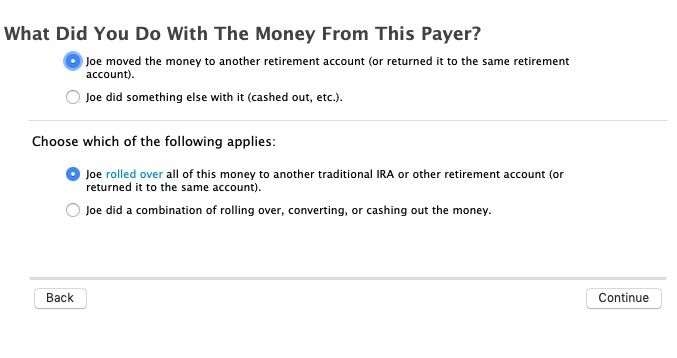

How do I " indicate that you moved the money to another retirement account (or returned it to the same account), that you rolled over the distribution and that you rolled over the entire distribution."

I returned the money to my IRA account and received a 5498.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of RMD Distribution - How to file?

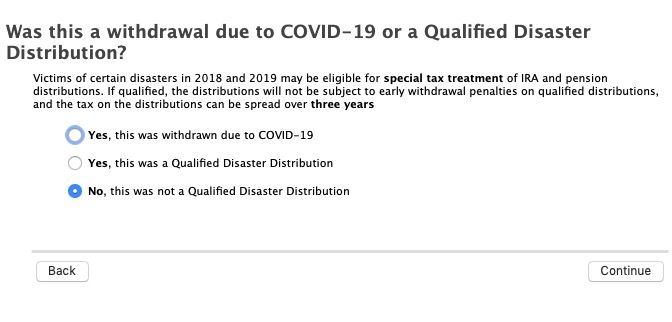

The above answer is incorrect. A RMD rollover is NOT a COVID related distribution - it is a simple rollover.

Do NOT say it is COVID related.

Delete the 1099-R to reset answer and re-enter.

Answer the RMD question that "None of this distribution was a RMD" or"RMD not required" depending on the TurboTax version - because it was NOT a RMD, there were no 2020 RMD's.

Then you will get the screen to say it was "moved" and all rolled over.

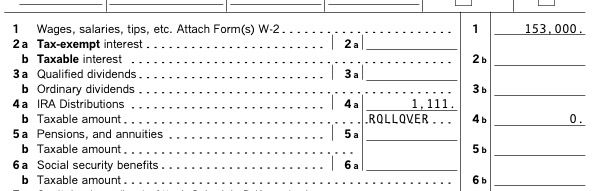

That will put the 1099-R box 1 amount on the 1040 form line 4a with the word ROLLOVER next to it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of RMD Distribution - How to file?

It looks like the RMD withdrawal and reinvested contribution cancel out, but Turbo Tax still gives me an error message: "Your IRA Contribution Isn't Permitted".

I did indicate that the withdrawal was rolled over, but I do not think there is a "rollover" indicated on the 1099-R

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of RMD Distribution - How to file?

You do not enter the rollover or replacement under Deductions as a new contribution. That is only for new contributions from your own money. Only enter it from the 1099R. After you enter the 1099R you say No it was not the RMD. Then enter how much you put back or rolled over.

IRA should show up on 1040 line 4a and zero taxable amount on 4b with the word ROLLOVER by it. Unless there was tax withholding taken out that you didn't replace. Then the withholding would be taxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of RMD Distribution - How to file?

@VolvoGirl wrote:Since there is no RMD required for 2020, after you enter the 1099R say it was NOT an RMD and then that you rolled it over (even if back into the same account).

I am still struggling with this. Can you please tell me exactly where in TT Desktop I can specify that I rolled the RMD back into the IRA? I simply can't find it. I tell TT the distribution wasn't an RMD and it does not ask whether I rolled it back. I'm on version 020.000.1688.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of RMD Distribution - How to file?

@bobweissman wrote:

@VolvoGirl wrote:

Since there is no RMD required for 2020, after you enter the 1099R say it was NOT an RMD and then that you rolled it over (even if back into the same account).

I am still struggling with this. Can you please tell me exactly where in TT Desktop I can specify that I rolled the RMD back into the IRA? I simply can't find it. I tell TT the distribution wasn't an RMD and it does not ask whether I rolled it back. I'm on version 020.000.1688.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Repayment of RMD Distribution - How to file?

What's happening in my flow is that I am not seeing the screen with "What did you do with the money from this payer?". It flows directly to the next screen "Was this withdrawal due to Covid-19?"

What have I done wrong?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

xiaochong2dai

Level 3

ecufour

Returning Member

CQ60177

New Member

zcindy9075

Level 2

beyondbackpack

Level 1