- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

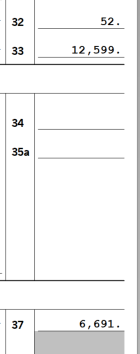

there is a correction, yes line 33 should be different - my error in copying. Without stimulus, Line 33 is $16071, line 33 with added Stimulus is $12599.

As you mentioned $16071-$3472=$12599. Which would be Line 33. Image With Stimulus.

So the different is (tax rate) $19290-$12599=$6691 Thus owing $6691. Why would you substract $3472 from $16071, its obviously going to decrease the total payment on Line 33. Thus you pay a higher tax.

Now if the stimulus is not taxable, therefore it doesn't make sense to even enter it. If we look at the table that shows regular normal taxes, image 2 Without Stimulus, my tax bill to IRS would be $3219, not $6691. Please note these are TT calculations. See the two image from TT form 1040 under the 2 scenarios.

With Stimulus Without Stimulus