- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Once I add what I have received in stimulus checks it makes my federal refund decrease. Why? I thought this was not suppose to impact my income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once I add what I have received in stimulus checks it makes my federal refund decrease. Why? I thought this was not suppose to impact my income?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once I add what I have received in stimulus checks it makes my federal refund decrease. Why? I thought this was not suppose to impact my income?

The entire amount of the Recovery Rebate Credit that you are eligible for is added to your return initially. After that when you input stimulus payment amounts you have already received, the credit is reduced accordingly on your return.

The reduction will never be more than the credit you are eligible for. You can test this by putting in stimulus amounts above what you are eligible for. You will see the reduction stops at the credit amount.

To recap the eligibility amounts:

Round one: $1200 (2400 if filed jointly) plus $500 for each dependent age 16 or under.

Round two: $600 (1200 if filed jointly) plus $600 for each dependent age 16 or under.

Here is a link with more information on the Recovery Rebate Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once I add what I have received in stimulus checks it makes my federal refund decrease. Why? I thought this was not suppose to impact my income?

I have the same question. Doing a early assessment of my 2020 taxes, basic taxed owed was about $250, when I added both stimulus amounts (1st @ $2300 2nd @ $1100), my taxed owed jumped to $3614!! Here again, we, according to the stimulus program this distribution was to be untaxed as income, but it's being taxed as income otherwise I wouldn't see such a significant jump in now owing. So either we were lied to or TurboTax has a glitch in this programming. please explain.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once I add what I have received in stimulus checks it makes my federal refund decrease. Why? I thought this was not suppose to impact my income?

@SocMO wrote:

I have the same question. Doing a early assessment of my 2020 taxes, basic taxed owed was about $250, when I added both stimulus amounts (1st @ $2300 2nd @ $1100), my taxed owed jumped to $3614!! Here again, we, according to the stimulus program this distribution was to be untaxed as income, but it's being taxed as income otherwise I wouldn't see such a significant jump in now owing. So either we were lied to or TurboTax has a glitch in this programming. please explain.

I have seen this same issue from a few other users. This is not systemic problem but local to just a few.

First, check your actual federal tax return Form 1040 and look at several lines on the form.

You can view your Form 1040 at any time. Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

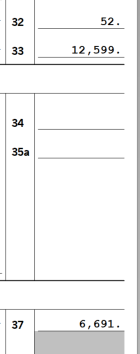

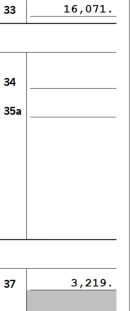

Line 30 is where stimulus payment you did NOT receive are entered as a tax credit. What is shown on Line 30?

Line 9 is your Total Income. Is the amount on Line 9 correct?

Line 15 is your Taxable Income. What is the amount shown?

Line 16 is the Tax on your Taxable income.

Line 24 is your Total Tax. What is the amount shown?

Line 33 is your Total Tax Payments. What is the amount shown?

Line 34 is your Federal Tax Refund

Line 37 is your Federal Taxes Owed

What amounts are shown for either the tax refund or the taxes owed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once I add what I have received in stimulus checks it makes my federal refund decrease. Why? I thought this was not suppose to impact my income?

I will review your recommendation and get back to you to confirm the outcome. Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once I add what I have received in stimulus checks it makes my federal refund decrease. Why? I thought this was not suppose to impact my income?

As you will see in the snapshot, there are two scenarios to show how the stimulus monies have increased my payment owed. One without adding Stimulus entry, tax owed $3219. Second with stimulus entry added, tax owed increased to $6691. So unless TT is not calculating correctly, then the Stimulus monies are being taxed, and not a credit. Basic simple math. And the data is from the 1040's using the two different scenarios.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once I add what I have received in stimulus checks it makes my federal refund decrease. Why? I thought this was not suppose to impact my income?

@SocMO Thank you for that detailed table.

What this appears to be is that the program entered $3524 of stimulus payments as a Credit based on your 2020 federal tax return entries before you actually entered the stimulus payments received. The credit reduced your taxes owed to $3219.

When you entered the amount of stimulus payments received the program correctly removed the credit to the credit you should receive $52. So your taxes owed should be $6691.

You will need to contact TurboTax support and get a verification from them for why the credit was originally entered on the Form 1040 Line 30 before you got to that section of the program to enter the amounts actually received.

I am also going to forward this post to the TurboTax Moderators of this forum so they can get a reading on whether the program is working as designed or if there is something that should be investigated further.

Again, thank you for your feedback, it is much appreciated.

Use this website to contact TurboTax support during business hours - https://support.turbotax.intuit.com/contact/

Or -

Support can also be reached by messaging them on these pages https://www.facebook.com/turbotax/ and https://twitter.com/TeamTurboTax

Or -

Use this phone number and select TurboTax - 1-800-4-INTUIT (1-800-446-8848)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once I add what I have received in stimulus checks it makes my federal refund decrease. Why? I thought this was not suppose to impact my income?

@SocMO One other thing - The amount you show for Line 33 is exactly the same in each table. Is this correct?

Line 33 should be different in each table.

Line 33 in the table with stimulus added should be $3472 less than Line 33 in the table without stimulus added.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once I add what I have received in stimulus checks it makes my federal refund decrease. Why? I thought this was not suppose to impact my income?

there is a correction, yes line 33 should be different - my error in copying. Without stimulus, Line 33 is $16071, line 33 with added Stimulus is $12599.

As you mentioned $16071-$3472=$12599. Which would be Line 33. Image With Stimulus.

So the different is (tax rate) $19290-$12599=$6691 Thus owing $6691. Why would you substract $3472 from $16071, its obviously going to decrease the total payment on Line 33. Thus you pay a higher tax.

Now if the stimulus is not taxable, therefore it doesn't make sense to even enter it. If we look at the table that shows regular normal taxes, image 2 Without Stimulus, my tax bill to IRS would be $3219, not $6691. Please note these are TT calculations. See the two image from TT form 1040 under the 2 scenarios.

With Stimulus Without Stimulus

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once I add what I have received in stimulus checks it makes my federal refund decrease. Why? I thought this was not suppose to impact my income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once I add what I have received in stimulus checks it makes my federal refund decrease. Why? I thought this was not suppose to impact my income?

I appreciate your review. Please note that entering the Stimulus data is at the Final Review section, not part of the Income data entry. If I select "we didn't get a stimulus payment" to run a comparison between with and without, the calculation tells me Your Credit is $3524, there Fed Tax Due $3219.

Now if I do the same by selecting Yes, and then enter the amounts 2336.35 and 1136, I get your credit is $52, and now the Fed Tax Due is $6691.

The program is essentially adding the stimulus back into the calculation increasing the Fed Tax Due. This is not correct. If I eliminate reporting the stimulus as it not taxable, then my Fed Tax would be $3219. So there is a problem with the calculation. You just can added it back in.

If the credit is substracted from the Taxable amount of 192290, it reduces the Tax Liability Line 33 to $12599. Substract what's been paid in Fed taxes, it will cause the Fed Tax due to increase. I've tried this many ways using TT and the calculation comes out the same. I am not comfortable using this process to show an increase in tax payment for monies that were not to be taxable.

Please check to see if this is missing something.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once I add what I have received in stimulus checks it makes my federal refund decrease. Why? I thought this was not suppose to impact my income?

Followup.

I think you are correct in your assessment. The credit is added first, so when you finalize your taxes before the Final Review, it shows you a Fed Owed or Refund - so in my case, it showed a Fed Owed of $3219

But then when you enter the Stimulus numbers at the Final Review, it then wipes the original credit you stated as happening and surprises you with a increase in Fed Owed or change in numbers. This should not work that way, as it's given the appearance the stimulus is being taxed.

As I ran the process again for the umthik time, I see that the credit is added in Line 30, and then when the monies are added in final review it reduced it and shown the actual credit in Line 30, thus increases the amount due in taxes.

This should be fixed, as it leaves the user an unwelcome surprise as the end of filing.

So basically I would owe the amount of $6691 if the credit had not be added in the first place and then substracted later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once I add what I have received in stimulus checks it makes my federal refund decrease. Why? I thought this was not suppose to impact my income?

Before you enter the amount of the stimulus payments at the screen Did you get a stimulus payment?, you have been given the full Rebate Recovery Credit (the equivalent of the two stimulus payments). This can be found on line 30 of the 2020 Federal tax return. At this point, this is an 'incomplete' Rebate Recovery Credit.

You can see this on the screen Great news! You qualify for the stimulus credit. The amount is displayed in the center of the page.

After you enter stimulus payment 1 and stimulus payment 2, the credit is offset by the stimulus payments and the 'incomplete' Rebate Recovery Credit is reduced or eliminated.

See this TurboTax Help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once I add what I have received in stimulus checks it makes my federal refund decrease. Why? I thought this was not suppose to impact my income?

Ok...this is what happens.

When there is no stimulus payments received the program will correctly enter a credit on your tax return on Line 30 which you are eligible to receive based on the information presented on your 2020 federal tax return, filing status, dependents and adjusted gross income. In this case the amount would be $3,524. This amount reduces your federal taxes owed from ($6,743 (-) $3,524) to $3,219.

However, you received and entered stimulus payments in the amount of $3,472. Since the original credit of $3,524 cannot be used, the program entered the difference of $52 on Line 30. So now the amount of taxes owed is correctly calculated ($6,743 (-) $52) to $6,691.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once I add what I have received in stimulus checks it makes my federal refund decrease. Why? I thought this was not suppose to impact my income?

Right, but you shouldn't have it referenced at the end at the Final Review. All during the input process the Fed Owed indicator shows a less owed because the Line 30 credit is transparent until at the end when you enter the Stimulus monies, then it substracts that amount from the transparent input in Line 30. therefore the surprise occurs at the end. Not something someone wants to see. Put the entry during the Income process, and then you can enter the Stimulus money upfront verses at the end. If I had done a regular 1040 form manually, I am sure I would have caught this sooner, but I relied on TT to walk through each step to get a running accurate calculation; not doing the adjustment at the end.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

laura_borealis

Level 4

Walkernate

Level 2

theseedbarakaat

New Member

t482

Level 2

casla0563

New Member